As we usher in the year 2024, it’s essential to reflect on the 2023 equity market performance and the catalysts driving its upward trajectory. Looking ahead to 2024, the Indian equity market stands as a beacon of strength. Amid global uncertainties, Shashikant provides valuable insights to illuminate the path forward. As we draw the curtains on…

Crafting a Well-Diversified Portfolio: 10 Stocks Across Sectors and Caps

Entering 2024, it’s imperative to review the 2023 equity market performance and the driving forces behind its growth. Looking ahead to 2024, the Indian equity market stands out as a beacon of hope. Will this upward trajectory persist amidst ongoing global uncertainty? Shashikant provides valuable insights to shed light on these pressing questions.

As we close the curtains on 2023, the Indian equity market has emerged as a beacon of positivity, unveiling a landscape adorned with green hues in the year-end retrospective. This transformation marks a stark departure from the apprehensive lows experienced in March, which were underpinned by global uncertainties and geopolitical instability. The driving forces behind this notable surge warrant scrutiny, along with the crucial question: Will this momentum extend into 2024?

Market Indices and Performance

While the majority of global equity indices are poised to test their 52-week highs, the Indian equity indices have reached unprecedented peaks. Most indices have delivered double-digit returns on a year-to-date (YTD) basis, with single-digit returns being a rarity. However, the rally has been characterized by disparities across segments. While the Mid-Cap and Small-Cap sectors showcased exuberance, the frontline indices, burdened by heavyweight financial and IT conglomerates, displayed relative restraint.

Standout Performances and Surprising Sectors

The BSE SME IPO index notably emerged as the top performer, registering an impressive 94.34% YTD return, drawing attention to the buoyancy of SMEs listed on the BSE SME platform. Following closely, the Realty index witnessed a resurgence after nearly 14 years, with companies like Unitech Limited showcasing notable resilience, recording over 350% growth since the year’s commencement. Even industry giants such as DLF exhibited robust performance, with an over 80% surge in share prices. Additionally, public sector undertakings (PSUs) defied expectations with substantial gains, exemplified by a 54% upswing in an index tracking the prices of major PSUs listed on the BSE. Banks and other enterprises primarily owned by the government displayed remarkable share price expansions, underscoring the surprising strength of the PSU segment.

2024 Projections and Beyond

As the curtain rises on 2024, the Indian equity market’s performance in 2023 sets an intriguing stage for the year ahead. With ongoing global uncertainties and evolving market dynamics, stakeholders are eager to unravel the trajectory that the Indian equity market will carve in the upcoming year. The resilience displayed by diverse sectors in 2023 poses compelling questions about sustainability and prospective trends in 2024 and beyond.

Factors Contributing to Stock Market Growth

The surge in stock market growth can be attributed to a convergence of supporting factors. Many of the obstacles that have troubled the global economy, including India, in the past year are gradually diminishing. Concerns about escalating interest rates, inflation, and the conflict in Ukraine, which previously rattled the financial markets, are fading away. Moreover, India’s noteworthy resilience, reinforced by domestic initiatives, a stable Indian currency, and strong economic fundamentals, has proven to be a potent catalyst.

Domestic Measures and Economic Fundamentals

India’s proactive measures to fortify its domestic economy have significantly contributed to the upward momentum in the stock market. The government’s initiatives to enhance infrastructure, coupled with efforts to streamline regulatory processes, have generated a positive sentiment among investors. Additionally, the country’s robust economic fundamentals, including a growing middle class and increasing consumer spending, have provided a solid foundation for sustained market growth.

Global Economic Landscape

Amid the receding concerns over global economic uncertainties, the stock market has witnessed a renewed surge. The declining impact of factors such as rising interest rates and geopolitical tensions has created an environment conducive to market expansion. Moreover, the steady performance of major global economies, particularly in Asia, has bolstered investor confidence and stimulated positive market dynamics, further fueling the upward trajectory of stock valuations.

