Formerly lauded for their pandemic-era growth, chemical stocks have entered a prolonged downturn, presenting diminished valuations that allure investors. An expert scrutinizes the industry’s decline, present financial standings, and future potential to evaluate the prudence of investing in these stocks as a contrarian gamble.

Individuals commonly exhibit a strong inclination to follow prevalent trends, reflecting a psychological tendency to align with the majority sentiment in their environment. This inclination influences various aspects of life, from embracing current fashion trends to engaging with popular social media content, and even mirroring the prevailing investment sentiments in financial markets. The collective sentiment often drives significant buying or selling activities, influenced by the widespread optimism or pessimism surrounding a specific stock or sector, as most investors tend to act in accordance with the prevailing sentiment.

Nonetheless, similar to life, the market accommodates ‘contrarians’ who adopt a strategic approach against the ongoing market trend. This unconventional strategy involves intentionally opposing the current market sentiment, choosing to sell when others are buying and buying when the majority is selling. Contrarian investors seek opportunities during times when market sentiment deviates from the perceived reality, aiming to capitalize on potential reversals or undervalued assets that others may overlook. For instance, many investors recognized IT stocks as favorable contrarian opportunities and initiated investments based on their individual risk appetites. Recently, there has been a turnaround for IT stocks as global recessionary concerns have diminished.

Investor confidence in the sector has been restored following a significant correction that led to IT stocks being available at reduced prices. The IT stocks experienced a considerable upturn, fueled by increased optimism arising from the Federal Reserve’s indication of interest rate cuts in 2024 and ongoing collaborations between domestic industry leaders and global IT majors to develop AI solutions, which have the potential to revolutionize the industry. When evaluating potential contrarian investment opportunities, the chemicals industry swiftly emerges as an industry encountering significant challenges. Let’s explore whether the chemical industry is on the verge of a potential turnaround by analyzing the financial performances of industry leaders, as well as assessing domestic and global risk factors and growth triggers.

Indian Chemical Industry: A Comprehensive Overview

The Indian chemical industry serves as a cornerstone of the nation’s economy, encompassing vital sectors such as bulk chemicals, agrochemicals, petrochemicals, polymers, fertilizers, and specialty chemicals. Embracing the sixth-largest global chemical producer status and ranking third in Asia, India contributes a noteworthy 7 percent to its GDP. Notably, India stands out as the world’s fourth-largest agrochemical producer and the third-largest consumer of polymers, positioning itself as a significant player in international markets.

Except for pharmaceutical products, India stands as the eleventh-largest exporter of chemicals, making a substantial 15 percent contribution to the global dyestuff and dye intermediate production. This notable stature firmly cements India’s position as a prime global dye supplier, portraying the industry’s commendable diversification, spanning over 80,000 commercial products and employing over 2 million individuals. Leveraging its proximity to the Middle East, a key raw material source for petrochemicals, India harnesses economies of scale, boasting a market value of USD 178 billion in 2019, projected to soar to USD 300 billion by 2025, with a robust CAGR exceeding 9 percent.

Acknowledging the industry’s pivotal role in India’s economic growth, the government grants 100 percent foreign direct investments (FDI), with the exception of hazardous chemicals. Anticipated investments amounting to ₹ 8 lakh crore by 2025 testify to the industry’s promising trajectory. In line with the Union Budget for 2023-24, the Department of Chemicals and Petrochemicals secures a designated budgetary allocation of ₹ 173.45 crore. Noteworthy initiatives include the introduction of production-linked incentive (PLI) schemes with a budgetary outlay of ₹ 1,629 crore, aimed at fostering bulk drug parks, shaping a landscape conducive to industry expansion and innovation.

Market Dynamics for Chemical Stocks in India

The Indian stock market’s performance in the initial half of 2023 remained subdued, with gains of a mere 5 per cent. Multiple factors, such as geopolitical tensions, global uncertainties, recession concerns, the Federal Reserve’s assertive approach, and a noteworthy sell-off triggered by a spike in 10-year U.S. Treasury yields to a 16-year pinnacle, collectively impacted global market performance.

In stark contrast, the latter half of 2023 witnessed Indian indices surging by more than double the gains of the first half. The robust upswing can be accredited to buoyant growth projections, a strengthened economic outlook, and a resolute electoral mandate in the recent polls. Consequently, both the BSE Sensex and Nifty 50 soared to achieve record peaks, registering gains of 16-17 per cent throughout 2023. While the recent uptrend favored the majority of sectors, resulting in corresponding stocks hitting new 52-week highs, chemical stocks demonstrated notable underperformance.

