In corporate and financial realms, executives bear flashy titles to captivate clients. The investment sector grapples with the performance debate between Chief Investment Officers (CIOs) and fund managers. Though tasks intertwine, CIOs project comprehensive control. This article dissects the roles, backed by statistical analysis.

Mutual Fund Dynamics: Unveiling the Role of CIOs and Fund Managers

The Rise of Mutual Funds in India:*

In the ever-evolving landscape of Indian investments, mutual funds have swiftly positioned themselves as a crucial avenue for investors seeking not only diversification but also expert management of their portfolios. This shift has been facilitated by the collaborative efforts of the industry catalyst, the Association of Mutual Funds in India (AMFI), and the vigilant regulatory oversight provided by the Securities and Exchange Board of India (SEBI). Together, they have cultivated a climate of confidence among investors, making mutual fund investments an integral part of the country’s financial ecosystem.

The Significance of Choosing the Right Fund:

As investors navigate through a plethora of mutual fund options, the decision-making process extends beyond merely selecting a fund. It entails a thorough understanding of the intricacies of the team steering the fund’s performance. Amidst the myriad of factors considered during fund selection, the roles of the Chief Investment Officer (CIO) and Fund Manager emerge as pivotal influencers. Despite their shared significance, the responsibilities and impact on a fund’s performance can vary significantly between these key players.

Deciphering Roles: CIOs vs. Fund Managers:

Delving into the realm of fund management, the distinction between the Chief Investment Officer (CIO) and Fund Manager becomes crucial. While both contribute significantly, the nuances lie in their distinctive approaches to managing funds. CIOs bring a unique perspective and strategic insight that sets them apart from other fund managers, influencing the fund’s trajectory in distinctive ways. Understanding these dynamics is paramount for investors aiming to make informed decisions in the dynamic world of mutual funds.

Elevating Investment Strategies:

The pivotal role of a Chief Investment Officer (CIO) goes beyond managing a fund; they serve as the visionary orchestrator, shaping investment strategies and charting the fund’s overall trajectory. The nuanced differences emerge when comparing funds under CIO leadership to those led by non-CIO fund managers, showcasing distinct approaches, levels of oversight, and impacts on performance.

Captain of the Ship:

Imagine the CIO as the captain of a mutual fund ship, steering it with ultimate responsibility. Their purview encompasses setting the investment strategy, meticulously overseeing risk management, and guiding the intricate construction of the overall portfolio.

The CIO’s expertise unfolds across various dimensions:

1. Strategic Vision: CIOs navigate the fund’s strategic course, defining its investment philosophy, asset allocation, and risk tolerance. They analyze market trends, identify long-term growth opportunities, and ensure alignment with stated objectives.

2. Leadership Dynamics: Acting as team leaders, CIOs mentor fund managers, providing guidance, expertise, and a cohesive investment framework. Their role extends to ensuring adherence to the defined strategy, fostering collaboration, and enhancing the team’s overall success.

3. Transparent Communication: Serving as the fund’s public face, CIOs communicate its investment strategy and performance to investors. Through transparent communication, they build trust by elucidating the rationale behind investment decisions and addressing market concerns.

Fund Managers: Skillful Navigators

In the financial landscape, fund managers navigate the waters, executing strategies set by the Chief Investment Officer (CIO). Responsibilities include meticulous security selection, portfolio construction within guidelines, and providing performance reports. They delve into research, analyzing financials, assessing fundamentals, and making informed decisions for optimal portfolio performance.

Exploring Fund Manager Responsibilities:

1. Security Selection: Fund managers dive into in-depth research, identifying lucrative opportunities within their asset class. This involves scrutinizing financial statements, assessing company fundamentals, and strategically managing securities.

2. Portfolio Construction: Within CIO guidelines, fund managers construct and manage portfolios, ensuring compliance with risk parameters and diversification standards. They actively monitor holdings, making adjustments for optimal performance.

3. Performance Reporting: Regular reporting to the CIO and the investment team is a key responsibility. Fund managers detail portfolio performance, individual security analysis, and rationale behind investment decisions.

Deciphering CIO Distinctions

Central Role of CIOs: Chief Investment Officers (CIOs) hold a central role in shaping the broader investment philosophy and strategic direction of a fund house. Their responsibilities encompass overseeing multiple funds or an entire suite of investment products. With a comprehensive grasp of market trends, risk management, and fund objectives, CIOs craft resilient investment strategies aligned with the fund house’s goals.

