Historical data indicates that small-cap investments outperform large caps when entering the market at its lowest point but underperform when investing at its peak.

Staying Invested in Small Caps: A Decision Guide

Small caps have enjoyed great success in recent years, creating significant wealth for many investors. But now the question arises: is it wise to continue investing in small caps?

Expert Opinions vs. Historical Analysis

Many experts have shared their opinions backed by data and analysis, but a simpler, more instructive approach is to examine the best and worst times to invest in small caps based on recent history. This could provide valuable insights for planning and potentially restructuring your portfolio.

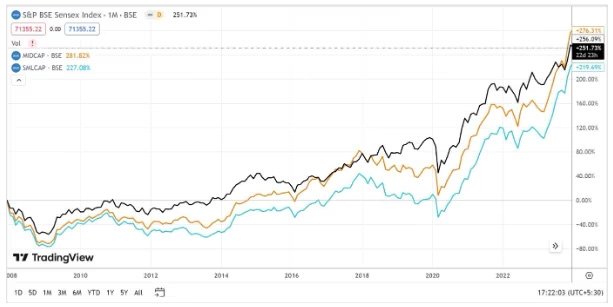

Let’s analyze a chart starting from December 2007, a period marked by stock market peaks, particularly in real estate and infrastructure sectors. After the peak:

Notice what happened when the sell-off came in 2008. Naturally, small caps (blue line) fell far faster than large caps (black line). But that’s just a near term impact.

The chart shows a sharp decline in small caps during the 2008 financial crisis, followed by a slow recovery. This period tested investors’ patience and resilience.

Following the crisis, small caps experienced a remarkable surge from 2009 to 2013, offering significant growth opportunities for astute investors.

Amid this boom, small caps also witnessed periods of high volatility, presenting challenges and opportunities for investors seeking to capitalize on market movements.

In more recent times, small caps have shown resilience and adaptability amidst changing market conditions, indicating their potential for long-term growth.

Considering the historical trends and the current market landscape, it’s essential to weigh the opportunities and risks associated with small caps.

By understanding the historical performance of small caps, investors can make informed decisions about their investment strategies. The experiences of the past can offer valuable insights for navigating future opportunities and challenges in the small cap space.

What’s the more important point is that you could have held on to your investments for the next 16 years, and even then, the large caps, represented by the BSE Sensex here, would have outperformed the small caps. Amazing. As an investor you got no extra return for buying riskier stocks, just because you entered at the top of the market.

Let’s pencil this in as an example of what happens when you invest at the top of the market.

Now, let’s take a look at the next chart. This one starts in January 2009 when the stock markets hit rock bottom as a result of the Great Recession.

At first glance, it may seem obvious that small caps outperform large caps in the near term. However, the real surprise lies in the significant outperformance over a 15-year period, making a compelling case for investing at market bottoms.

The following chart provides a snapshot from January 2018, capturing a time when markets were once again hitting their peaks.

This has a similar pattern to the first chart. Initially small caps underperformed large caps, but in the long term they marginally outperformed large caps. Such a minor underperformance is not worth the additional risk, and this too serves as an example of what can happen if you invest at the top of the market.

Our last chart starts in March 2020, during the most recent big sell off.

The impact of market timing on small and large cap investments has been a subject of keen interest for investors. The patterns observed in the market sell-off of 2008 and the subsequent recovery from the Great Recession have provided valuable insights into the behavior of small and large cap stocks during different market conditions.

Small Caps vs. Large Caps

Despite the common belief that small caps experience larger declines during market sell-offs, the recovery from the Great Recession demonstrated a significant shift in investment dynamics. Over a 16-year period, it was evident that large caps outperformed small caps, challenging the notion that investing at market peaks yields additional returns. While small caps may fall faster during sell-offs, the long-term performance of large caps surpasses that of small caps, indicating the importance of strategic investment decisions during market fluctuations.

Strategic Investing

During periods of market exuberance, it becomes crucial to reassess investment strategies. Small caps may not necessarily outperform large caps over the long term in such market conditions, posing a question on the risk-reward trade-off associated with investing in small caps during market peaks. It becomes apparent that being relatively overweight on large caps instead of small caps during bullish market phases may prove beneficial for investors seeking to mitigate risk.

Contrary to this, in times of market distress, the potential for higher returns emerges with small cap stocks. The risk-reward trade-off shifts in favor of small caps during market downturns, presenting an opportunity for investors to capitalize on the potential long-term outperformance of small caps relative to large caps. This emphasizes the significance of taking calculated risks and adapting investment strategies based on market sentiments and prevailing conditions.

Market Timing and Risk Management

The ability to recognize market peaks and bottoms remains a challenge for investors. While no definitive indicators exist to predict market movements, analyzing historical patterns can provide valuable insights. It is crucial for investors to understand the significance of market timing in relation to small and large cap investments and to embrace the principles of strategic risk management and informed decision-making.

The Impact of Market Timing on Small and Large Cap Investments

Bull Market Characteristics

A bull market, often characterized by sharp spikes in stock prices and the emergence of new valuation metrics, draws in a surge of money flows, especially into smaller companies. With lots of IPOs hitting the market and the emergence of new gurus predicting multi-decade bull runs, the market atmosphere becomes charged with speculative fervor.

Market Peaks and Small Cap Investments

In the event of a market peak where one believes the small cap stocks are overvalued, it might be prudent to lighten the exposure to small caps. This doesn’t imply getting rid of core small cap holdings purchased at attractive prices, but serves as a cautious approach to potentially overvalued segments of the market.

Continued Allocation and Decision Making

Investors pondering whether to add to their small cap allocation must evaluate the existing market conditions and the quality of stocks in their portfolio. Whether via stock purchases or mutual fund SIPs, the decision to continue adding to small cap exposure requires careful consideration.

Considerations for Allocation

The focus here is to depict how one could consider allocating funds at various market stages. It’s intended to represent a pattern that may repeat in the future, rather than a comprehensive, data-heavy analysis. This serves as a starting point for investors to review their allocation across small caps, mid caps, and large caps.

Final Note

While market timing presents inherent challenges, the analysis of historical market behavior illustrates the dynamic interplay between small and large cap stocks during different market phases. Effective risk management, strategic allocation of investments, and a prudent approach to market timing are essential for investors to navigate through changing market dynamics and optimize long-term investment returns.

Investors are encouraged to review their allocation between small caps, mid caps, and large caps, while ensuring rational and informed decision making. It’s paramount to seek advice from a personal investment advisor or wealth manager before executing any financial decisions, thereby anchoring investment choices in individualized, professional guidance.

Happy rational investing to you.

You should always consult your personal investment advisor/wealth manager before making any decisions.