Real estate developers are observing extraordinary presales figures, marking an exceptional display of market appetite and indicating the sector’s robust demand. These remarkable sales not only portray the market’s resilience but also serve as a gauge of the impressive stock performance predicted. This article delves into the current state of the sector, explores the driving forces behind its growth, and examines whether this peak could lead to a correction or propel it to new highs.

DLF Ltd., a prominent player in the Indian real estate arena, achieved a remarkable milestone by selling its entire inventory of 1,113 high-end luxury residential units, amounting to an impressive ₹ 7,200 crore. Notably, this remarkable feat occurred even before the official project launch, indicating a fervor reminiscent of the previous year’s trend observed with DLF and other real estate entities across India.

The industry giants like Prestige Estate Projects Ltd. and Sobha Ltd. also announced record-breaking sales figures, reflecting the sector’s potential for sustained growth. This surge in presales occurred even during the typically slower season, showcasing the sector’s resilience and its anticipated impressive stock performance.

The broader Indian equity market, exemplified by the Nifty 500, notched its fifth consecutive year of growth in CY23, recording a substantial 25.2 per cent gain. The market’s resilience is evident from the fact that the last negative return was observed in 2018, underscoring its ability to withstand economic challenges. Notably, the realty index emerged as a standout performer, nearly doubling its value over the last nine months of the year.

Several factors drove this stellar performance, including the RBI’s decision to maintain stable repo rates, a festive-induced economic upturn, a robust rebound in demand, and encouraging business updates from realty companies during the second quarter. These dynamics have propelled the real estate sector to remarkable heights, contributing to the broader market’s impressive performance.

The real estate sector’s record presales demonstrate its buoyancy and robust demand, amplifying its significance as a driver of the broader market’s resilient performance. While the current surge is remarkable, it also prompts close observation to discern whether it may lead to a market correction or propel the sector to new highs.

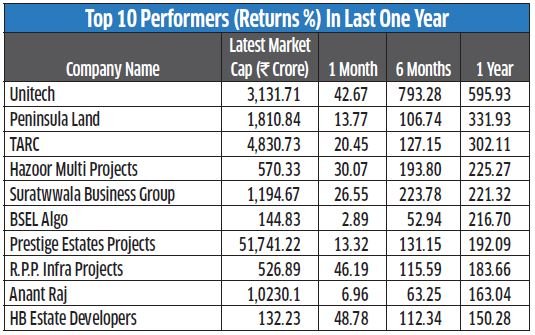

Nifty Realty’s recent surge to a 15-year high signifies the sector’s impressive momentum. This upward trajectory is bolstered by optimistic quarterly reports from major industry players. Post-pandemic, there has been a remarkable resurgence in property demand, especially in the luxury segment. Housing sales in major cities have experienced significant growth, contributing to Nifty Realty’s outstanding performance. In the last one year, 26 realty companies listed with the NSE saw market capitalisation of greater than ₹ 100 crore while their share prices more than doubled. Unitech, which had faded into oblivion, saw its share price jumping by six times. It increased from ₹ 1.72 to ₹ 12.56 in one year, indicating strong investor confidence in realty stocks. Investors looking for growth potential and stability might be wondering if realty stocks still hold the promise and one should take exposure in realty stocks now. Before that let us understand the growth drivers of the real estate sector and how much is already priced in.

The Growth Drivers

1. Rising Indian Household Income

According to a report by World Economic Forum, growth in income will transform India from a bottom-of-the-pyramid economy to a middle-class economy. With post-pandemic normalcy returning to the economic sphere, household income growth is expected in the upper-middle class and lower-middle-class brackets. It is estimated that over 10 crore households will be added to the upper mid-income and lower mid-income bracket by 2030. Households from this income bracket are expected to drive the demand for housing aimed in the mid income category in Tier I and II cities.

2. Increasing Urbanisation

It is a globally established fact that demographic shifts fundamentally affect the demand for real estate. India’s large population base of over 1.4 billion provides a huge domestic demand base. Along with rising population, India’s urbanisation rate is also increasing at a fast pace. As per UNDP projections, by 2046, approximately 50 per cent of India’s population will be urban. However, rapid urbanisation is expected to drive the demand for housing, offices and other real estate asset classes in the medium to long term. UNDP has projected that there will be eight cities with a population of 1 crore and above by the year 2035 in India, highlighting the unmet housing demand.

