Investors often overlook the critical factors impacting their returns, instead focusing on elements beyond their control. From market timing to behavioral biases, uncovering the real reasons behind the struggle for profits in equity mutual funds is essential.

Prime Reasons Why Investors don’t make money in Equity Mutual Funds?

Investors often overlook the critical factors impacting their returns, instead focusing on elements beyond their control. From market timing to behavioral biases, uncovering the real reasons behind the struggle for profits in equity mutual funds is essential.

One fundamental misconception lies in attempting to regulate returns, despite the true levers of control resting with risk, cost, time, and behavior. This shift in mindset can redefine one’s approach to equity mutual fund investments.

The Perils of Market Timing and Emotional Investing

Investors frequently channel their funds into the market during periods of inflated valuations, fueled by the cycles of fear, greed, and hope. This practice underscores the need for a comprehensive understanding of market dynamics.

The Gulf Between Theory and Practice in Asset Allocation

While the importance of asset allocation is widely acknowledged, its implementation often falls short, leading to imbalanced portfolios and increased vulnerability to market fluctuations.

A pivotal challenge for investors is deciphering the true nature of risk, often obscured by widespread misconceptions. Unraveling this paradox is essential for making informed investment decisions in the equity mutual fund arena.

Behavioral Biases: The True Decider of Investment Success

Investors’ irrational responses to market exuberance and extreme fear play a defining role in their financial outcomes. Recognizing and mitigating these behavioral biases is critical for achieving prolonged success in equity mutual fund investments.

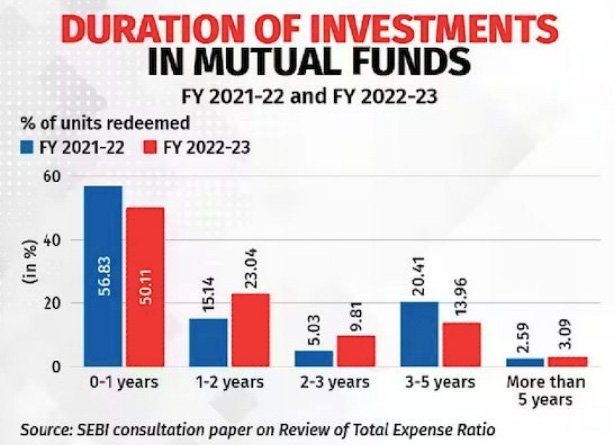

The data from FY2021-22 and FY2022-23 sheds light on the duration of investments in Mutual Funds and provides crucial insight into investor behavior, revealing disparities between what investors should do and what they actually execute.

Approximately 72% of investors stay invested in Mutual Fund Schemes for less than 2 years, while nearly 77% maintain their investments for less than 3 years. Astonishingly, only around 3% of investors remain invested in a Mutual Fund Scheme for more than 5 years. Consequently, a significant number of investors who fail to stay invested often lament their inability to accrue wealth within the Mutual Funds arena.

The predominant reason behind investors’ struggle to capitalize on equity investment lies in their own behavioral patterns, characterized by impulsive and irrational decision-making when navigating through the landscape of Equity Mutual Funds.

In Summary:

The data from FY2021-22 and FY2022-23 illustrates alarming trends in the durations of investments in Mutual Funds, underscoring the pervasive issue of investors failing to maintain long-term commitments. Notably, a considerable percentage of investors struggle to capitalize on equity investments due to their own behavioral tendencies, leading to suboptimal outcomes.