Against the backdrop of heightened credit demand, banks have chosen to diminish their statutory liquidity ratio (SLR) holdings, marking a deliberate departure from their previous liquidity risk management tactics.

Mumbai: Indian banks are seeking to meet the surging demand for loans by selling off a portion of their investments in government securities. This maneuver comes as banks grapple with fierce competition for deposits, which are becoming increasingly scarce.

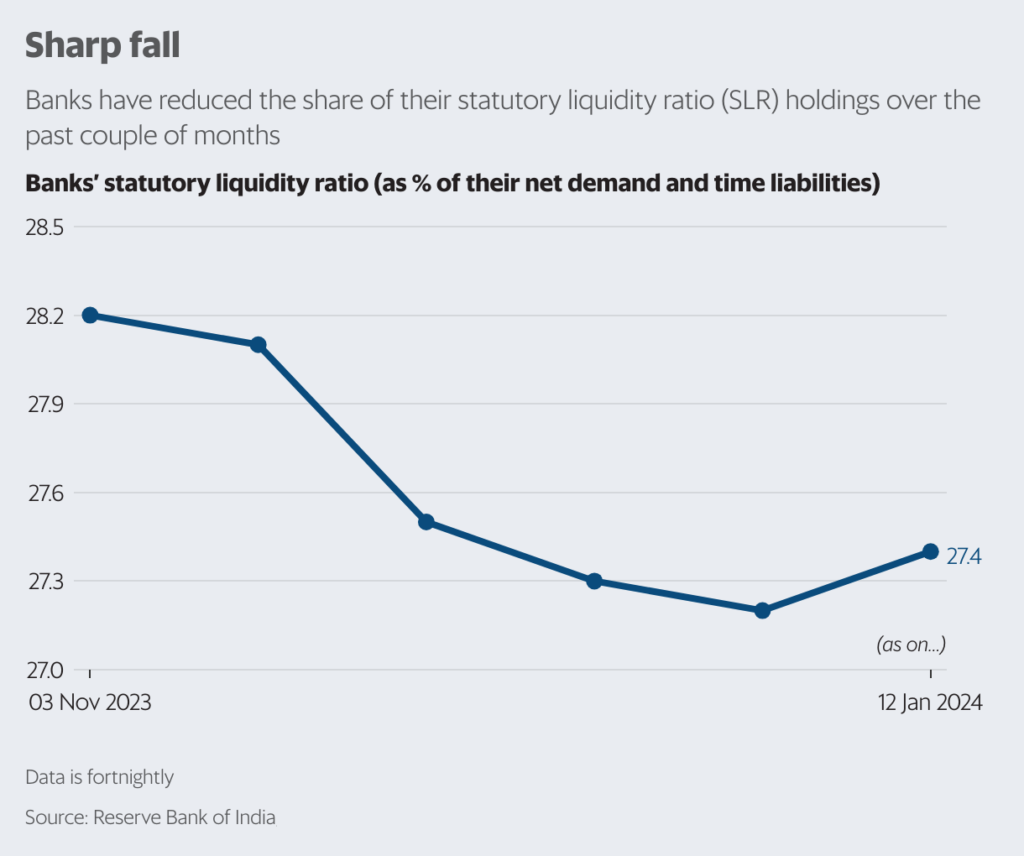

Analysis of data from the Reserve Bank of India indicates that banks have been lowering their share of statutory liquidity ratio (SLR) holdings over the past few months. This strategic shift underscores the banks’ efforts to navigate the challenging landscape, adapt to changing market conditions, and sustain their lending activities amidst evolving dynamics.

Indian Banks Adjust SLR Holdings to Meet Loan Demand

Indian banks are making strategic adjustments to their investment portfolio by lowering their holdings of Statutory Liquidity Ratio (SLR) securities to address the rising demand for loans amid intense competition and a shortage of deposits. This move comes as a response to the escalating need for lending and reflects a proactive approach to managing liquidity challenges.