Depth of CIO Analysis: Distinguishing CIOs lies in their depth of research and analysis. Their multifaceted role demands a profound understanding of macroeconomic trends, industry dynamics, geopolitical influences, and emerging market developments. This holistic perspective empowers them to navigate intricate market landscapes, making informed decisions impacting the entire portfolio.

Decoding the Impact: CIOs vs. Fund Managers in Fund Success

In the intricate landscape of fund management, the roles of Chief Investment Officers (CIOs) and fund managers stand as linchpins for success. While both contribute significantly, the influence of CIOs often takes center stage due to their strategic vision and comprehensive oversight. A pivotal question arises: Does the choice between fund managers and CIOs significantly impact the returns of actively managed equity-dedicated funds?

Unveiling the Methodology: Examining Returns in Equity-Dedicated Funds

To unravel this query, we embarked on an empirical study, scrutinizing the returns of approximately 750 equity funds. Our focus sharpened on direct plans, strategically excluding factors like fund house cost structures and minimizing the impact of expense ratios. Notably, index funds and exchange-traded funds (ETFs), characterized by passive management, were purposefully left out. This meticulous curation distilled our selection to a robust 500 funds.

Navigating the Landscape: Focusing on Top Fund Houses

The spotlight then turned to the industry’s heavyweights – the top 22 fund houses, collectively commanding 95% of the industry’s total Assets Under Management (AUM) as of September 2023. This refined our exploration to 400 equity-focused funds, exclusively scrutinizing the ‘direct’ plan category.

Strategic Stratification: Fund Management Structures Under the Microscope

Diving deeper into analysis, funds were categorized based on their management structures. A clear distinction emerged between funds solely managed by fund managers and those under the direct or indirect guidance of the CIO. To qualify as a CIO-managed fund, a prerequisite of at least one year of CIO involvement in fund management was established. This nuanced categorization allowed for a granular examination, separating funds primarily steered by individual managers from those benefiting from CIO insight or joint management scenarios involving the CIO.

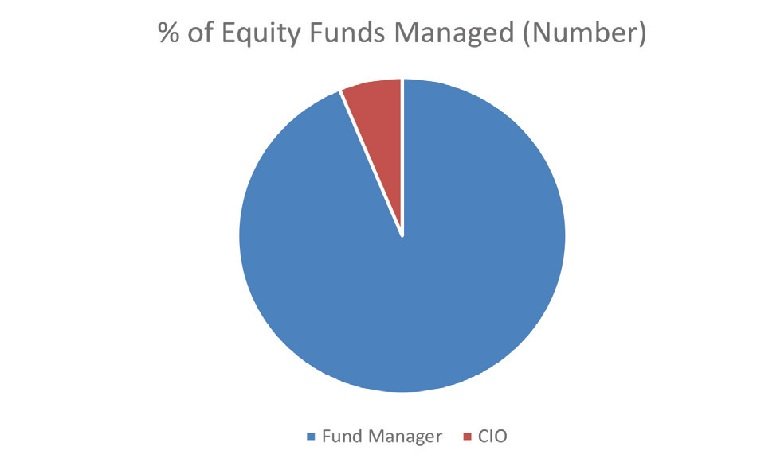

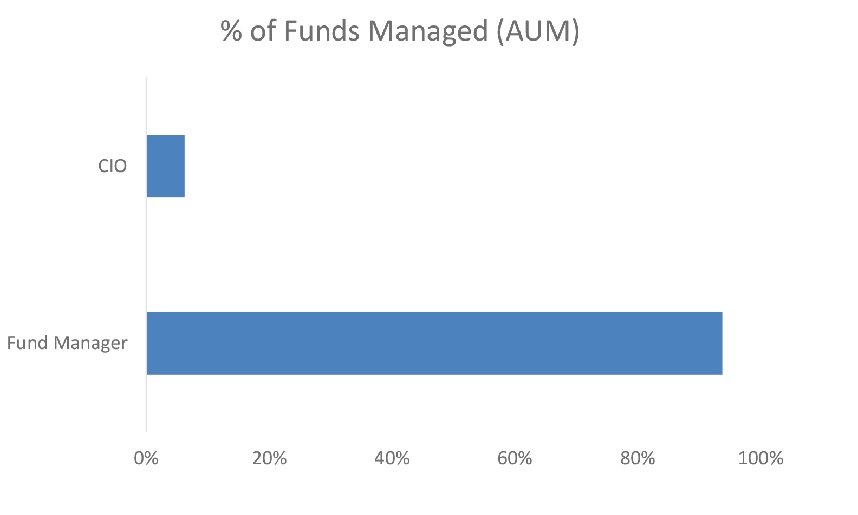

Fund Distribution Analysis: Unveiling Managerial Proportions

In our comprehensive scrutiny of 400 funds, a noteworthy revelation emerges – a substantial 92% are overseen by fund managers, leaving a mere 8% under the direct purview of Chief Investment Officers (CIOs). Delving deeper into the assets under management (AUM) perspective, funds guided by CIOs constitute a minute 6% of the total equity assets managed. This dual perspective underscores that, whether assessed by the number of funds or the magnitude of assets managed, the realm governed by CIOs lacks substantial prominence in contrast to the predominant landscape steered by fund managers.

