The difficulty of securing deposits has intensified amid growing credit demand, influenced by low interest rates and banking system modifications.

Indian Banks Struggle with Declining Deposits

The banking sector in India is witnessing a shift in the dynamics of traditional deposits, resulting in significant implications for bank performance in the near future. This shift is primarily driven by two key factors, both of which have contributed to a slowdown in deposit growth.

Regulatory Influence on Savings

Over the years, regulatory emphasis on maintaining nominal interest rates at low levels, despite occasional periods of negative real rates, has led to a diversion of a portion of the country’s incremental household savings to alternative assets, particularly mutual funds. This trend became evident when the mutual fund industry’s assets under management surpassed ₹50 trillion in December 2023. To provide context, this amount was a mere ₹884,631 crore in December 2013. Notably, the data categorized by the Association of Mutual Funds in India reveals a significant shift in investment patterns. As of end-September 2023, household investment in equity mutual funds, including retail and high net worth individuals, was three times larger than the aggregate of wholesale investments from corporates, banks, and foreign portfolio investors.

Structural Changes in Deposits Market

Simultaneously, the traditional market for deposits is undergoing substantial structural changes. This transformation is likely to have far-reaching consequences for banks, impacting their performance in the coming quarters. The decline in deposit growth has forced Indian banks to grapple with a dwindling deposit stream, resulting in escalated operational costs and constricted margins.

The confluence of these factors has created a pivotal moment for ordinary deposits within the seemingly ‘boring’ domain of banking. As Indian banks navigate these complexities, it becomes crucial to monitor and adapt to the evolving landscape of deposits, considering the potential implications for the sector’s financial health and stability.

The Banking System’s Reluctance to Adjust Deposit Rates

The banking system has displayed a sluggish response in adjusting deposit rates, despite the Reserve Bank of India (RBI) raising benchmark rates. Traditionally, banks are quick to increase lending rates following RBI rate hikes, but they drag their feet in raising deposit rates. Conversely, when RBI reduces rates, deposit rates plummet faster than lending rates. This presents a challenging scenario for depositors. Additionally, the robust performance of equity markets over the past 12-18 months has enticed depositors to channel their surplus funds into alternative investment avenues. Moreover, the 2016 demonetization episode may have also contributed to discouraging people from depositing money in banks.

