The industry is actively exploring alternatives such as biomass, municipal waste, and pharma waste to fuel cement kilns.

Cement manufacturers are proactively incorporating renewable energy sources like wind and solar power, along with waste heat recovery systems, to minimize environmental impact and lower operational expenses. This strategic shift is a response to the industry’s high power and fuel costs, constituting a substantial portion of production expenses.

With power and fuel costs representing 35-40% of the sector’s overall production expenses, the integration of green energy and alternative fuels is anticipated to diminish reliance on costly thermal power plants and state grids for electricity. This transition toward sustainable energy sources aligns with the industry’s endeavor to curtail operational costs and environmental footprints.

In a bid to mitigate environmental impact, the cement sector is exploring the utilization of biomass, municipal waste, and pharmaceutical waste to fuel cement kilns. Given the extensive reliance on coal in the clinker production process, these alternatives offer promising prospects for reducing greenhouse gas emissions while ensuring sustainable manufacturing practices.

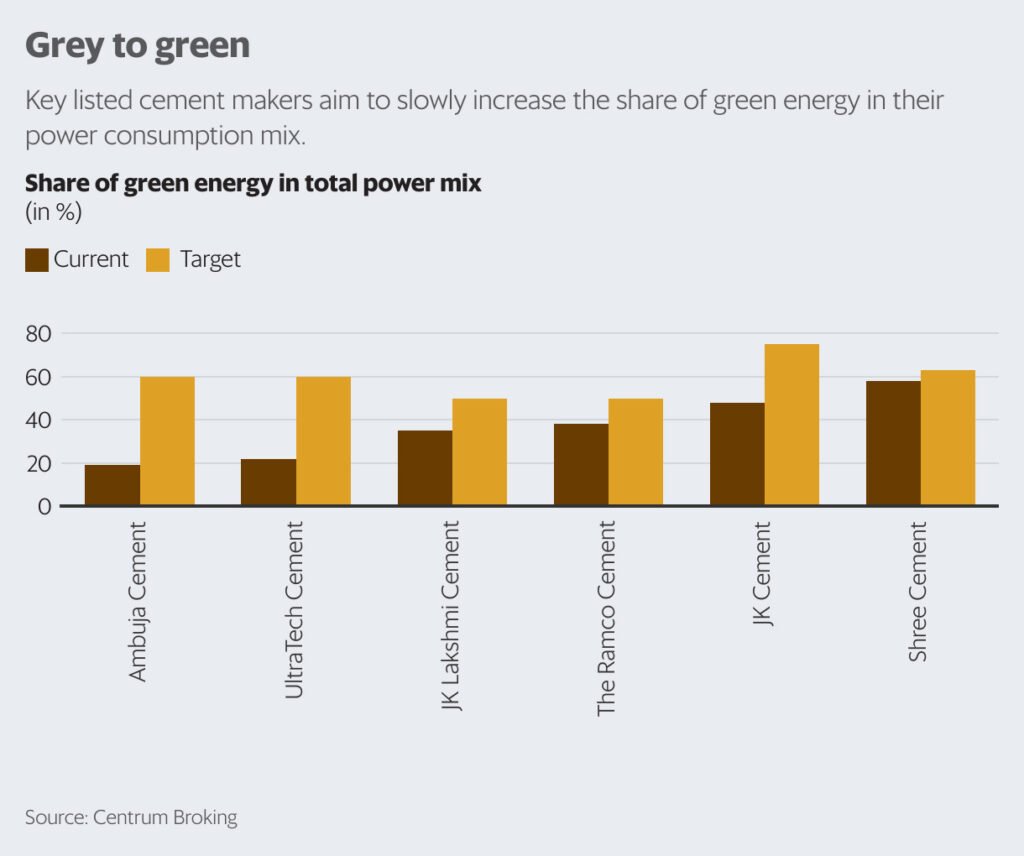

The cement industry is making significant strides in its adoption of green energy initiatives, with substantial investments directed towards solar and wind power as well as waste heat recovery systems (WHRS). According to Crisil Ratings, the sector’s reliance on green power is projected to increase from 30-35% to 40-45% by FY27, indicating a strong commitment to sustainability.

Overcoming Decarbonisation Challenges

While the industry is actively pursuing decarbonisation, the transition poses inherent challenges. The adoption of alternative fuels faces technical constraints due to lower calorific values compared to traditional fossil fuels such as coal and petcoke. Additionally, the prolonged timelines for regulatory approvals and significant capital investment present barriers to swift transformation.

Balancing Sustainability with Financial Performance

Enhancing the proportion of green energy aligns with efforts to reduce the carbon footprint of cement production. However, achieving comprehensive decarbonisation requires time and substantial investments. Although pivotal for sustainability, the integration of green energy alone may not directly impact stock prices, with market dynamics continuing to rely on demand and pricing dynamics.

Market Expectations and Price Dynamics

Analysts anticipate a 10% year-on-year growth in cement demand for FY24, driven by pre-election tailwinds. Additionally, price upticks have been observed, with all-India prices rising by 3% sequentially in Q3FY24. However, the sustainability of these price increases remains a critical consideration amidst the industry’s ongoing evolution.