The upcoming year holds promising changes in demand and supply, offering ample opportunities for these three companies.

Promising Trends in Commodity Stocks for 2024

As we enter 2024, commodity stocks show resilience and potential for gains in the economic landscape. The anticipated decline in interest rates by year-end indicates a favorable outlook for commodities, as their prices often have an inverse relationship with interest rates. Higher interest rates can typically dampen commodity prices due to increased inventory holding costs.

The year ahead promises dynamic shifts in demand and supply, offering numerous opportunities across various sectors.

Considering these factors, let’s explore the top three commodity companies that deserve a spot on your watchlist.

1 Tata Steel: Navigating Challenges and Seizing Opportunities

Tata Steel, Asia’s pioneering private steel company, encountered a tumultuous 2023 marked by interest rate hikes, a strong dollar, sluggish China reopening, inflation, and disappointing financial performance. The company’s net profit plummeted by 92% YoY in the June quarter and reported a net loss of ₹62 billion in the September 2023 quarter, attributing an impairment charge of ₹26.3 billion related to its subsidiary, Tata Steel UK, and restructuring expenses.

Promising Outlook for 2024

2024 holds promise. India’s robust steel demand, propelled by government spending on infrastructure, signals significant volume growth, particularly in the latter half of FY25. Furthermore, a resurgence in global steel spreads is anticipated to bolster the company’s prospects.

CEO TV Narendran anticipates escalating steel demand, driven by infrastructure development. Tata Steel’s strategic plans include a yearly investment of ₹100 billion to augment capacity by 1-2 million tonnes, reinforcing its market position. The firm has already deployed ₹86.4 billion in the first half of FY24, aligning with its ₹160 billion annual budget. Future initiatives encompass expanding production at Kalinganagar and Angul, along with substantial investments in the downstream sector. Additionally, strategic investments in Gamharia are on the horizon.

Narendran has also outlined ambitions to elevate the company’s annual installed steel-making capacity to 40 million tonnes per annum by 2030 in India, from the current 22 MTPA. With a resolute stance, Tata Steel navigates adversity and positions itself to harness upcoming opportunities.

2 UltraTech Cement: A Growth Trajectory

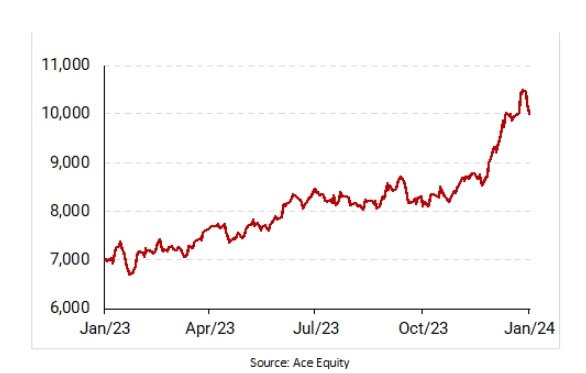

UltraTech Cement, India’s leading cement manufacturer, witnessed a substantial 51% surge in its share price in 2023, reflecting its strong performance. With a noteworthy achievement of 100 million tonnes in production, dispatches, and sales in FY22-23, the company sustained its momentum into the first half of FY23.

Upward Momentum and Expansion

In the June 2023 quarter, UltraTech reported a significant 20% YoY increase in volumes, with an impressive capacity utilization rate of 89%. Moreover, the company has indicated strong cement demand across sectors, leveraging the anticipation of heightened infrastructure spending in the lead-up to the 2024 general elections.

Strategic Expansion Plans

UltraTech’s ongoing expansion efforts, including a 5.5 MTPA capacity addition in the current fiscal year following a substantial 12.4 MTPA expansion in FY23, are proceeding as planned. The recent commissioning of a 1.3 MTPA brownfield cement capacity at Hirmi in Chhattisgarh and a 2.8 MTPA greenfield grinding capacity at Cuttack, Odisha, serves as a testament to the company’s commitment to expansion and innovation.

Strategic Acquisitions and Sustainable Initiatives

UltraTech aims to enhance its market position by acquiring Kesoram Industries’ cement business, a strategic move to augment its capacity in a competitive market. Additionally, the company is actively advancing its sustainability initiatives by striving to triple its green energy share to 60% by FY26. Furthermore, its commitment to the government’s eFAST initiative is evident through the incorporation of 500 electric trucks and 1,000 CNG/LNG vehicles by June 2025.

UltraTech Cement’s robust performance, expansion endeavors, strategic acquisitions, and sustainable initiatives position the company for continued growth and dominance in the cement industry.

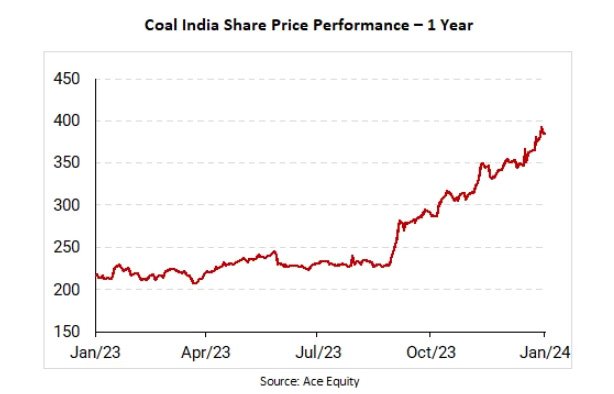

3 Coal India: Meeting Energy Demand and Diversification Plans

Coal India (CIL), a key player in the coal industry, has shown promising growth and investment plans. Encouraging Performance and Growth The company’s shares soared as it reported an 8.2% YoY growth in coal production, reaching an over eight-year high. It aims to invest substantially in capacity enhancement and expansion into new sectors to meet India’s energy needs and diversify its operations.

Strategic Investments and Expansion

With annual investments of ₹15-20 billion over the next three years, CIL plans to boost mining and washing capacity, improve rail infrastructure, and venture into thermal and solar power plants. Additionally, the company seeks to acquire lithium, cobalt, and nickel assets abroad, indicating its strategic diversification efforts.

Efficiency and Diversification Initiatives

CIL is focused on enhancing efficiency in coal transportation through first-mile connectivity projects, ultimately reducing logistics costs. Furthermore, the recent amendment in its Memorandum of Association reflects its commitment to expanding into non-ferrous and critical minerals, signaling its intent to venture into new sectors.

Significant Role in India’s Energy Sector

As India targets a 1-billion production goal for CIL in FY24, the company is poised to contribute significantly to the country’s energy sufficiency. Ramp-up production and output from existing and new captive mines are pivotal to achieving this ambitious target.

Robust Dividend History

CIL has maintained a strong dividend track record since its listing, never missing a dividend payment. With a consistent dividend yield, the company remains an attractive proposition for investors seeking stable returns.

Coal India’s robust performance, strategic investments, diversification plans, and pivotal role in India’s energy sector position it as a strong player in the market. With a strong dividend track record, the company offers stability and growth prospects for investors seeking long-term opportunities in the energy and mining sector.

Conclusion

As the outlook for companies dealing in commodities appears positive for 2024, it’s crucial to recognize the multitude of factors influencing commodity prices, both at home and abroad. Although offering potential rewards, these investments are susceptible to geopolitical tensions, supply chain disruptions, and unforeseen market fluctuations. Thus, approaching commodity stocks demands a comprehensive understanding of market dynamics and a tolerance for volatility.

Given the inherent volatility of commodity investments, it is prudent to diversify your investment portfolio, effectively mitigating the risks associated with these unpredictable assets. Thorough research, coupled with seeking guidance from financial experts, is paramount before venturing into the realm of commodity stocks.