Understanding the importance of sustaining your systematic investment plan (SIP) amid market volatility is crucial for long-term wealth creation. Despite market fluctuations, pausing your SIP might not be the most prudent decision. By consistently contributing to mutual funds through SIP, investors can navigate market fluctuations and maximize their potential for long-term financial growth.

As soon as the market begins to take a downward turn or shows signs of volatility, it’s common for investors to react impulsively by halting their systematic investment plans (SIPs) in an attempt to mitigate perceived losses. However, this knee-jerk reaction might not be the most prudent choice. Discover why allowing your SIP to continue its journey of long-term wealth creation is crucial, especially in the face of market fluctuations.

The Indian stock market has recently experienced significant growth while also exhibiting moments of volatility, leaving many retail investors uncertain about their next steps. The question of whether to pause SIPs to shield against potential losses at market peaks frequently arises. Despite the understandable temptation to time the market and safeguard savings, discontinuing SIPs during market highs can prove to be a costly mistake for several reasons.

Consider this: Did you commence your investments or begin investing when the market was at its lowest point? If the answer is yes, reflect on whether it fell further from your entry level. If your calculations about the market’s trajectory were inaccurate, it illustrates the futility of attempting to time the market by assuming it will decline. The market ascends during periods of strength and descends during periods of weakness. Consequently, selling or pausing SIPs when the market exhibits robustness is likely an ill-advised choice.

SIP entails investors making regular, automated contributions to mutual funds at predetermined intervals.

The Crucial Role of SIPs in Wealth Creation

Systematic Investment Plans (SIPs) play a vital role in wealth creation through their unique features and disciplined approach. The rupee-cost averaging method ensures that more units are purchased when prices are low and fewer when prices are high, maximizing long-term investment benefits. With the current market at historically high levels and the potential for further growth, maintaining a long-term perspective is imperative for investors seeking financial success.

The Pitfalls of Pausing SIPs

Investors often consider pausing their SIPs during market downturns to protect their investments. However, this approach may lead to missed opportunities for wealth accumulation when the market eventually rebounds. Investing is not only about wealth creation but also about saving and growing money over time, highlighting the importance of consistency in SIP contributions.

Evaluating the Decision: Case Studies

Reflecting on the initial goals set when starting a SIP can provide insight into the rationale behind contemplating a pause. While valid reasons may justify a pause, market fluctuations alone shouldn’t be the sole determinant. By analyzing three scenarios, the costs associated with pausing SIP investments become clearer, emphasizing the potential drawbacks of interrupting a disciplined investment approach.

In the world of investments, the decision to pause a Systematic Investment Plan (SIP) can have substantial implications, as demonstrated in three particular scenarios.

Case 1: Market Timing and the Cost of Pausing

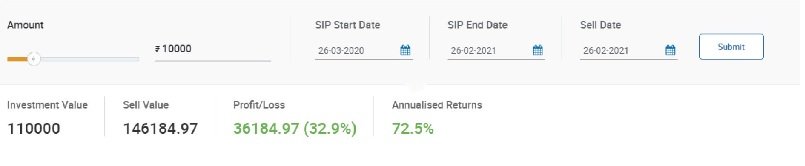

The first case involves an investor who halted their SIP on February 26, 2021, amidst concerns about a significant market correction. However, had they ended the SIP on that date, the annualized return would have been an impressive 72.5%, with a total profit of 32.9% on the entire investment. This case illustrates the potential drawbacks of pausing SIPs due to short-term market fluctuations.

Case 2: Missed Opportunities for Growth

In the second scenario, we explore the potential outcomes if the investor had not stopped their SIP on February 26, 2021. Had they continued the SIP, they could have potentially gained a 48% return on their investment, despite a lower annualized return of 57.91%, showcasing the long-term benefits of consistent investing.

Case 3: The Power of Consistent Investing

Lastly, considering a scenario with uninterrupted SIP contributions, the projected return would have been 42.94% with an annualized return of around 20%, emphasizing the significance of sustained, consistent investment approach.

The analysis of these cases underscores the importance of maintaining a long-term perspective in investments. Although annualized returns may fluctuate over time, the absolute value of the investment is crucial for long-term financial goals. This highlights the potential drawbacks of making decisions based solely on short-term market movements.