Positive Policy Developments

Favorable policy developments, both at the domestic and international levels, have played a pivotal role in shaping the current growth trajectory of the stock market. Proactive measures taken by the Indian government, such as policy reforms aimed at attracting foreign investments and simplifying tax structures, have instilled confidence in the investment community. Furthermore, international agreements and trade accords have contributed to strengthening market sentiment, signaling a favorable outlook for global trade and economic cooperation.

Key Factors Propelling Growth in the Indian Equity Market

Favourable Macro Conditions

The Indian equity market has experienced significant growth, driven by a confluence of factors that have created a conducive environment for economic expansion. One of the key drivers of this growth has been the favorable macro conditions that have emerged in the country. A decrease in inflation, coupled with the Reserve Bank of India’s accommodating stance on interest rates, has laid the groundwork for robust economic growth. Moreover, the government’s emphasis on infrastructure spending and reforms has further bolstered investor confidence, setting the stage for sustained market expansion.

Higher GDP Growth

India’s higher GDP growth has defied expectations, standing at 7.8 per cent in Q1FY24 and 7.6 per cent in Q2FY24. This growth has been fueled by robust investment growth, despite subdued consumption growth. The surge in gross value added (GVA), driven by the expansion of the industrial sector, has been a significant contributing factor. The strong corporate profitability expected in the coming quarters is likely to sustain this growth trajectory, even as consumption faces continued pressure.

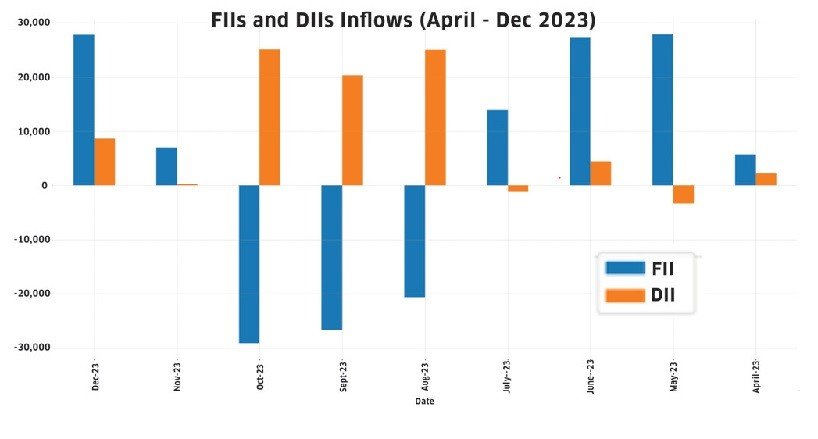

FIIs Inflows

India’s relative stability and appealing valuations have consistently attracted foreign investment, despite global market fluctuations. This influx of liquidity has acted as a catalyst for the recent bullish trend in the Indian equity market. Foreign investors have re-entered the Indian markets, encouraged by the country’s robust macroeconomic fundamentals and the domestic market’s upward trend. In November, foreign investors ended a three-month selling streak, becoming net buyers of Indian equities and injecting a total of ₹ 27,775.95 crore month-to-date (MTD) and ₹ 33,179.44 crore in the last nine months ending December 20. Domestic institutional investors (DIIs) have also played a pivotal role, acquiring domestic shares worth ₹ 81,490 crore since the beginning of the financial year. The drop in US bond yields, triggering substantial capital flows toward emerging markets like India, has further contributed to this trend. Sectors like large-cap financials and IT, favored by FIIs and reasonably valued, are expected to sustain their upward trajectory.

The Indian equity market’s growth has been bolstered by favorable macro conditions, higher GDP growth, and consistent inflows of foreign and domestic investments. These factors, along with robust corporate profitability and sustained market expansion, paint a promising picture for the future of the Indian equity market.

