Amidst a record-breaking market year, the focus turns to an enduring topic in finance and business – taxes. A Tax Expert unpacks what investors should do if their invested company faces a tax notice, highlighting the critical role taxes play in financial planning.

Taxes have long been an essential element of human societies, representing a complex system with direct and indirect categories. Understanding these aspects of taxation is crucial for individuals and businesses to navigate their financial responsibilities.

Direct Taxes: Impacting Individuals and Businesses

Direct taxes are explicitly imposed on individuals or businesses according to their income, wealth, or assets. Examples of such taxes include Income Tax, Capital Gains Tax, and Property Tax. The responsibility for direct taxes falls squarely on the taxpayer, directly influencing their financial obligations.

Indirect Taxes: Influencing Goods and Services

In contrast, indirect taxes are imposed on goods and services at different stages of production and consumption. Examples of these levies include GST, Value-Added Tax (VAT), and excise duties. While businesses initially bear the burden of indirect taxes, they frequently pass on these costs to consumers through elevated prices, shaping the overall economic landscape.

Crossing Borders: International Tax and Customs

Navigating international tax and customs regulations adds another layer of complexity to the taxation landscape, presenting unique challenges and considerations for global interactions.

Double Taxation Avoidance Agreements (DTAAs): Mitigating Taxation Challenges

Double Taxation Avoidance Agreements (DTAAs) serve as treaties between countries aimed at preventing the adverse effects of double taxation, where the same income faces taxation in multiple jurisdictions. These agreements often establish residency rules and tax credits to alleviate the burden of double taxation, promoting international economic interactions.

Customs Duties: Regulating International Trade

Customs duties represent taxes imposed on goods imported and exported across borders, regulating international trade activities and serving as a vital source of government revenue. Understanding and adhering to customs regulations is imperative for businesses engaged in international trade to ensure compliance and minimize financial implications.

Addressing Investor Concerns

The apprehension surrounding tax notices was recently highlighted by a friend’s experience with a company receiving a tax notice from the Income Tax Department. This occurrence prompted concerns and anxieties, prompting considerations of potential financial repercussions and investment decisions. However, it is essential for investors to comprehend the nuances of tax notices and their impact on companies before making significant decisions, alleviating unnecessary panic and ensuring informed actions.

A Guide for Investors

Receiving a tax notice from a company in which an investor has a stake can trigger unease, prompting the need for careful deliberation before taking any action. It is paramount for investors to adeptly grasp the situation and proceed with calculated steps. Here’s a comprehensive approach for investors facing such circumstances:

Understanding the Nature of the Notice

A foundational step for investors confronted with a tax notice is to comprehend its nature. discerning whether the notice is an audit summon, a request for supplemental tax payments, or the imposition of penalties is crucial. Each category demands a distinct level of urgency and warrants tailored response strategies.

Delving into the Reasons

Probing the reasons underpinning the notice is equally essential. Carefully examining the content of the notice unveils the underlying issues, which often encompass inconsistencies in reported income, oversights in tax filings, or delinquency in fulfilling tax responsibilities. This understanding serves as the bedrock for devising an appropriate course of action.

Estimating the Financial Impact

Furthermore, evaluating the potential financial implications carries significant weight. By gauging the effects of the notice on the company and its consequent impact on the investment, investors can make well-informed decisions. Understanding how the notice might financially impact the company allows investors to take proactive and strategic steps.

In the realm of investments, encountering tax notices necessitates a balanced and informed approach. By thoroughly comprehending the nature of the notice, exploring its underlying reasons, and estimating the financial ramifications, investors can navigate these situations judiciously. This thoughtful approach mitigates impulsive decision-making and empowers investors to respond to tax notices with prudence and discernment.

A Strategic Approach for Investors

Understanding the Complexities

When faced with a tax notice, undertaking a comprehensive approach is crucial. The initial step involves gathering information and seeking professional assistance. It’s essential to initiate communication with the company’s investor relations department or management team to gain insights into their perspective on the notice and their intended response strategy. Simultaneously, meticulously examining the company’s financial statements and disclosures sheds light on the tax issue at hand, providing a better understanding of the situation.

