Streamline your family’s investment portfolio management using the intuitive self-declaration form, ensuring a comprehensive overview and simplified transactional experience with just a single phone number and email ID.

How Investors Can Manage Multiple PANs in Mutual Funds Effectively

Financial planning has become increasingly important as individuals strive to achieve their financial aspirations. In pursuit of their goals, people are turning to mutual funds as an alternative to traditional savings schemes for purposes such as education, marriage, and retirement. As this trend grows, investors are also involving family members in these endeavors. However, managing multiple phone numbers, bank accounts, and email IDs associated with various investment portfolios can be challenging, especially when trying to align them to meet specific financial goals, particularly for an entire family.

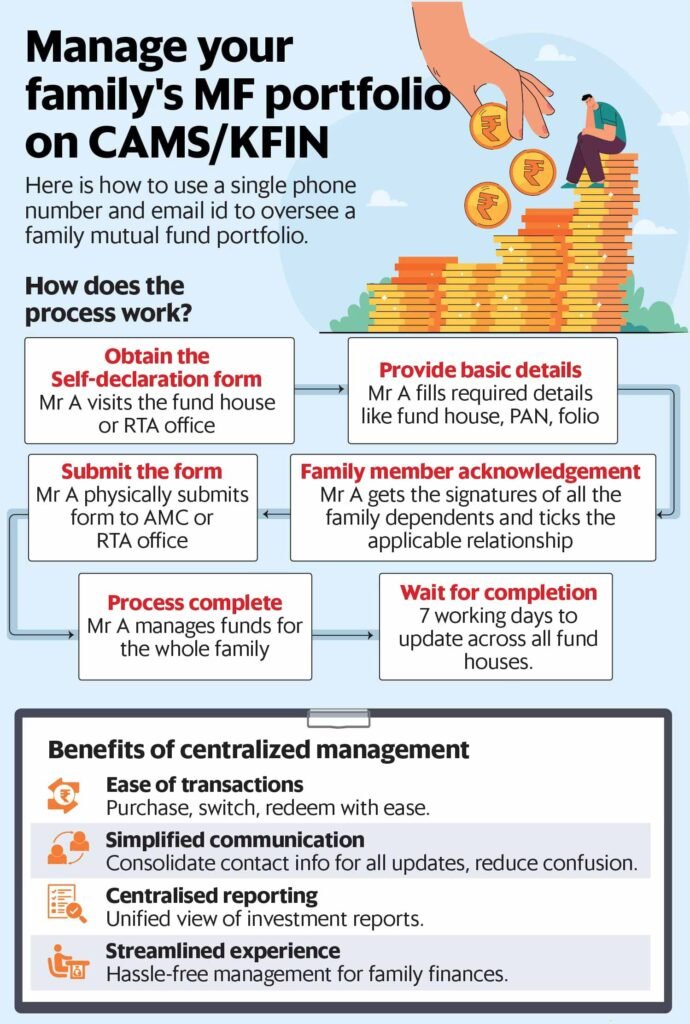

Many individuals find the process of managing multiple PANs (Permanent Account Numbers, issued by the income tax department) for family members’ mutual fund investments to be a cumbersome task. Thankfully, there are ways to simplify this process. Registrar and transfer agents (RTAs) such as MYCAMS and KFIN offer self-declaration forms that provide investors with a more convenient way to manage their investments under common credentials. This comprehensive guide aims to provide investors with the necessary knowledge on how to effectively handle multiple PANs on platforms like MYCAMS and KFIN.

RTAs are important third-party companies appointed by businesses to maintain the ownership records of their shares or securities. Specifically, they are responsible for the smooth and accurate functioning of shareholding and transactions. Publicly traded companies, in particular, are required to appoint an RTA. Through direct contact with the RTA, investors can address matters related to their shareholding, such as updating their address or requesting a duplicate certificate.

By leveraging self-declaration forms provided by RTAs, investors can streamline the management of multiple PANs across different mutual fund investments. This approach simplifies the administrative burden associated with handling various family members’ investment portfolios and aids in consolidating these under common credentials. Ultimately, this can result in a more efficient and organized approach to managing mutual fund holdings for the entire family.

