Investing in quality stocks paves the way for steady returns, particularly in volatile markets. The quality factor thrives in the Indian stock market, leveraging the nation’s distinct economic landscape.

What is quality investing?

Investing with a focus on the quality factor means identifying companies that exhibit strong financial health, sustainable competitive advantages, and consistent earnings growth. Among the oldest and most recognized factors in investing, quality has historically performed exceptionally well in the Indian stock market, capitalizing on the country’s unique economic conditions and market structure.

How Does Quality Investing Deliver Reasonable Returns?

Is Quality Resilient During Market Volatility?

India’s stock market often experiences greater volatility than developed markets. Quality companies, characterized by strong balance sheets, typically outperform during turbulent times. For instance, during the COVID-19 pandemic in Q1 of 2020, sectors like healthcare, IT, and FMCG—known for their quality companies—significantly outperformed the market, achieving alpha in the range of 5-20%. Notably, the volatility of these sectors remained much lower compared to the broader market.

Why Choose Long-Term Growth Over Speculation?

Quality stocks, backed by strong fundamentals, offer stability and consistently compounding returns over time. During speculative market phases, various sectors may draw attention for their potential. However, only a select few companies deliver on those expectations, prompting investors to return to quality. Historical examples include the infrastructure boom in 2007, the PSU surge in 2014, and the NBFC excitement in 2018, all followed by prolonged downturns. Quality companies tend to provide reasonable returns after these periods of irrational exuberance.

What Role Do Sustainability and Leadership Play?

Many quality companies in India operate in sectors with significant barriers to entry, such as FMCG, IT, healthcare, and banking. These firms often maintain a dominant market position, which leads to sustained profitability and reasonable long-term returns. They also command premium valuations. However, investors should remain aware of the risks associated with quality investing before committing their capital.

Are There Valuation Risks to Consider?

Quality stocks frequently trade at premium valuations due to their strong fundamentals and profitability. However, overpaying for these stocks can diminish future return potential, particularly if growth expectations aren’t met. For example, several private banks that were trading at high valuations a few years ago have struggled recently.

Why Do Quality Stocks Underperform in Momentum-Driven Markets?

During bullish market periods, momentum investing may drive speculative, lower-quality stocks—especially in cyclical sectors like real estate and infrastructure—to outperform in short bursts. In these phases, quality stocks may lag in price performance due to their conservative growth outlook and valuation strategies.

How Does Sectoral Concentration Affect Quality Investing?

What Are the Risks of Focusing on Quality Sectors?

Focusing on quality as an investment factor often leads investors toward sectors such as FMCG, IT, healthcare, and banking, where companies typically exhibit high profitability, low debt, and robust balance sheets. However, this concentration can expose investors to sector-specific risks, including regulatory changes, currency fluctuations (particularly impacting IT and healthcare), and macroeconomic trends that may influence demand in FMCG and banking.

Can Stability Hinder Growth Potential?

Quality companies tend to be mature businesses with stable earnings, which may not match the growth potential of smaller, more aggressive firms. This emphasis on stability might result in relatively modest returns during economic growth phases. Additionally, since quality investing often relies on historical metrics, there’s no guarantee that past performance will continue in the future.

How Has Quality Performed in Recent Years?

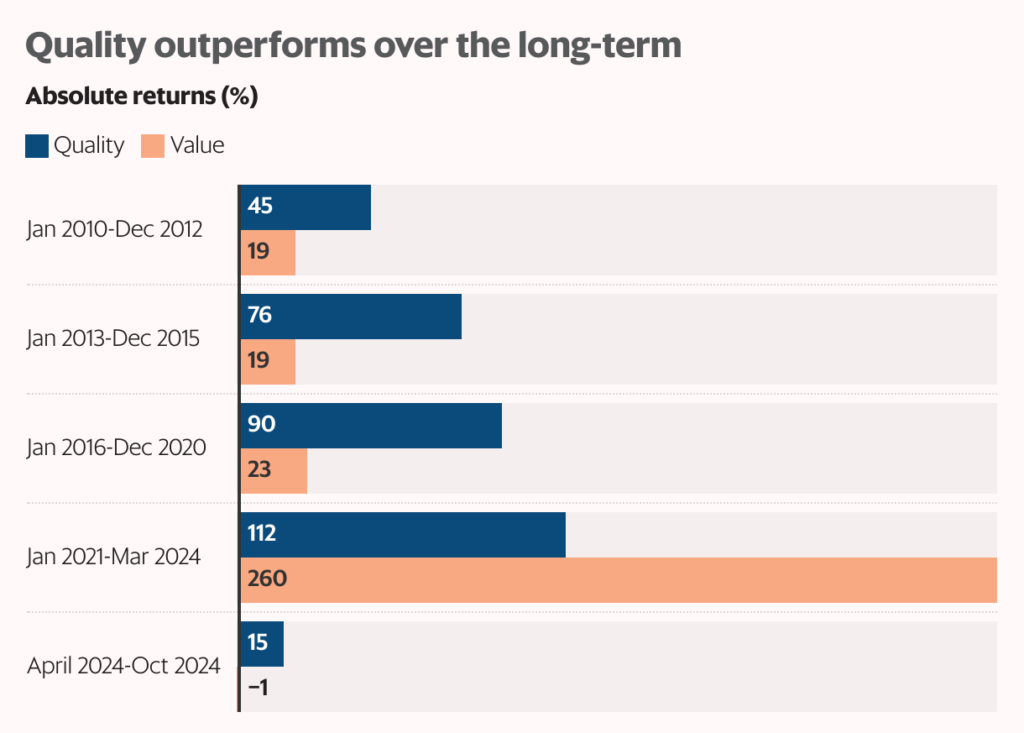

In the Indian markets, quality as an investment factor has consistently outperformed over longer periods. However, in the past three years, value stocks have gained the upper hand due to a surge in various sectors, leading many investors to overlook quality. Despite this shift, we expect this anomaly to correct itself as investors recognize inflated valuations and begin seeking out genuinely strong businesses with a proven long-term track record.

What Framework Should Investors Use for Quality Investing?

Approaching quality investing with the right framework—by avoiding companies with questionable credentials, being mindful of growth prospects, refraining from overpaying, and considering sector rotation within quality—can yield long-term alpha with significantly lower volatility compared to the market.