Understanding SLR and Banks’ Investments

The SLR is the mandatory portion of deposits that banks are required to invest in approved securities. While the Reserve Bank of India (RBI) mandates banks to maintain SLR investments of at least 18% of their Net Demand and Time Liabilities (NDTL), banks typically maintain a higher percentage, around 28-29%, when credit demand is low.

In response to pressure on the deposit front, banks have reduced their SLR holdings to 27.4% of NDTL as of 12 January, marking a decline from the ratio of 28.1% on 17 November 2023 and 28.7% on 14 July 2023, as per the fortnightly business data released by RBI.

Implications and Expert Insights

Financial experts have indicated that the reduction in SLR holdings is likely a result of banks selling off these securities due to an anticipated shortfall in deposits. Madan Sabnavis, chief economist at Bank of Baroda, highlighted that the decrease in SLR indicates that banks have likely divested these securities in the market.

Sabnavis further explained that this divestment possibly involved non-bank players, such as insurance companies, as opposed to interbank transactions. He emphasized that this move is indicative of the current liquidity situation, where banks are responding to a prolonged deficit and the absence of any permanent infusion of liquidity by the RBI, such as open market operations.

According to Sabnavis, banks collectively hold an excess of 8-9% in SLR holdings, and the reduction in these holdings represents a strategic response to the prevailing liquidity challenges faced by the banking sector.

Challenges of System Liquidity Deficit

Recent data from Bloomberg indicates that the system liquidity deficit in India has exceeded ₹3 trillion due to constrained government spending, with the deficit standing at ₹2.5 trillion as of 28th January. Since mid-September, the banking system has experienced a persistent liquidity deficit, interrupted only by intermittent days of surplus.

Banking Strategy: Raising Deposit Rates

In response to the liquidity deficit, banks have been increasing deposit rates to attract customers to deposit their funds. However, the difference between the pace of credit and deposit growth has seen minimal change.

Credit-Deposit Ratio and Its Impact

As of 12th January, non-food credit, which encompasses loans provided by banks to individuals and companies after adjusting for loans given to the Food Corporation of India (FCI), exhibited a year-on-year growth rate of 20.4%, compared to a 13% year-on-year growth in deposits. Consequently, the credit-deposit ratio rose to 77.55% as of 12th January, up from 75.14% a year earlier. This ratio serves as an indicator of the portion of a bank’s deposit base allocated for loans.

Competition for Deposits

Bankers anticipate challenges in acquiring deposits, acknowledging the intense competition among lenders for the same pool of deposits. Ravi Narayanan, Group Executive of Retail Liabilities, Branch Banking, and Products at Axis Bank Ltd, stated that “It will be a war for deposits” during a press briefing on 23rd January.

Impact on Deposit Growth

Puneet Sharma, Chief Financial Officer of Axis Bank, expressed concerns that the current liquidity environment may impede deposit growth for the banking system.

Strategic Shift: Reduction in SLR Investments

Several market experts have observed a trend of banks reducing their investments in Statutory Liquidity Ratio (SLR) holdings, and some have initiated sales of government securities (G-secs) to address the disparity between deposits and credit. Ajay Manglunia, Managing Director and Head of the Investment Grade Group at JM Financial, emphasized that while banks have begun selling G-secs to bridge this gap, most of them are still holding onto these investments.

Evolving Landscape

Manglunia noted a significant shift in the liquidity scenario, highlighting that surplus funds that were once invested in G-secs are now being redirected towards meeting the increased demand for credit. This demonstrates a shift from a scenario of surplus liquidity to one in which banks are more actively addressing the heightened demand for loans in the market.

The adjustment in SLR holdings by Indian banks underscores their proactive approach to managing liquidity and meeting the increasing demand for loans. It reflects the banks’ strategic response to the evolving financial landscape and the competitive pressures in the lending market. These developments showcase the adaptability of Indian banks in navigating changing dynamics while striving to sustain their lending activities.