3. Recovery in Employment Rate

Major labour market indicators such as the all-India unemployment rate, worker population ratio and labour force participation rate have surpassed the pre-pandemic levels. The unemployment rate has been declining amid the rising labour force participation rate. The labour market conditions in urban areas have shown consistent improvement during 2022-23, surpassing the pre-pandemic January-March 2020 level. Organised sector employment, as measured by payroll data, indicated a recovery in job creation in FY 2023.

The average net subscribers added to Employees’ Provident Fund Organisation (EPFO) per month increased to 11.5 lakhs in 2022-23 from 10.2 lakhs in 2021-22, signalling an improvement in formal employment opportunities. The various alternate employment indicators also showed steady improvement in employment conditions during FY 2023. The purchasing managers’ index for employment showed continued uptick in payroll hiring in both manufacturing and services sector.

4. Nuclear Families

India has been witnessing a reduction in the overall household size in the past few decades. The trend is likely to continue further. This is primarily because of the increase in the nuclear status of the families. With the change in family dynamics towards a nuclear setup, more households are getting added and hence consumption is increasing, which in turn fuels the demand for housing. Reduction in the average household size further leads to an increase in demand for housing.

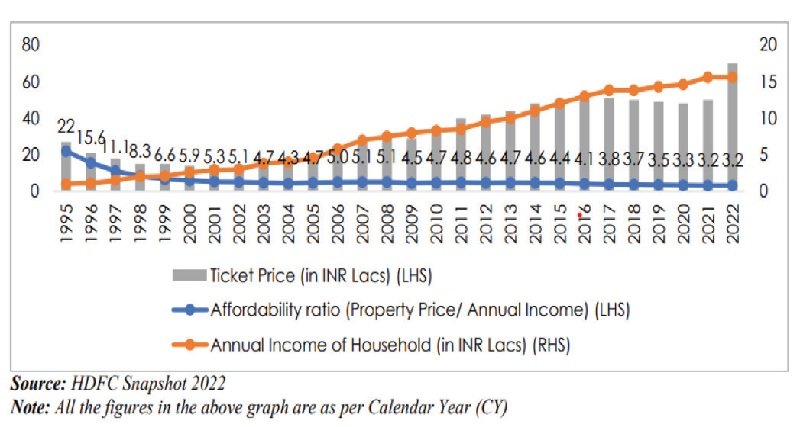

5. Improving Affordability Index

Based on a report by a big broking firm, the government’s support at policy level and increase in household income have improved the overall affordability levels to their best in the last two and a half decades. The increase in household income with almost steady levels of the ticket prices have resulted in increasing the affordability of housing units. The affordability ratio has gotten better, going from 22 in 1995 to 3.2 in 2022. A lower affordability ratio implies that there is higher affordability. The following graph sets forth the housing affordability trend.

6. Consolidation Leading to Higher Share of Branded Players

The Indian real estate sector has witnessed consolidation in the past few years. With the implementation of RERA, developers who were financially weak were not able to adhere to compliance norms and therefore were either seen going out of business or consolidating with larger players. The liquidity crisis following the ILFS crises further worsened the situation for such developers, which resulted in an increase in the share of new launches by branded developers. According to Anarock Property Consultants, the share of new launches by Tier 1 developers increased from approximately 41 per cent in 2015 to approximately 56 per cent in 2018, which has been increasing gradually on account of the liquidity crisis.

7. Increasing Home Loan Penetration

Housing finance penetration witnessed improvement in 2020. The trend of housing finance penetration in urban areas suggests that urban areas will likely have a relatively greater share of future growth in housing finance, almost reaching 50 per cent of the total population. Better housing finance option automatically increases the demand for realty. The following graph shows the housing finance penetration in India from 2011 – 2020.

Other Fixed Income Products: Non-Generation of Enough Savings Avenues

From a broader perspective, approximately 65 per cent of the total savings and investments, relative to GDP, are allocated to real estate and gold, with the remaining 35 per cent directed towards financial assets, including equity and bank fixed deposits. This suggests that as GDP increases, the upward trend in real estate and gold investments is likely to persist. This summary is derived from the available data. According to consumer surveys conducted by Anarock Property Consultants, in 2018, 2019, 2020, 2021 and 2022, real estate consistently emerged as the preferred asset class among various investment options.