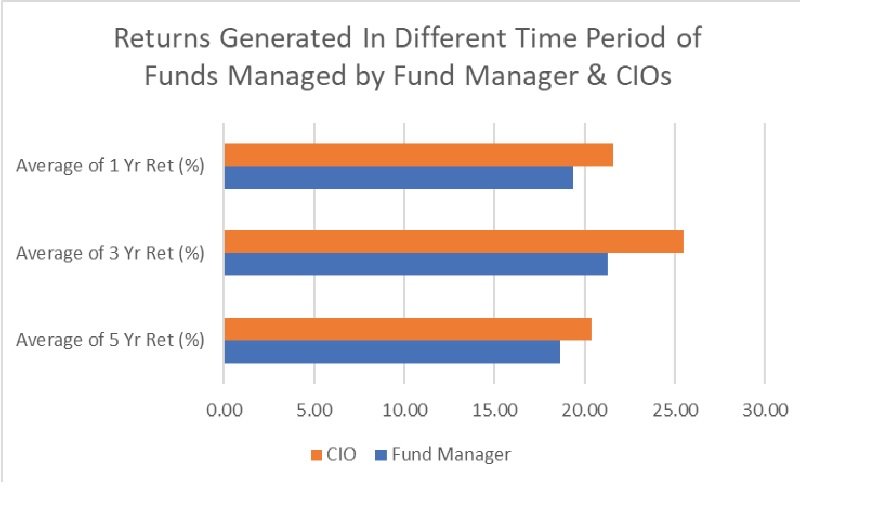

Analyzing Return Disparities: CIOs vs. Fund Managers

Examining the average returns of funds led by Chief Investment Officers (CIOs) versus those managed by fund managers unveils intriguing insights over various timeframes. In a five-year span, CIO-led funds exhibited a 20.40% average return, surpassing fund manager-led counterparts at 18.65%. This trend persisted over three years, with CIO-led funds boasting a 25.49% average return against fund manager-led funds’ 21.30%. Even within a one-year timeframe, CIO-managed funds maintained an edge with a 21.59% average return compared to fund manager-led funds’ 19.37%.

While discernible differences exist across all periods, the gap widens over longer durations, hinting at potentially more effective strategies or decision-making within CIO-managed funds. These figures suggest a consistent trend of slightly higher returns for CIO-led funds, particularly over extended investment periods, implying a potential performance edge attributed to CIO oversight and strategic involvement.

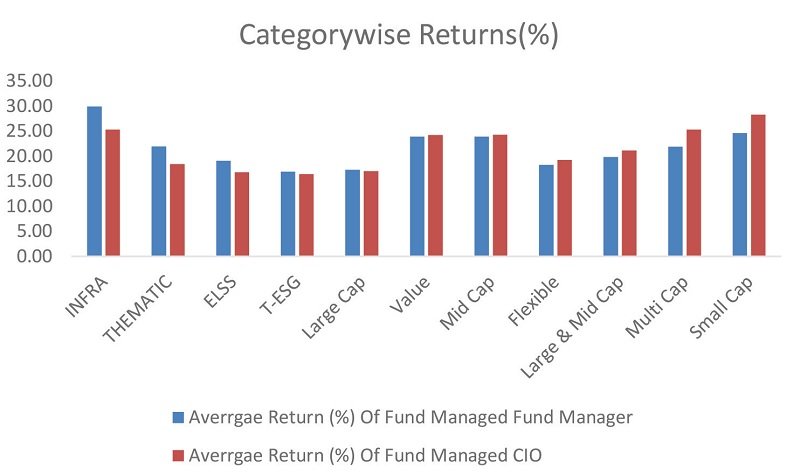

Investigating Return Disparities: A Focus on Equity Categories

Venturing into the nuances, we delved into the roots of return variations across diverse equity categories, concentrating on one-year average performance for meticulous analysis. Scrutinizing the average returns of funds under Chief Investment Officers (CIOs) versus fund managers within distinct equity categories uncovers intriguing patterns. Particularly striking is the notable supremacy of CIO-led funds in Small-Cap and multi-cap-dedicated equity funds. In these segments, CIOs yielded returns of 28.31% and 25.31%, respectively, outpacing fund managers at 24.61% and 21.90%.