Engaging Expertise

Seeking the expertise of professionals such as tax advisors or financial consultants with specialized knowledge in corporate tax matters is advisable. These professionals play a pivotal role in interpreting the intricacies of the notice, conducting a thorough assessment, and providing strategic recommendations for appropriate courses of action. Their insights are invaluable in navigating the complexities of tax-related challenges, ensuring a well-informed and strategic response.

Maintaining Vigilance

The next crucial step involves maintaining a vigilant stance by closely monitoring the unfolding situation tied to the tax notice. Staying well-informed and updated on the case’s progress and any pertinent developments is paramount. This entails regular engagement with reliable news sources and official updates from the involved parties. Sustaining open lines of communication, fostering a continued dialogue with both the company and advisors, is crucial. Proactive communication ensures that you are well-positioned to respond effectively to any shifts in the landscape.

Periodic Reassessment

Furthermore, conducting a periodic reassessment of your investment is essential. As the situation evolves, revisiting your initial investment thesis and evaluating whether the unfolding events necessitate adjustments to your holdings or contemplation of an exit strategy is crucial. This reflective approach ensures that your investment decisions remain aligned with your financial goals and risk tolerance in the dynamic context of the ongoing tax matter.

A strategic approach to addressing tax notices involves gathering information, seeking professional assistance, maintaining vigilance, and conducting periodic reassessments. These steps empower investors to respond effectively and ensure their investment decisions align with their financial goals amidst the complexities of tax-related challenges.

Understanding the Significance of Notice Materiality

In the realm of corporate affairs, the concept of ‘materiality’ bears crucial weight, signifying the relevance of information pertinent to a company. Essentially, it encapsulates data that holds the potential to sway the decisions of well-informed investors.

Elements of Materiality Assessment

The evaluation of materiality hinges on two fundamental components:

◼ Magnitude: This pertains to the scale or quantitative influence of the information. For instance, a minor profit deviation may not be deemed material, whereas a significant accounting discrepancy exceeding 10% of the earnings would certainly qualify as such.

◼ Qualitative Importance: This encompasses the potential qualitative repercussions of the information on the company’s future prospects, risk profile, or competitive standing. Even seemingly minor issues, such as the departure of a key executive or a legal dispute with a major supplier, could attain materiality if they bear substantial implications for the company’s future.

Ramifications of Material Disclosure

Once identified as material, disclosed information holds the power to profoundly impact both the company and its investors:

Implications for Companies

- Credibility and Trust: An organization’s adherence to timely and precise divulgence of material details fosters trust among investors and stakeholders, underscoring the importance of potential fallout in terms of reputation and legal repercussions when such transparency is lacking.

- Stock Performance and Market Evaluation: Material disclosures wield significant influence on a company’s stock value. Favorable information such as surpassing earnings projections can propel the stock upward, while unfavorable news like a product recall may precipitate a sharp downturn.

- Decision-Making and Strategic Planning: Management harnesses material information to drive well-informed choices pertaining to investments, operational activities, and future blueprints. Neglecting such vital information can culminate in ill-advised decisions and adverse outcomes.

Impact on Investors

- Investment Strategies: Access to precise and timely material information empowers investors to craft well-informed decisions regarding the purchase, sale, or retention of their stakes in the company.

- Risk Evaluation: Material disclosures aid investors in comprehending the perils associated with the company and adjusting their investment tactics accordingly.

- Investor Trust: Consistent and forthright release of material information nurtures investor trust, fostering confidence and encouraging continued investment, thus bolstering the company’s long-term expansion.

Examples of Material Information:

- Variations in financial performance (revenue, profits, etc.).

- Mergers and acquisitions.

- Noteworthy legal entanglements or regulatory predicaments.

- Launch of new products or market advancements.

- Alterations in key personnel or management.

Key Considerations for Investors

As a prudent investor, comprehending the significance of legal or regulatory notices holds paramount importance. It’s imperative to react thoughtfully, refrain from hasty selling actions, and approach the scenario with a composed mindset.