Over the period H2 2018 to H2 2022, there has been a steady rise in buyer preference for real estate as an investment, increasing from 53 per cent in 2018 to 61 per cent in 2022. Concurrently, due to rising interest rates, fixed deposits have also experienced increased favour in recent years, climbing from 2 per cent in H2 2021 to 8 per cent in H2 2022. However, anticipating a decline in interest rates in the future, there may be a shift in demand from fixed deposits back towards real estate.

With an expanding economy putting more money into the hands of consumers, there is a noticeable trend of increased spending on housing, including larger homes. This trend is evident not only in major metros but also in ‘A’ cities and ‘B’ cities. Consequently, the demand for real estate is expected to remain robust, driven by the preference for homeownership and larger residences as consumers experience economic growth.

Another important point, which could tilt in favour of real estate going forward, would be the gradual reduction in the rates of interest. That probably would be showing the first signs somewhere in the end of the CY24, wherein you may find that the central bank has started talking about reducing the rate of interest. With that in mind, we expect the demand for real estate and consumer spending on non-essential items to keep growing.

Housing Demand at Inflection Point

Beyond the enduring structural factors shaping the housing market, there appears to be a pivotal moment in the cyclical trajectory of housing demand, poised for sustained growth in both volume and pricing in the near to medium term. Several factors contribute to this shift: the changing sentiment propelled by lockdown experiences and the persistent trend of remote work and online schooling, fostering a preference for functional and adaptable homes that can accommodate workspaces.

Affordability has increased with a decreasing ratio of home loan payments to income over the years, and the diminishing gap between rental yields and home loan rates amplifies the inclination towards home purchases over renting. The impact on the office real estate market is notable. While the initial months of the pandemic saw an adaptation to work-fromhome practices, subsequent months witnessed reconsideration by certain financial and manufacturing occupiers, reflecting a preference for office spaces to enhance employee productivity. Although the work-from-home model has positives like time savings, it is not without challenges, such as connectivity issues.

Anarock Property Consultants anticipates a coexistence of work-from-home and work-from-office models. Grade-A developers have sustained rent recovery rates, and despite the consolidation of office space demand, there is a surge in demand for larger office spaces per employee. The adherence to stringent health and safety guidelines is pushing for techenabled buildings, an advantage for Grade-A developers. In large metropolitan cities like Mumbai, decentralisation of work centres is becoming inevitable, a trend accentuated by the pandemic. New townships in suburban areas are witnessing the development of office spaces.

Recent trends also show office occupiers exploring setups in proximity to residential hotspots, benefiting from lower rents, quality developments by large developers, and increased employee productivity due to reduced travel time. So, from that perspective, one should remain bullish about this sector. Next, let’s talk about the market and the pricing. Are they running ahead of their fundamentals? The market might have anticipated the better result of this sector, which means we are running ahead as far as the output on the earnings is concerned. Now let us delve deep into this.

Financial Performance

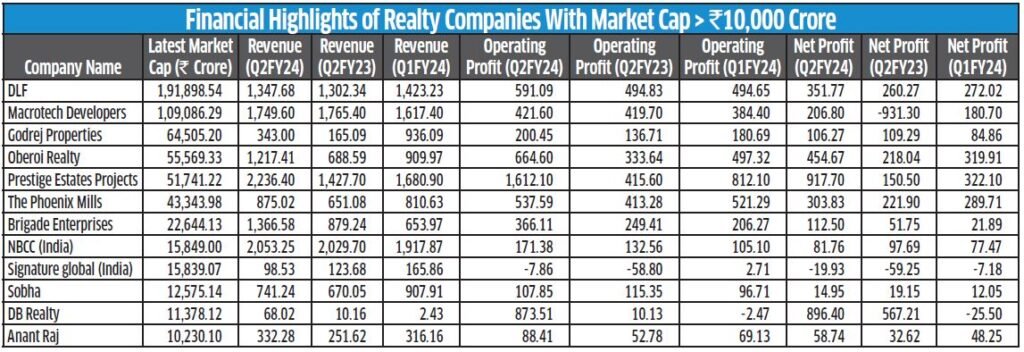

The top 78 listed players in the realty space have a combined market capitalisation of over 7.17 lakh crore. For the second quarter of FY24, these listed companies generated net sales of ₹ 22,858.61 crore, up by 22.4 per cent compared to ₹ 18,460.70 crore in Q1FY23. Among the listed peers, Godrej Properties, The Phoenix Mills and Oberoi Realty clocked robust sales growth. The PBIDT excluding other income in Q2FY24 stood at ₹ 7,127.63 crore with a YoY growth of 77 per cent from ₹ 4,026.95 crore in Q1FY23. Average PBIDT margins improved by 730 bps and stood at 31.50 per cent for Q2FY24. The net profit of the realty space for the second quarter of FY24 stood at ₹ 3,122.99 crore, up by 833.29 per cent YoY from ₹ 599.48 crore in Q1FY23.