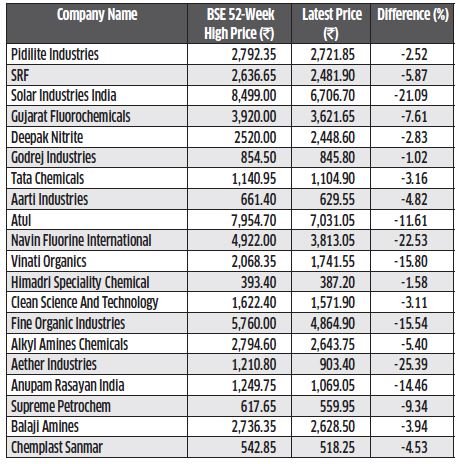

Upon dissecting the tabulated data showcasing the 52-week high prices and the latest figures on the BSE for the leading 20 chemical companies by market capitalization, a conspicuous downtrend emerges. Each chemical stock has undergone a significant slump from its respective 52-week high, resulting in an overall decline of 16.81 percent. This existing landscape prompts an inquiry into the viability of contrarian investment in chemical sector stocks for risk-tolerant investors, given the diminished valuations of these equities. Moreover, an essential consideration lies in evaluating the durability and timeliness of the investment verdict.

Chemical Industry Resilience Amid Global Economic Challenges

Amidst the chaos triggered by the global economic slowdown during the pandemic, the chemical industry emerged as a notable exception, displaying remarkable resilience. The surge in global pharmaceutical needs was a major contributing factor to this standout performance, propelling chemical stocks into a robust rally that was fueled by a sense of heightened optimism for the sector. This buoyant outlook stemmed from both the amplified global demand and the strategic implementation of the ‘China Plus One’ approach, which aimed to diversify operations beyond China and explore alternative investment destinations.

The enforcement of strict environmental laws targeting pollution from China’s chemical and pharmaceutical companies posed challenges, leading to a decline in China’s dominance in the chemical industry. Simultaneously, U.S. and European businesses faced pressure from investors to reduce their reliance on China. The pandemic-induced disruption of supply chains further accentuated this shift in the industry landscape. Consequently, India emerged as a potential beneficiary of these circumstances, with its technical expertise and cost-competitive manufacturing capabilities positioning it to capture an enhanced market share.

The ‘China Plus One’ strategy not only benefited India but also provided a boost to the European Union, Mexico, Taiwan, and Vietnam as companies sought alternative investment destinations beyond China. This shift in investment focus reflected the evolving dynamics within the global chemical industry, underlining the adaptability and resilience of market participants amidst uncertain and challenging economic conditions.

The interplay of global factors and regional dynamics has reshaped the landscape of the chemical industry, presenting both challenges and opportunities for market participants across various geographies. The pandemic-driven disruptions have served as a catalyst for strategic re-evaluations and repositioning within the industry, shedding light on the intricate interdependence of global events and localized actions. As the industry continues to navigate through this ever-changing terrain, the ability to swiftly adapt to emerging trends and capitalize on shifting market dynamics will define the success of industry players in this new era of heightened unpredictability.

The conflict between Russia and Ukraine had a profound influence, especially with the prolonged closure of Russia’s main gas pipeline, worsening Western Europe’s gas shortage. There were concerns that ‘Europe Plus One’ could supplant China Plus One as firms contemplated divestment in Europe due to issues like insufficient gas supply, mandated targets for cutting electricity usage, and the resulting production decline. Amid these circumstances, China, with its capability for excessive chemical production, adopted a dumping strategy, exporting goods at prices below their market value in their country of origin.

The availability of discounted goods had a damaging impact on local manufacturing, intensifying competition and making it incredibly challenging to compete in both domestic and global markets. India’s chemical trade deficit skyrocketed to USD 17 billion in the 2022-23 fiscal year, a striking contrast to the USD 3 billion trade surplus recorded in 2020-21. Domestic chemical manufacturers, already contending with the instability of high raw material prices, encountered a substantial setback, reporting notable declines in both revenue and profitability.