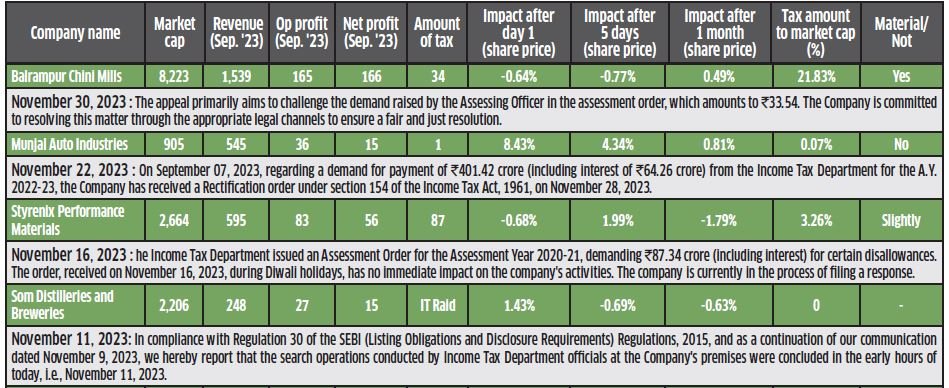

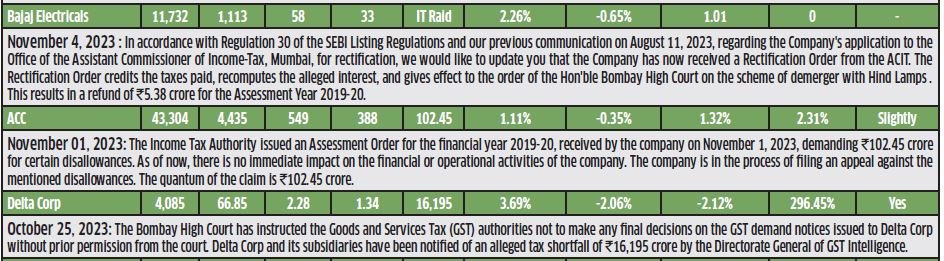

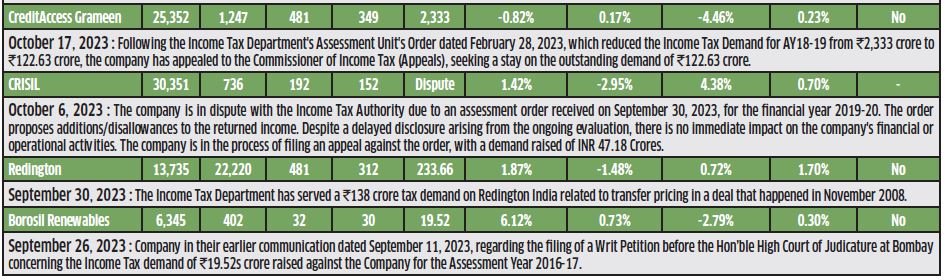

Taking an in-depth analysis of the provided data, a prevailing pattern emerges – the influence of notices generally diminishes over time. Nonetheless, an exception stands out, notably in the case of Delta Corp. Here, the tax amount associated with the notice significantly contrasts with its market valuation, indicating a potentially substantial impact on the company.

In scenarios where a company, such as Delta Corp, confronts a substantial repercussion from a legal or tax notice, it may be prudent for investors to contemplate divesting their holdings. The decision hinges upon an evaluation of the company’s future prospects. If the notice severely impedes the company’s growth or financial well-being, retaining the stock might not be advisable.

The adage, “It’s better to depart than to repent later,” encapsulates the essence of making timely and well-informed choices in financial markets. Exiting a stock under specific circumstances, particularly when challenges appear imminent, can be a strategic maneuver to safeguard one’s investment portfolio.

Conclusion

For investors, emphasizing the understanding of legal or regulatory notifications is vital. It’s crucial to approach the situation with composure and make well-informed decisions rather than acting impulsively. Upon examining the provided data, a prevailing trend emerges – the influence of notifications tends to wane over time, except in the case of Delta Corp, where the notice’s tax amount significantly diverges from its market value. In instances where a company faces a substantial impact from a legal or tax notice, divesting holdings may be prudent, contingent upon the evaluation of the company’s future prospects. Making timely and informed decisions in financial markets is crucial, and exiting a stock under certain circumstances to protect one’s investment portfolio can be a judicious move.