Valuation and Future Prospects

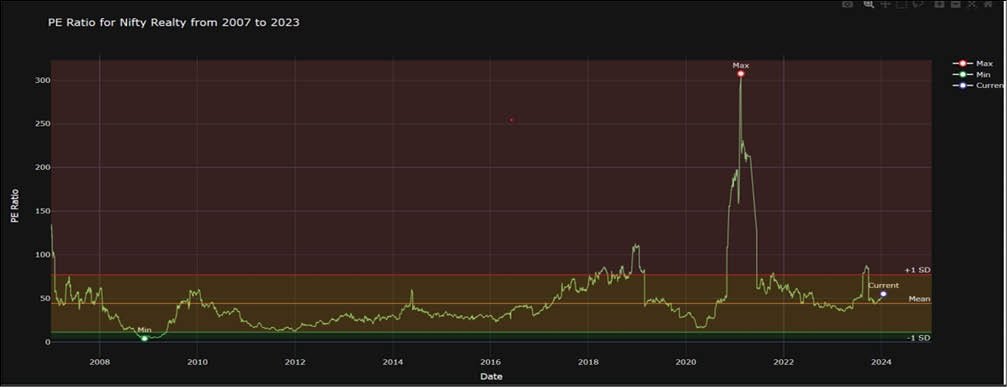

The Indian real estate sector is currently undergoing a robust phase, evident from its valuation metrics. With a current PE ratio of 55.1 times, exceeding the historical average of 44.16 times, it signals investors’ willingness to pay a premium for future earnings potential. However, this valuation is not extreme, falling within one standard deviation below its long-term mean.

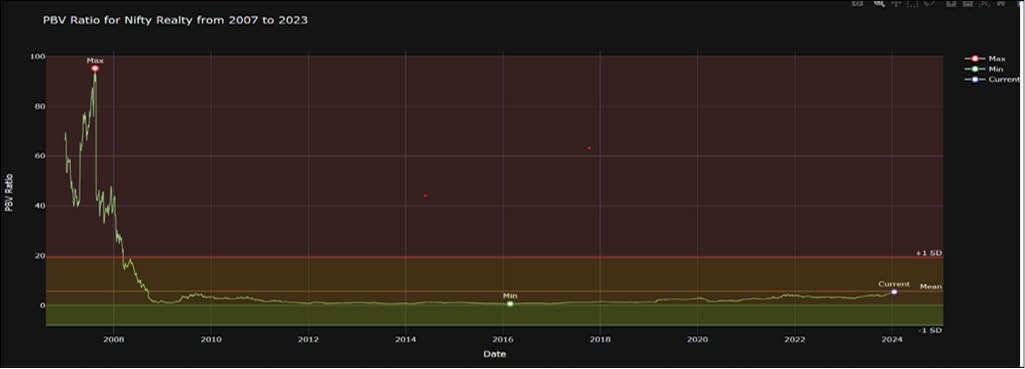

When examining a more stable parameter, the price-to-book value (PBV), the valuation appears below its long-term average. At 5.45, compared to the long-term average of 5.71, the PBV ratio suggests that despite the ongoing rally, there is still room for growth in this index.

Listed real estate players are actively expanding their market presence by exploring new and untapped markets beyond their traditional strongholds. This strategic diversification enables them to broaden their portfolio, reach new customer segments, and fortify their overall competitiveness. Over the past 18 months, there has been a notable increase in inventory levels as developers strive to meet the rising demand for diverse real estate offerings. This growth underscores the developers’ confidence in the market’s future potential and their commitment to providing an extensive range of options for buyers.

Looking forward, the market share of large organised developers is poised to expand further in the next 2-3 years, driven by healthy balance-sheets, access to capital, and the exit of weaker, unlisted developers from the market. Most developers in the listed space have ambitious launch plans for the next couple of years, aiming for double-digit sales value and compound annual growth rate (CAGR) over the same period. Consequently, investors may find it prudent to allocate a portion of their portfolio to this dynamic sector.