However, these instances were exclusive, showcasing substantial CIO-led advantages compared to fund manager-managed funds. For instance, CIO-led infrastructure funds displayed an average return of 25.29%, contrasting with fund managers’ 29.94%. Similarly, in categories like Large-Cap and thematic (ESG and ELSS), fund managers demonstrated comparable or slightly superior performance, underscoring the unevenness of CIO-led funds’ out-performance across segments. While CIO-led funds exhibited robust returns in specific domains, certain categories witnessed better performance by fund manager-led funds.

Beyond Averages: Assessing Relative Fund Performance

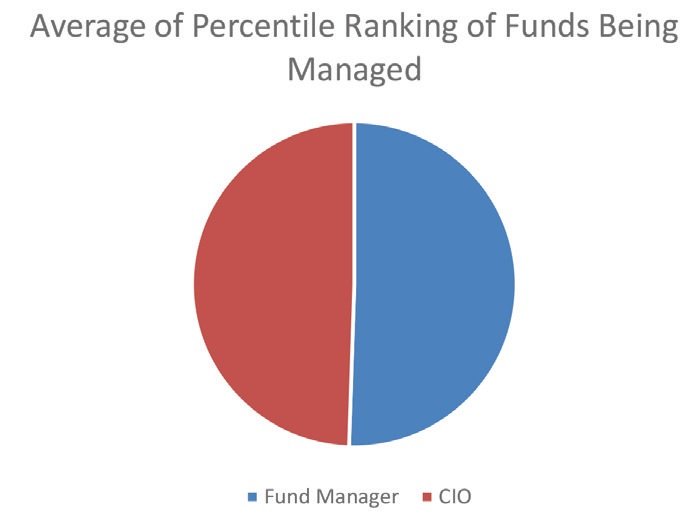

Merely gauging average returns may not provide a comprehensive understanding of funds’ relative performance within their categories. To gain deeper insights, we conducted a percentile ranking analysis, focusing solely on one-year returns. Surprisingly, the average rankings did not showcase substantial differences between funds managed by Chief Investment Officers (CIOs) and those under fund managers’ supervision. Fund manager-led funds exhibited marginally better percentile rankings, but the gap wasn’t notably significant. Despite this slight edge, the minimal percentile difference suggests comparable performances, indicating close relative standings within their respective categories.

The Dynamic Realm of Mutual Funds: Insights from Financial Experts

In the ever-changing landscape of financial markets, fund managers grapple with daily turbulence, while Chief Investment Officers (CIOs) chart the long-term course. The CIO’s vision serves as the guiding force behind the fund’s philosophy, ensuring that each manager’s tactical maneuvers align seamlessly with the broader investment strategy. To genuinely gauge a fund’s potential, a discerning eye must scrutinize the entire team. While a seasoned CIO sets the sails, the expertise and alignment of individual managers play a pivotal role in steering the ship toward investment success.

Choosing the Right Mutual Fund: Beyond the Hype

Selecting the appropriate mutual fund often resembles navigating a complex maze. The prevailing tendency is to fixate on the allure of CIOs or fund managers. However, solely focusing on these figures poses the risk of neglecting other critical aspects. Our in-depth research illuminates a nuanced truth: Although CIO-managed funds may exhibit a marginal advantage, it is statistically unsound to base investment decisions solely on this factor. Instead, broaden your evaluation criteria and prioritize elements such as consistency, alignment of philosophies, and robust risk management.

Scrutinizing the Holistic Picture

Beyond the glitz of titles, it is imperative to consider consistent performance over time. The ability of a fund to weather market storms and showcase steady growth speaks volumes, irrespective of management hierarchies. The investment philosophy of a fund serves as its compass, dictating its direction. It is crucial to ensure that this philosophy aligns seamlessly with your values and financial goals. Transparency and a well-defined strategy are the keys to sound investment decisions.

Look Beyond the CIO Spotlight

Rather than getting captivated by fancy titles, focus on a fund’s holistic profile. Emphasize consistent performance, a clearly defined philosophy that resonates with your values, and robust risk management practices. This comprehensive approach empowers investors to make well-informed and prudent decisions in navigating the intricate landscape of mutual funds with confidence. By prioritizing these factors, investors can align their investments with their objectives and risk tolerance, forging a path towards financial success.