“Unlocking Profit Potential: Just Dial’s Drive for 25% Margin Growth”

Just Dial sets its sights on unlocking profit potential through a strategic focus on achieving 25% margin growth within its local search business. With a solid financial position, investors are presented with an opportunity to tap into this growth strategy.

Just Dial Limited: Revolutionizing Local Search in India

Just Dial Limited is a key player in the transformation of small and medium businesses (SMEs) in India through its robust platforms, contributing significantly to the digitalization of local enterprises.

Boasting a database of over 36.5 million listings, Just Dial has established itself as a leader in the local search industry by harnessing digitalization and advanced technology to efficiently connect customers and end-users.

The company is strategically positioned to capitalize on growing trends such as the rise in smartphone usage, expanding internet access, and the government’s initiatives towards digitalization, thereby catalyzing the advancement of SMEs in the country.

The Impact of Just Dial Limited on Indian SMEs

Just Dial Limited has emerged as a key driver in the digital transformation of SMEs across India.

Through its extensive database and innovative platforms, the company is empowering local businesses to reach a wider audience and engage with consumers in a more effective manner.

By embracing cutting-edge technology and leveraging the increasing prevalence of smartphone usage and internet connectivity, Just Dial is facilitating the growth and visibility of SMEs, aligning with the government’s digitalization agenda.

Leveraging Digitalization for Business Growth

As more consumers turn to the internet and smartphones for their purchasing decisions, Just Dial’s comprehensive platforms enable SMEs to adapt to this digital shift seamlessly.

With over 36.5 million listings, businesses can leverage Just Dial’s expansive database to enhance their online presence and connect with potential customers, thereby driving growth and success in an increasingly digital marketplace.

By embracing emerging trends and advancements in technology, Just Dial is playing a crucial role in propelling the digital evolution of SMEs and reshaping the local search landscape in India.

Seizing Opportunities in a Digital Era

Just Dial is strategically positioned to capitalize on the growing number of smartphone users and the expanding internet penetration in India.

The company’s commitment to leveraging digitalization and cutting-edge technology underscores its dedication to enabling SMEs to thrive in an increasingly digital-centric environment.

By aligning its strategies with evolving consumer behavior and government initiatives, Just Dial remains at the forefront of driving the growth and development of local businesses across the country.

The products and services offerings of Just Dial:

- JD Mart serves as a B2B marketplace tailored for SMEs, enabling manufacturers, suppliers, distributors, wholesalers, exporters, importers and retailers to showcase their products online through digital product catalogues. On the buyer side, JD Mart facilitates the discovery of quality vendors offering a diverse array of products to meet B2B needs.

- JD Omni offers cloud-based solutions empowering SMEs to align their services with the digitalisation trend. This includes customisable and transaction-ready websites, integration of third-party resources, and features like cloud point of sale, inventory management, customer relations and website building tools, thereby simplifying business operations.

- JD Pay presents a convenient digital payment solution for both merchants and consumers, offering a seamless and secure payment experience through various channels including unified QR codes, cashless transactions, cards, UPI, net banking, and online wallets.

- The Just Dial mobile app, available on Android and iOS platforms, caters to consumer needs by providing intuitive business discovery services, user ratings, location-based search, recommendations, AR-based listing finder, and comprehensive business details.

- The JD Ratings tool facilitates mobile-verified and unbiased ratings and reviews, aiding SMEs in gathering feedback and enhancing user decision-making.

- JD Analytics dashboard offers valuable insights into customer actions, leads, reviews, competition trends and customer feedback, serving as a comprehensive solution for daily business needs.

Sector Overview

Over the past seven years, India’s telecom tower industry has grown by 65 per cent, with projections indicating that the adoption of 5G technology could boost the economy by USD 450 billion from 2023 to 2040.

With nearly one billion active smart phones and an expected 920 million unique mobile users by 2025, the sector presents a promising investment landscape.

The rise in mobile phone usage and decreasing data costs are anticipated to bring 500 million new internet users online, creating opportunities across various sectors such as e-commerce and food delivery.

India currently leads the world in mobile data consumption, with data usage per user reaching 19.5 GB in 2022, driven by affordable rates.

As 5G rolls out, mobile broadband usage is expected to increase further, necessitating upgrades to digital infrastructure.

The PM Gati Shakti National Master Plan aims to boost digital infrastructure development, with the Gati Shakti Sanchar Portal streamlining approvals for broadband expansion.

Government policies supporting reduced fees and relaxed FDI norms have fostered an environment conducive to growth, attracting higher investment inflows and increased merger and acquisition activities.

E-commerce has become the preferred mode of shopping in India, with cheap mobile internet rates and increased connectivity driving the digital economy.

The market is expected to reach USD 111 billion by 2024, with e-commerce sales forecasted to grow at a CAGR of 18.2 per cent between 2021 and 2025.

There is significant potential for e-commerce growth in semi-urban and rural areas, supported by improved infrastructure and government initiatives to expand internet access.

The MSME sector, comprising over 63.3 million units, plays a crucial role in India’s economy, contributing to GDP and job creation.

The government aims to increase the sector’s GDP contribution to 40 per cent by 2025 through measures to enhance competitiveness and promote online procurement via platforms like GeM.

This focus on MSMEs indicates their importance to India’s economic development, with young entrepreneurs leveraging new-age marketing tools and social media to tap into untapped markets.