Gazing into 2024: Outlook for India’s Economic Landscape

India’s Prospects in 2024

As we set our sights on 2024, the trajectory of India’s future appears to be taking shape, providing a brighter outlook compared to the past year. Factors such as geopolitical tensions, global rate adjustments, and inflationary trends may linger, but India’s inherent strengths offer reasons for optimism. Projections suggest that India’s GDP growth will stand out globally, driven by vibrant domestic consumption and a thriving services sector. The International Monetary Fund has acknowledged India as a stellar performer, projecting its contribution to global growth to exceed 16 percent.

Positioning India as one of the swiftest-growing major emerging markets, the country’s infrastructure and digitalization reforms have laid the groundwork for attracting more investments. The government’s sustained efforts in implementing reforms, particularly in infrastructure and manufacturing, have the potential to unleash the next wave of economic expansion. Furthermore, a reduction in inflation coupled with a probable moderation in interest rates sets the stage for a phase of stable and moderate interest rates in the Indian economy, potentially bolstering economic activities.

Analyzing India’s Financial Landscape and Equity Market Opportunities

Factors Influencing India’s Equity Market in 2024

India’s financial and equity markets are undergoing a transformation in the wake of shifting policy rates, foreign investment projections, and market performance amidst global uncertainties. These developments are shaping the investment landscape and offering new opportunities for both domestic and foreign investors.

India’s Interest Rate Dynamics and Equity Market Potential

India’s policy rates have returned to pre-pandemic levels, presenting a stark contrast to the prevailing situation in developed markets where rates remain notably elevated. This lower interest rate scenario is poised to favor equity markets, potentially leading to enhanced returns for market participants. The alignment of India’s policy rates with pre-pandemic levels underscores stability and signals a conducive environment for investment in equities.

Foreign Investment and Market Stability

The Indian equity market stands to benefit from the current foreign portfolio investor (FPI) holdings, which have reached a decade-low. Anticipated foreign investment in the debt market, driven by India’s forthcoming inclusion in the JP Morgan Emerging Market Government Bond Index, is expected to foster increased stability for the Indian rupee. This impending shift has the potential to contribute to lower yields, subsequently resulting in a reduced cost of equity that could further bolster the Indian equity market.

India’s Equity Market Outlook Amidst Global Uncertainties

Despite prevailing geopolitical uncertainties and global market fluctuations, India’s unique fundamentals and resilience present a persuasive case for sustained optimism. Notably, in the current market upswing, large-cap stocks have exhibited relative underperformance, positioning them favorably in terms of valuations. This trend offers an added layer of resilience against potential negative developments in the months ahead. Conversely, high-quality mid-cap stocks have shown resilience in a bullish market environment, despite short-term operational challenges and potential medium-term shifts in market fundamentals.

Market Caution and Identification of Potential Risks

Amidst the positive trajectory, caution is advised, particularly concerning several low-quality mid-cap and small-cap stocks, which have experienced substantial surges. These segments of the market may be susceptible to overvaluation, indicating the presence of a potential bubble that investors should carefully navigate.

As we embark on the journey into 2024, it’s crucial to anticipate the pivotal months ahead. The global and Indian markets are primed for a period that will significantly shape the trajectory of the first half of CY24. The duration and impact of peak interest rates in the US and other developed economies will undoubtedly influence global economic strength and market sentiment throughout 2024.

In this context, the Indian equity market is poised for ongoing consolidation alongside selective growth. The broader market, fueled by escalating consumer demand and robust corporate earnings, is expected to maintain its upward trajectory. Identifying sectors positioned to benefit from structural economic shifts will be a key factor in navigating the evolving landscape.

In the 2nd part of this article, we will provide a comprehensive rationale for the selection of stocks for the 2024 portfolio. This well-diversified portfolio encompasses various sectors and market capitalizations, aiming to capitalize on the diverse opportunities presented by India’s evolving economic landscape. Stay tuned as we delve into the strategic insights underpinning these stock selections, guiding investors through the potential avenues for growth and value creation in the Indian equity market.