Taking advantage of services provided by RTAs not only offers convenience but also ensures compliance with regulatory requirements, thus contributing to a seamless investment management experience. As more individuals recognize the benefits of mutual fund investments in achieving financial goals, the need for efficient management of multiple PANs becomes increasingly pronounced. By understanding and utilizing the resources offered by RTAs, investors can navigate the complexities associated with managing family investments and strive for improved financial planning outcomes.

Simplifying Financial Procedures: Updating Self-Declaration Forms

Since 1 October 2022, investors encountering issues with online mutual fund transactions due to outdated contact information can now make use of self-declaration forms introduced by RTAs. These forms facilitate the crucial task of updating contact details across all fund houses. Below are the three steps that can be followed for this process:

Step 1: Acquire the Form

Begin by obtaining the self-declaration form either from the relevant fund house where you and your family have mutual fund investments or directly from the RTA office.

Step 2: Provide Essential Information

Complete the form by filling in vital details such as the name of the fund house, folio number, and PAN.

Step 3: Verification and Submission

Get the self-declaration form verified by a family member who should indicate their relationship status by choosing from options like self, spouse, guardian, dependent children, dependent siblings, or dependent parents. This step allows for the specification of ownership of the provided email and mobile number, followed by the signing of the form.

Timeframe and Submission Modes

The entire process usually takes around seven working days to ensure the swift update of contact details across all fund houses. It is important to note that the self-declaration forms can be submitted via both online and offline modes.

In the online mode, you have the option to complete the process by visiting the CAMS/KFIN website. Alternatively, if submission via physical mode is preferred, a visit to the nearest RTA (CAMS/KFIN) or the office of the relevant asset management company is necessary to submit the required documents.

By following these simple steps, investors can ensure that their contact details are updated efficiently across all their mutual fund holdings, allowing for smoother online transactions in the future.

Streamlined Process for Mutual Fund Management

When it comes to managing mutual fund transactions and keeping contact details up to date, self-declaration forms play a crucial role for investors. These forms offer a centralized approach to streamlining the management of family investment portfolios. By opting for this facility, individuals benefit from various advantages, including ease of transactions, simplified communication, and centralized reporting.

Ease of Transactions

With the self-declaration forms, individuals can easily conduct basic transactions such as purchase, redemption, switch, and non-financial transactions like updating bank details or KYC details for their entire family under one umbrella.

Simplified Communication

By providing common contact details, investors no longer need to juggle multiple email IDs or phone numbers for updates and notifications, enhancing communication efficiency.

Centralized Reporting

Investors can conveniently manage all investment reports under a single set of credentials, gaining a unified view of their family’s portfolio across various fund houses. This centralized approach also facilitates tax filing.

However, in cases of family disagreements or individual updates, members can submit separate contact details forms directly to the respective RTA.

Understanding Tax Implications

In the context of family declaration for mutual fund investments, it’s essential to clarify the concept of tax clubbing. While tax clubbing generally refers to the combining of incomes or profits of family members for tax purposes, in the context of mutual fund investments, it primarily involves stating relationships and not actual income or profit.

According to Nitesh Buddhadev, a chartered accountant and founder of Nimit Consultancy, “There is no question of tax clubbing here because it is just a matter of declaration and not income or profit.”

Declaring family members for mutual fund management does not automatically mean their incomes or profits will be combined for tax purposes. It’s primarily a matter of clarifying ownership of investments, and it does not directly affect taxation.

Challenges and Limitations of Family Declaration

While the concept of family declaration offers substantial benefits, there are certain challenges associated with the process, especially in the physical mode of submission. These challenges include form rejection due to signature mismatches. Alternatively, there is an online process available for family declaration, yet it also presents challenges such as website loading issues due to server problems or delayed receipt of one-time passwords sent to mobile numbers.

Furthermore, the limited family options available might not accurately represent all family scenarios. For example, individuals managing mutual fund investments of someone who is not their dependent, such as grown-up children, parents, or spouse, may face limitations in the system, forcing these individuals to be shown as dependents. Additionally, there is no option to add relations like in-laws, partners, and friends, further limiting the flexibility of the system.

In conclusion, as the landscape of financial planning continues to evolve, the role of RTAs and their services becomes indispensable in simplifying the management of multiple PANs for mutual fund investments. Investors are encouraged to explore the tools and resources provided by RTAs such as MYCAMS and KFIN to effectively streamline and consolidate their family’s mutual fund holdings under common credentials.