According to financial experts, opting for separate term insurance with lower premiums is advised for consumer advantage.

In the realm of insurance and investment, Unit-Linked Insurance Plans (Ulips) have long been debated for their efficacy in providing both life cover and investment returns. Traditionally, financial experts have favored the approach of purchasing separate term insurance with low premiums and simultaneously investing in mutual funds for better returns. However, there has been a shift in the landscape with insurance companies introducing new plans that combine term insurance with Ulips to offer enhanced sum assured and market-linked returns.

Piyush Trivedi, joint president and head of Alternate Channel & Digital Channel at Kotak Mahindra Life Insurance Co., highlights the demand for survival benefits among customers, emphasizing the effectiveness of high sum-assured Ulips in meeting these needs. The sum assured (SA) multiples in Term Unit Linked Insurance Plans (TULIPs) can range from 100-200 times the annual premium, varying based on the policyholder’s age, policy term, and premium payment term. In contrast, Ulips generally yield returns of 10 times the annual premium.

Moreover, these innovative insurance products offer additional benefits for long-term policyholders, including the return of mortality charges, refund of fund management charges, premium allocation charges, and loyalty additions. Notably, Tata AIA Life Insurance, with its Tata Smart Sampoorn Raksha, was the pioneer in launching this concept in 2021, followed by similar offerings from other prominent insurers such as HDFC, Bajaj, Max, and ICICI Prudential.

One of the key attractions of these plans is the premium flexibility they offer, enabling individuals of different ages to purchase high sum assured policies at the same premium amount. The maturity benefits are contingent upon factors such as the policyholder’s age, sum assured multiple, investment value, and policy term. While specific minimum premium limits have not been disclosed by many insurers, Kotak Life Insurance has established a minimum premium of ₹1 lakh per annum for its TULIP offering, providing a clear framework for potential policyholders.

As the insurance industry continues to evolve, the emergence of these innovative insurance products signifies a strategic convergence of life cover and investment opportunities. It remains essential for consumers to carefully evaluate their individual needs and risk appetites when considering these offerings to make informed decisions about their financial future.

The Advantages of Ulip Premium and Investment

Madhu Burugupalli, senior executive vice president and head of products at Bajaj Allianz Life Insurance, explains the dynamics of Ulip premium, highlighting its two key elements: the death benefit and the investment value. With Ulip, customers have the flexibility to choose their own multiple for the death benefit, with most plans offering a multiple of 100x of the annual premium. Burugupalli also notes that younger policyholders have the potential to have a multiple of 170x, making Ulip an attractive investment choice for the younger demographic.

Comparing Ulip with Traditional Investment Options

Financial advisers often advise clients to weigh the benefits of Ulip against a combination of a term plan and an equity mutual fund when considering investment-linked products. Kotak Life Insurance provides a comparative analysis, illustrating that a 35-year-old paying a premium of ₹1 lakh for 10 years in a 40-year policy term could potentially receive ₹70 lakh on maturity, assuming an 8% investment growth rate. Additionally, a term plan for this individual could be purchased at a premium of ₹46,138, leaving a premium differential of ₹53,862 to be invested in an equity mutual fund. Kotak’s data demonstrates that with an expense ratio of 0.8% and a compound annual growth rate of 8%, the mutual fund could accumulate ₹63.84 lakh.

Evaluating Ulip’s Performance

Trivedi of Kotak Life emphasizes the advantages of Ulip, stating that it outperforms a combination of a mutual fund and term insurance for longer tenures due to loyalty additions on maturity. However, Trivedi acknowledges that in the short to medium term, mutual funds may yield better returns until the refund of different charges is factored in. It’s important to note that these conclusions are contingent on the expense ratio being 0.8%. Alternatives such as a Nifty50 direct-growth Index Fund could offer a significantly lower expense ratio of as low as 0.1%, impacting the overall comparative analysis.

