The year 2024 brings economic uncertainties and global tensions to the forefront. Emphasize the importance of savings and fortify your financial security in this pivotal time.

Mastering Financial Resilience: Navigating 2024’s Economic Uncertainties

Introduction

Embrace the new year as an opportunity to fortify your financial standing and achieve your 2024 financial goals. In the face of economic fluctuations and geopolitical tensions, strategic financial planning is crucial. This comprehensive guide explores the significance of financial savings, building wealth, and effective money management to secure your financial future.

Prioritizing Savings: Your Shield Against Economic Downturns

Economic Concerns in 2024

Economists predict a potential recession in 2024, emphasizing the need for a robust savings buffer. Discover how prioritizing savings can help you weather economic downturns and safeguard your financial stability.

Inflation Challenges and the Power of Additional Savings

With inflation outpacing wage growth, your purchasing power is at risk. Uncover the importance of additional savings to combat inflation challenges and maintain your financial well-being.

Building Financial Security Amidst Global Uncertainties

Impact of Conflicts and Political Turmoil

Global conflicts and political instability can disrupt markets and economic activity. Learn how increased savings act as a safety net during times of uncertainty, providing stability amidst global challenges.

Addressing Supply Chain Disruptions through Savings

Ongoing supply chain issues can lead to higher prices and shortages. Explore how a larger savings cushion enables you to cope with unexpected expenses arising from disruptions, ensuring financial resilience.

Small Steps, Big Impact: Cultivating Financial Security

The Power of Small Savings Efforts

In 2024, every rupee saved contributes to a brighter financial future. Understand how even small savings efforts can make a substantial difference over time, propelling you closer to your personal financial goals.

Insights from RBI’s Financial Stability Report

India’s Household Financial Landscape

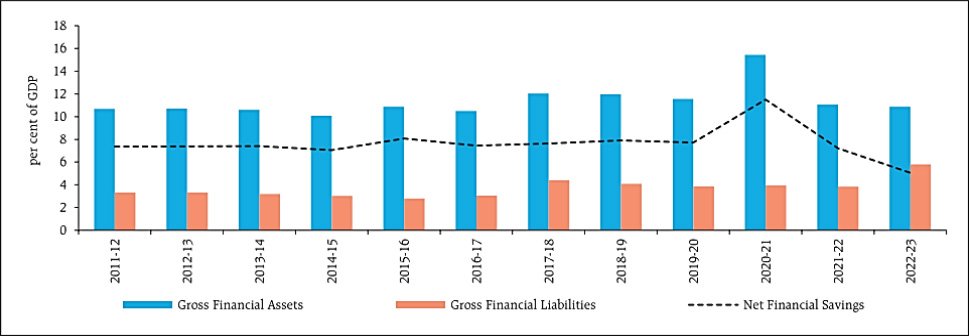

Referencing the Reserve Bank of India’s Financial Stability Report, explore the trajectory of India’s Household Gross Financial savings. Gain insights into the impact of rising financial liabilities on net financial savings and the country’s household debt compared to other emerging market economies.

(Source: RBI Financial Stability Report, December 2023)

Smart Saving Strategies for Achieving Your 2024 Financial Goals

Step 1: Mastering Effective Money Management – Monitoring and Analyzing Your Expenditure

One fundamental strategy for reaching your financial targets in 2024 involves understanding and managing your spending. To begin, it is crucial to gain insight into your financial behaviors by tracking your expenses for a month. You can utilize budgeting tools or develop a detailed spreadsheet to monitor every transaction, from essential purchases to recurring subscriptions. By assessing your spending patterns, you can pinpoint areas where reductions are feasible without compromising on necessities.

Effective Guidelines:

- Identifying ‘Financial Drains’: Explore and eliminate unnecessary recurring subscriptions, impulsive purchases, and excessive dining out.

- Embracing No-Spend Days: Implement a few days each week where you only purchase essential items, steering clear of indulgent spending on food and impulse buys.

- Utilizing Cost-Effective Alternatives: Consider economical transport options such as public transit or carpooling to curb expenses associated with personal vehicle use and rising fuel costs.

Adopting a frugal approach does not equate to self-denial. It’s about making savvy decisions to optimize your resources while maintaining your desired quality of life.

Step 2: Automating Your Savings for Seamless Accumulation

Simplify your savings endeavor by automating your deposits. Numerous financial institutions and employers offer the facility to arrange automatic transfers from your salary account to your savings account or investment vehicles like mutual funds. By determining a fixed amount that aligns with your financial plan and earnings, you can witness steady growth in your savings over time.