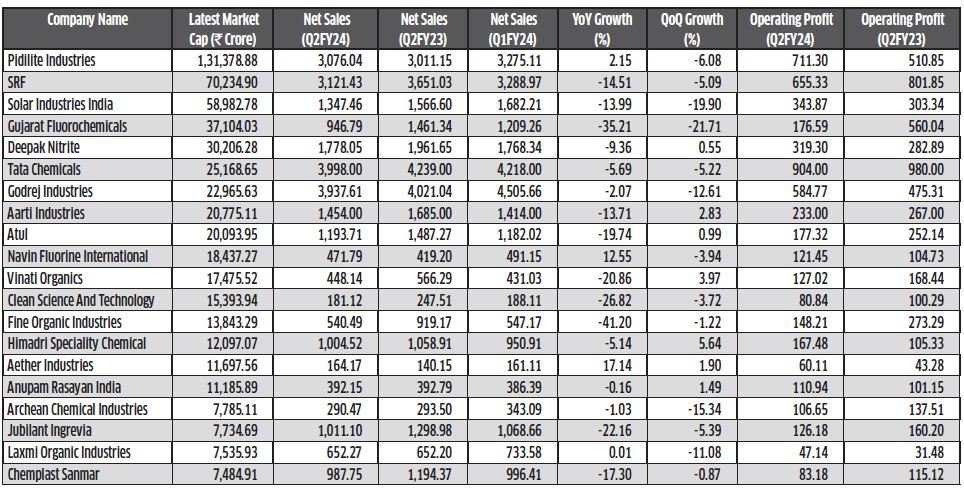

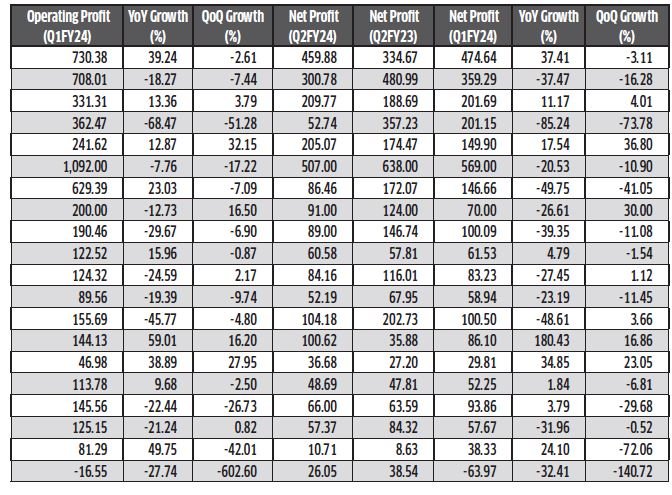

Financial Evaluation of Top Chemical Companies in Q2FY24

The financial evaluation of the top 20 chemical companies by market capitalization in the latest Q2FY24 quarter yielded disappointing results. While some companies showed improvement compared to the previous quarter, the overall performance declined in comparison to Q2FY23 figures. Only three companies, Pidilite Industries Ltd., Navin Fluorine International Ltd., and Aether Industries Ltd., reported year-on-year revenue growth, while a greater number of companies reported modest growth on a quarter-on-quarter basis. The aggregate decline in revenue lessened from approximately 11% year-on-year to a 6% quarter-on-quarter decline, signaling improvement.

A similar pattern was observed in operating profit and net profit, with the decline in profit figures showing improvement. The aggregate decline in operating profit improved from 8% to 6%, and the decline in net profit reduced from 21% to 8% on a quarter-on-quarter basis compared to year-on-year figures. Nonetheless, companies continue to report lower numbers than previous quarters, although all are still registering profits, indicating a need for recovery time. The recovery may occur once the effects of China’s chemical dumping diminish.

“A contrarian approach is just as foolish as a follow-the-crowd strategy. What’s required is thinking rather than polling.”

— Warren Buffett

Conclusion

In light of the widespread application of chemicals in pharmaceuticals, agrochemicals, agriculture, petrochemicals, automotive, construction, electronics, food and beverages, textiles, and renewable energy sectors, the chemical industry plays a pivotal role in a country’s economic development. Its contribution to the GDP and its global market position cannot be disregarded. Despite being seen as high-growth stocks during the pandemic, the chemical sector has faced prolonged challenges, both domestically and globally, leading to reduced stock valuations that are now appealing to investors.

Taking a contrarian approach to leverage potential reversals emphasizes the need to assess the sustainability and timeliness of specific investment assets. Positive expectations for a sentiment shift in the first half of fiscal year 2025 coincide with a significant reduction in China’s surplus inventory. Upward trends are observed in spending on discretionary items like pigments and polymers, while textiles and dyes are experiencing a slower recovery. Analysts anticipate a rapid rebound for bulk chemical companies, especially those catering to diverse end-user markets, as demand picks up momentum.

A gradual recovery is anticipated in the agrochemical and pharmaceutical sectors, despite ongoing challenges in improving revenue, which is expected to improve after the cessation of China’s chemical dumping practices. Companies are expected to require several quarters to recuperate and strengthen profitability. Therefore, investing in chemical companies holds promise, but it is advisable for investors with a higher risk tolerance and a long-term perspective to consider such investments at this time.