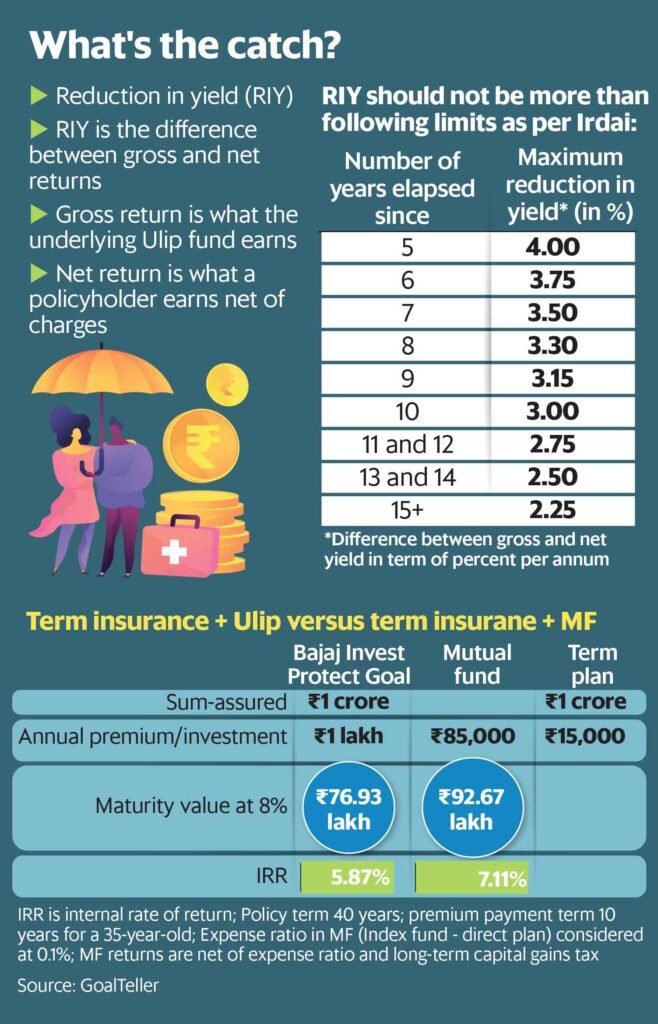

Founder of GoalTeller, Vivek Banka, conducted a thorough analysis of the Bajaj Invest Protect Goal, a product akin to Ulip. Upon paying an annual premium of ₹1 lakh for a 10-year premium payment policy and holding a policy term of 40 years, a 30-year-old policyholder stands to receive ₹76.93 lakh on maturity, assuming an 8% investment growth rate. However, the internal rate of return (IRR) is estimated at 5.87% due to various charges such as fund management, policy administration, and premium allocation fees that are deducted from the investment value.

An alternative worth considering involves opting for a term cover at an annual premium of ₹15,000 for the same policy and premium payment term. The remaining ₹85,000 differential in premiums per year is directed towards a Nifty50 direct-growth index fund for 10 years, with no further additions in subsequent years. This approach is projected to yield a corpus of ₹92.67 lakh, factoring in an expense ratio of 0.1% and equity long-term capital gains tax, consequently producing an IRR of 7.11%. Vivek Banka suggests, “If one chooses a direct-growth plan in a large-cap equity fund, the MF+term combination will yield better returns.”

It is important to note that Ulips enforce a lock-in period for the initial five years, limiting liquidity. On the other hand, mutual funds offer enhanced liquidity. While Ulips permit partial withdrawals after 5 years, the fund value may be lesser compared to what could have been amassed through an equity mutual fund. This underscores the significance of weighing the liquidity aspect when evaluating the Ulip and mutual fund options.

Understanding Ulip Performance and Challenges

When considering Ulip performance, factors such as mortality return, premium allocation, fund management charges, and loyalty benefits play a significant role in determining the Internal Rate of Return (IRR) for Ulips. However, there exists a crucial aspect known as the reduction in yield (RIY) that demands attention. RIY represents the return differential between the underlying fund of a Ulip, assumed at 4% and 8% in benefit illustrations by insurers, and the net returns received by the policyholder after deducting charges.

Irdai, the insurance regulator, has laid down specific limits for RIY, stating that this difference should not exceed 4% at the end of the fifth policy year, 3% at the end of the tenth policy year, and 2.25% at the end of the fifteenth policy year and beyond. However, due to various charges, the RIY tends to exceed 3% in most Ulips, resulting in net returns for policyholders falling below the anticipated levels. Insurers then refund mortality, premium allocation, and other charges to enhance the net return and comply with the Irdai-specified RIY limit. Despite these refunds, experts caution against getting swayed solely by this factor.

Sumit Ramani, actuary and co-founder of ProtectMeWell.com, emphasizes that a combination of term insurance and mutual funds is potentially a better option than a high Sum Assured (SA) Ulip from a financial efficiency standpoint. However, he points out that the underwriting norms are more stringent in term plans.

Jain of Policybazaar suggests that TULIP could be a viable alternative to Trop (term with return of premium) due to its market-linked nature, offering the potential for better returns on maturity.

It’s important to note that Trop entails a refund of the total premiums paid during the premium payment term at maturity if the policyholder survives the policy period. Jain illustrates this with an example, comparing Max Life TROP and Max Life high SA ULIP policy for a 35-year-old individual. The former yields just ₹8.5 lakh on maturity with a premium of ₹30,734 for ₹1 crore coverage, while the latter provides ₹24.6 lakh with a premium of ₹50,762.

In conclusion, the discussion on Ulip premium and investment, the unique features of Ulip, its potential advantages over traditional investment products, and the importance of considering expense ratios when evaluating its performance are essential takeaways for individuals assessing their investment options.

Understanding the nuances of Ulip performance is essential to make an informed decision, considering factors such as RIY, policy refunds, and the potential returns on maturity. Considering expert opinions and thorough evaluation is key to making the right choice when it comes to selecting insurance products and investments.