Financial Overview

Just Dial Ltd. boasts a market capitalisation of ₹7,067crore. The promoters currently hold about 74.31 per cent of the shares, while FIIs and DIIs possess around 4.87 per cent and 8.89 per cent of the shares, respectively. The free float of the company is at 11.93 per cent.

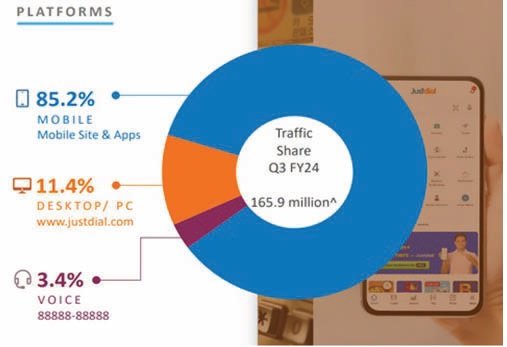

Looking at the quarterly financial performance of Just Dial, on a consolidated basis, in Q3FY24, the company reported revenue of ₹265 crore which surged by 19.7 per cent as compared to ₹221.4 crore in Q3FY23, while the EBITDA of the company also soared by 122.8 per cent and stood at ₹60 crore as against ₹48.8 crore in Q3FY23.

Similarly, the net profit of the company jumped 22.3 per cent to ₹92 crore as compared to ₹71.8 crore in Q3FY23.

This growth was primarily driven by healthier collections which the company has been experiencing during the past few quarters.

The last 12-month collections have grown by 25.7 per cent on a YoY basis. Moreover, as highlighted earlier, the cost control measures should result in margin expansion with each passing quarter, and the same has been playing out as well.

The EBITDA margin stood at 22.8 per cent, which expanded by 10.5 percentage points on a YoY basis and 400 bps on a QoQ basis.

Employee costs, which account for a majority of the expenses, decreased by 11.3 percentage points to 67.3 per cent on a YoY basis on account of decline of employee headcount in both sales and non-sales functions. The focus was on maximising productivity and bringing in efficiencies across functions.

Furthermore, deferred revenue stands at a healthy level of ₹472.7 crore, growing 17.5 per cent on a YoY basis.

Looking at the previous three quarters’ financial performance of Just Dial, on a consolidated basis, in 9MFY24, the revenue of the company stood at ₹773 crore which surged by 26 per cent as compared to ₹612 crore in 9MFY23, while the EBITDA of the company soared by 181 per cent and reached ₹146 crore as against ₹52 crore in 9MFY23. Similarly, the net profit of the company jumped 213 per cent to ₹247 crore as compared to ₹79 crore in 9MFY23.

Additionally, upon scrutinising the financial wellbeing of the company in terms of liquidity and solvency, it is evident that the interest coverage ratio is at 46.5 times, the current ratio is at 7.64 times, and the debt-to-equity ratio is close to zero at 0.02, signifying the company’s minimal debt and interest paying capacity.

These metrics collectively indicate a robust financial position in terms of liquidity and solvency. Furthermore, assessing the performance indicators, the return on equity (ROE) stood at 1.3 per cent and the return on capital employed (ROCE) was at 1.7 per cent, which is a matter of concern as the company isn’t able to achieve a healthy return on equity capital or even on the total capital.

Outlook

The company is focused on making its local search business more profitable. It has set a goal to reach a 25 percent profit margin by the end of the year.

Collaborative initiatives with Jio teams, including My Jio integration and Jio Ads, underscore Just Dial’s commitment to leveraging partnerships for growth. Additionally, efforts to pilot thirdparty sales assistance and prioritise organic traffic growth through advertising reinvestment signal proactive measures to drive business expansion.

Notably, Just Dial has observed an improvement in customer retention, indicating effective strategies in enhancing user satisfaction and loyalty.

The company has capitalised on technology to streamline operations and enhance efficiency. Leveraging automation, the company has achieved content enrichment and data collection without a corresponding increase in physical manpower.

This prioritisation of technology aligns with Just Dial’s commitment to improving productivity and operational effectiveness, crucial for sustaining competitiveness in the digital landscape.

The company’s sales and marketing efforts reflect a targeted approach towards geographic-specific manpower planning and revenue optimisation.

Emphasis on new customer acquisitions through resellers and self-signups highlights Just Dial’s proactive stance in expanding its customer base.

Moreover, strategies aimed at realising improvements and managing the impact of price increases on customers underscore a comprehensive approach to revenue generation and customer satisfaction.

Looking ahead, Just Dial maintains a margin guidance of 25 per cent with potential revisions, indicating confidence in its operational capabilities and growth prospects.

The integration of Just Dial with other Reliance Group platforms presents opportunities for synergies and expanded market reach.

Initiatives focusing on content enrichment, AI integration and the monetisation of new platforms position Just Dial for sustained growth and innovation amidst evolving market dynamics.

Furthermore, when examining its key valuation metrics, the company’s price to earnings (PE) ratio is 21.3 times, which is marginally lower than its five-year historical median PE of 22.4 times.

Also, the current PE multiple of 21.3 times still remains substantially below the industry average of 45.3 times. Additionally, the EV/EBITDA ratio stands at 15.2, which is also slightly below its five-year historical EV/EBITDA median of 15.7.

Hence, It is worth keeping this stock under close radar for potential upside.

Disclaimer: This content is purely for informational purposes and does not constitute a recommendation for stock investment. Any decision related to investments should be made in consultation with a qualified financial advisor.