Effective Guidelines:

- Streamlining Automatic Transfers on Payday: Plan for a percentage of your salary to be automatically transferred to your designated savings account as soon as you receive your paycheck.

- Incrementally Enhancing Contributions: Initiate with a modest sum and gradually boost your contributions in sync with income growth.

Step 3: Build Contingency Fund

In uncertain economic times, having a contingency fund is crucial to safeguarding your financial stability. To prepare for unexpected expenses in 2024, it’s essential to prioritize building a healthy contingency fund.

Determining the Fund Size: Financial experts recommend aiming for 6-12 months of living expenses, including loan EMIs, as a benchmark for your contingency fund. While this may seem daunting, it provides a crucial safety net against unforeseen financial challenges.

Effective Guidelines:

- Allocate Regular Contributions: Incorporating a portion of your income on a monthly or quarterly basis into your contingency fund is a prudent strategy. Tailor these contributions to align with your income and anticipated future requirements.

- Regularly Review and Adjust: As your financial situation evolves, regularly reassess your emergency fund in line with changes in income and expenses. Ensure that your contingency fund remains aligned with your evolving needs.

Step 4: Reduce Debt Burden

Effective debt management is instrumental in freeing yourself from the burden of debt and accelerating your progress towards achieving your savings goals.

Effective Guidelines:

- Comprehensive Debt Analysis: Compile a comprehensive overview of your debts, including balances, interest rates, and minimum payments. Prioritize them based on the interest rates, providing a roadmap for tackling your debts strategically.

- Choosing a Repayment Method: Consider the Avalanche Method, wherein you prioritize repaying the debt with the highest interest rate first, or the Snowball Method, focusing on clearing the debt with the smallest balance initially.

Remember, reducing debt and bolstering your savings is a gradual process that demands persistence and dedication. By embracing these actionable tips, you can effectively navigate your financial journey towards greater stability and security.

Unlocking the Potential of Compound Interest for Building Wealth

Exploring the potential of compound interest can be a pivotal step towards building wealth and achieving financial freedom in 2024.

Time is a valuable asset in the realm of personal finance. By beginning the savings and investment journey early, individuals can leverage the power of compound interest to witness their wealth grow exponentially over time.

Embracing Wise Investment Choices

When considering the deployment of savings for wealth creation, individuals can opt for avenues such as stocks, bonds, and mutual funds to capitalize on long-term growth opportunities. While these options come with inherent risks, the potential returns can significantly surpass those of traditional savings accounts over an extended period.

SIP Investments: Embracing mutual funds through Systematic Investment Plans (SIPs) can be an ideal route to benefit from the power of compounding. SIPs facilitate a regular savings habit, make investment more affordable, and eliminate the need for a substantial initial investment.

Consistent Contribution Increment

As personal income expands, incremental increases in savings and investment contributions serve as a catalyst for the compound interest mechanism, further amplifying the accumulation of wealth. It is imperative to resist the allure of short-term financial temptations and remain committed to long-term financial goals, allowing compound interest to work its magic over time.

Diversifying Income Streams

In addition to boosting savings, diversifying income streams can significantly accelerate the journey toward financial stability. Monetizing personal hobbies, skills, or talents through avenues such as freelancing, side hustles, or negotiation for a raise at the current job can provide supplementary income, bolstering savings efforts and advancing financial goals.

By strategically employing the principles of compound interest, prioritizing wise investment choices, and enhancing income streams, individuals can lay a robust foundation for building wealth and working towards financial freedom in the coming year.

Conclusion: Forging a Financially Empowered Future

In conclusion, the pursuit of wealth is not about quick fixes or get-rich-quick schemes. Instead, it is a steady and deliberate journey, characterized by prudent choices and unwavering commitment. By implementing the strategies outlined above, you are equipping yourself with the knowledge and tools needed to navigate toward enduring financial stability and growth.

As we embark on this journey into 2024, seize the opportunity to take charge of your financial destiny. Embrace these strategies and let them serve as your guiding beacon toward a more prosperous and fulfilling future.

Disclaimer: The decision to invest in the securities market carries inherent risks. It is imperative to carefully review all related documents before making any investment. The information provided in this article is for educational purposes only and should not be construed as a recommendation to invest in mutual funds or as personalized investment advice.