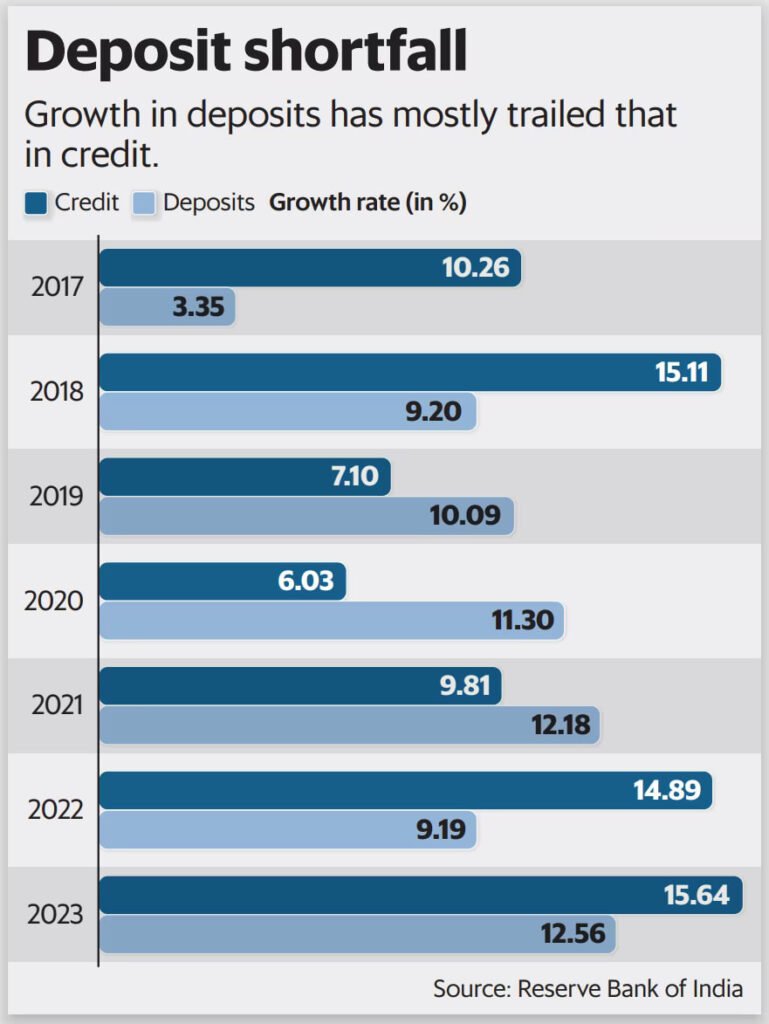

The confluence of these factors has resulted in some noticeable fluctuations over the last two years. Although aggregate deposit growth in calendar year 2023 improved to 12.5% compared to the previous year, bank credit grew at a faster pace of 15.64% during the same period. Consequently, several banks, especially private ones, reported a credit-deposit ratio exceeding 100%, indicating their reliance on non-deposit liabilities to meet the escalating demand for loans. This situation occurred at a time when the RBI was draining excess liquidity from the system, driving inter-bank and debt-market rates higher and inflating borrowing costs for banks issuing certificates of deposit.

Shift in Focus: Importance of Deposit Mobilization

With the changing landscape, bankers are now beginning to recognize the significance of deposit mobilization for their core banking operations. During the easy-money era, when fee income bolstered bottom lines and low-cost funding could be accessed from various alternative sources, deposits were viewed as outdated remnants of a controlled economy. However, as RBI’s anti-inflationary measures curtailed fee incomes, bankers heavily reliant on the credit business faced a setback due to sluggish deposit growth. This emphasized the fundamental importance of deposits in sustaining banking operations.

Evolution of Deposit Mobilization in Indian Banking

Historical Context

When it comes to the basic essentials of banking, two critical elements stand out: capital and human resources. In India, the availability of labor has never been a major issue; however, there has been debate over whether the quality of available human resources meets the industry’s demands. On the capital front, the aggregation of funds typically involves equity, deposits from the public, and market borrowings. Notably, the focus on deposit mobilization gained momentum following the nationalization of banks in 1969, aligning with a broader socialist economic model.

Development Initiatives and Deposit Expansion

Post-nationalization, banks emerged as vital tools in advancing the government’s developmental objectives. Data from the Reserve Bank of India (RBI) illustrates a substantial expansion in the branch network, particularly targeting rural areas. This strategic expansion led to a sevenfold increase in deposit collection within a decade, soaring from ₹4,646 crore in 1969-70 to ₹33,377 crore by 1979-80. The surge in deposit generation played a pivotal role in financing the government’s social sector expenditure, with funds being channeled through high regulatory reserves. Even following the economic reforms of 1991, the underdeveloped debt market compelled banks to continue relying heavily on deposits.

Resurgence of Deposit Mobilization

In an intriguing turn of events, traditional deposits have regained prominence, alongside the revival of physical bank branches, which were previously criticized as costly extensions. This has triggered a structural realignment in the deposit market, likely leading to implications for banks’ bottom lines. As the industry adapts to this shift, banks with expansive branch networks are expected to capture a larger share of the deposit market. Notably, several prominent banks in both the public and private sectors have been strategically expanding their branch networks, penetrating new districts. Complementing this physical presence are direct marketing initiatives through dedicated sales teams and digital outreach endeavors. Conversely, banks unable to match this level of investment in branch coverage may need to rely on a more expensive blend of deposits and market borrowings, potentially reshaping sections of the industry.

In conclusion, the banking sector’s inertia in adjusting deposit rates, combined with the lure of alternative investment avenues and the aftermath of demonetization, has led to substantial shifts in deposit and credit growth. This has prompted bankers to refocus their attention on deposit mobilization as a critical aspect of their banking business, particularly in the context of evolving market dynamics and regulatory measures.

The focus on deposit mobilization in the Indian banking sector has undergone a cyclical resurgence, underscoring the enduring significance of traditional deposits amid evolving financial landscapes. This renewed emphasis on deposit gathering and branch expansion reflects a strategic repositioning of banks to navigate the changing dynamics of the industry and sustain competitive advantages.