Unprecedented Opportunity: Indian MFs Now Tax-Free for Foreign Investors in GIFT City

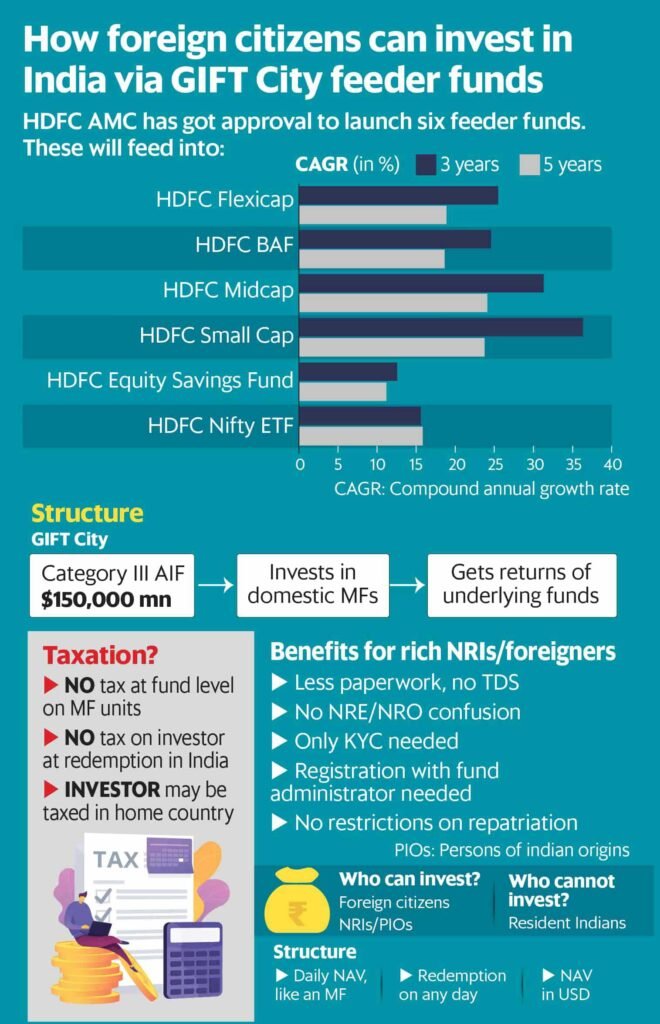

In a groundbreaking development, renowned Indian asset management company HDFC AMC has received the green light to initiate six feeder funds in GIFT City (IFSC), presenting a game-changing opportunity for foreign capital inflow into India’s stock market. These feeder funds, structured as Category III AIFs, will channel investments into HDFC AMC’s domestic mutual fund (MF) schemes.

Tax Benefits for GIFT City Funds

Funds operating within GIFT City that trade MF units in India are exempt from capital gains taxation, presenting an attractive advantage for foreign investors. However, it’s essential to note that while these feeder funds are not subjected to capital gains tax for MF units, they will still incur a 15% short-term or 10% long-term capital gains tax on stock transactions. As Category III AIFs, the tax implications are at the scheme level, providing investors in GIFT City with tax-free redemptions. Moreover, with daily net asset values denominated in US dollars, these six AIFs will offer daily purchase and redemption opportunities.

Simplified Investment Process and Tax Benefits for Foreign Citizens and NRIs

Traditionally, foreign citizens interested in investing in India had to navigate the intricate process of registering as foreign portfolio investors (FPIs), posing a significant barrier. In contrast, GIFT City funds streamline the investment process through a straightforward KYC format, eliminating the need for investors to open bank accounts in GIFT City. This simplified approach extends the reach of investment opportunities, benefiting non-resident Indians (NRIs) as well. Currently, NRIs encounter complex regulations, including the necessity to open specific accounts and navigate stringent investment routes in India. However, with the introduction of GIFT City funds, NRIs can enjoy the exemption from tax deduction at source (TDS) on capital gains, marking a significant shift in the investment landscape for this demographic.

By investing exclusively in growth plans of mutual fund schemes, the AIFs within GIFT City can ensure that their income remains primarily in the form of capital gains, thus circumventing tax deductions. Notably, investors in feeder funds are not mandated to possess a Permanent Account Number (PAN), although those with a PAN are required to disclose it. This new development presents a pivotal opportunity for foreign and NRI investors to access Indian MFs with unparalleled ease and significant tax benefits, revolutionizing the investment landscape in India.

Unlocking Opportunities in GIFT City: HDFC AMC Feeder Funds

Renowned Indian asset management company HDFC AMC has recently introduced six feeder funds within the prestigious Global Financial Hub, GIFT City. These funds, structured as Category III AIFs, aim to provide foreign investors and non-resident Indians (NRIs) with unprecedented access to India’s stock market while offering significant tax advantages.

The Advantage for Foreign Investors

For foreign investors, these feeder funds present a unique opportunity to tap into India’s dynamic stock market with a simplified investment process. By operating within GIFT City, these funds offer tax benefits, exempting capital gains from taxation for mutual fund units. Additionally, investors can enjoy daily redemption opportunities, enhancing liquidity and flexibility in their investment strategies.

Accessibility and Ease of Investment

One of the key advantages of these feeder funds is the streamlined investment process, particularly beneficial for foreign citizens and NRIs. The simplified procedures not only make investing more accessible but also remove the complexities often associated with traditional investment avenues. Moreover, the funds offer exemptions from tax deductions at source (TDS) on capital gains, providing further incentives for foreign investors to participate in India’s market.

Potential Tax Implications for End-Investors

While the feeder funds offer significant tax benefits within the GIFT City framework, it’s important to note that end-investors in these funds may still be liable to tax in their home jurisdiction. This consideration underscores the importance of seeking professional tax advice and understanding the potential implications of investing in these funds.

What’s the Catch?

While the introduction of these feeder funds brings substantial opportunities, there are certain limitations to consider. The funds have a minimum ticket size of $150,000, catering primarily to affluent foreign investors and NRIs. Furthermore, marketing these funds in foreign jurisdictions requires registration with foreign regulators, adding a layer of complexity for widespread promotion.

Addressing Regulatory Requirements

To expand the accessibility of these funds, HDFC AMC has taken steps to register with the US Securities and Exchange Commission (SEC), signaling its commitment to making these funds available to qualified investors in the United States. However, investors who choose to enter the funds independently, without marketing from the AMC, can do so freely.

In conclusion, the establishment of feeder funds within GIFT City by HDFC AMC signifies a pivotal opportunity for foreign investors and NRIs to access India’s stock market with ease and significant tax benefits. While there are considerations and regulatory requirements to navigate, the overall impact of these feeder funds is poised to revolutionize the investment landscape and stimulate foreign capital inflow into India’s thriving market.