Restarting SIP: Understanding Fibonacci Levels for Resuming Investments

If you have paused your Systematic Investment Plan (SIP) due to concerns about market corrections, understanding the right re-entry point is crucial. After a strong market rally, a retracement often occurs, providing an opportunity for investors to resume SIPs and capitalize on the upward momentum. In this article, we will explore the significance of Fibonacci levels as a tool for identifying potential re-entry points for paused SIP investments.

The Role of Fibonacci Analysis

Fibonacci analysis is particularly relevant when there is a distinct upward or downward movement in stock prices. When a stock undergoes a sharp upward or downward movement, it tends to retrace before continuing its trend. For example, if a stock surges from Rs50 to Rs100, it might retract to around Rs70 before resuming its upward trend. This pattern of retracement is where Fibonacci analysis comes into play.

Application to Market Trends

Following the post-pandemic downturn, the NSE index Nifty 50 experienced a notable rally, soaring approximately 148% from its low of 7,511 to 18,600. Subsequently, the market retraced to essential Fibonacci levels, particularly the 23.60% mark of this rally. This retracement presents a potential opportunity for investors to consider re-entering the market.

Predicting Bounce-Back Points

Investors often use Fibonacci levels to predict potential bounce-back points in market trends. The 38.20% Fibonacci level is of particular significance, as it offers insights into potential retracement levels. Calculating this level involves considering the rally from 7,511 to 18,600 and computing 23.60% of this surge. This calculation yields a potential retracement level, which may serve as a strong demand zone for investors and support the continuation of the market rally.

Revisiting SIP Investments

Considering these insights, the calculated area might be a suitable region to consider restarting a paused SIP, should the opportunity arise. As a practical tip, using 25% instead of 23.6% can make it easier to identify potential re-entry points for paused SIPs.

Exploring the Benefits of Continuous SIPs

For a deeper understanding of the benefits of continuous SIP investments and wealth creation, readers are encouraged to explore our article, “Maximizing Wealth Creation: The Power of Systematic Investment Plans (SIPs).”

Analyzing Market Peaks and Declines: Lessons from Nifty 50

Determining potential market peaks and subsequent corrections is a challenge for investors. While no universal rule exists, historical data can offer valuable insights. Our focus on Nifty 50 entails examination of key market downturns, notably the 2008 and 2020 crashes. Identifying occasions of sharp 5% declines in a single day provides cautionary signals. For instance, on January 18, 2008, Nifty experienced a 5% single-day drop, succeeded by an over 8% decline the next day, indicative of the 2008 crash. Similarly, the 2020 crash saw Nifty plummet around 5% on March 9, 2020, followed by an over 8% fall the following day. Although such declines often coincide with market peaks, exceptions exist, where recoveries followed without substantial downturns.

Conclusion

Late veteran investor Rakesh Jhunjhunwala attributed a substantial portion of his wealth to Titan Limited, emphasizing the importance of patience in stock holding. His steadfast approach to holding the stock through market fluctuations ultimately led to significant gains. Similarly, investors can harness the potential of Systematic Investment Plans (SIPs) to navigate market volatility and cultivate long-term wealth. This article explores the effectiveness of SIPs as a strategic tool during uncertain market conditions and the benefits of maintaining consistency and perseverance amidst market fluctuations.

In the world of investments, market volatility can be a daunting aspect, triggering apprehension and uncertainty among investors. During such periods, investors often grapple with the decision of whether to continue or halt their SIPs. However, maintaining SIPs during market downturns can yield substantial benefits in the long run. By persisting with SIPs, investors can accumulate more units at lower costs, potentially bolstering their returns when the market rebounds. This approach underlines the significance of adopting a steadfast investment strategy in the face of market turbulence.

Over the span of more than a decade, equity SIPs have proven to be highly effective, outperforming the need for actively managed timing of entry and exit points. Short-term market fluctuations can disguise the true potential of SIPs, thus emphasizing the importance of sustained commitment to SIPs for long-term financial objectives. Discontinuing SIPs prematurely can disrupt potential returns and impede progress towards achieving long-term financial goals. Therefore, it is crucial for investors to maintain a long-term perspective with SIPs, recognizing the value they present amidst market uncertainties.

SIPs are particularly well-suited for navigating volatile markets, offering a strategic advantage in acquiring assets at lower costs during periods of market turbulence. Therefore, rather than viewing market fluctuations as deterrents, investors can harness the benefit of acquiring assets at discounted prices through SIPs. The key lies in maintaining consistency and perseverance amidst market fluctuations, leveraging SIPs as a tool to bolster long-term investment objectives.