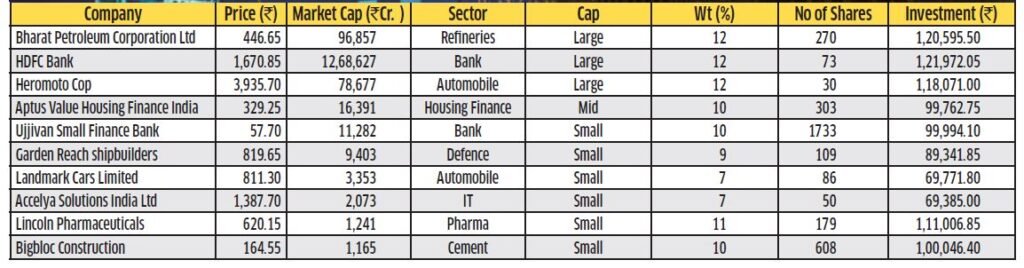

The selection of stocks for the 2024 portfolio is discussed alongside a comprehensive rationale, guiding investors through potential avenues for growth and value creation.

In First Part of this article we have discussed the 2023 performance and Factors Influencing India’s Equity Market in 2024. We also posted the selection of stocks for the 2024 portfolio.

In the current sections, we will provide a comprehensive rationale for the selection of stocks for the 2024 portfolio. This well-diversified portfolio encompasses various sectors and market capitalizations, aiming to capitalize on the diverse opportunities presented by India’s evolving economic landscape. Stay tuned as we delve into the strategic insights underpinning these stock selections, guiding investors through the potential avenues for growth and value creation in the Indian equity market.

Accelya Solutions India Ltd.

CMP (₹ ): 1,387.70

BSE CODE : 532268 I Face Value (₹ ) : 10

Mcap Full ( ₹ Cr.) : 2,073.26

Accelya Solutions India Ltd. (ASI) operates as a prominent software solutions provider for the global airline and travel industry, facilitating end-to-end digital transformation within airline businesses. Specializing in passenger, cargo, and industry solutions, ASI offers certified solutions such as Order Accounting, which enhances airlines’ retailing and distribution strategies. With a focus on financial services in the post-pandemic landscape, the company is supporting airlines in achieving long-term growth and recovery.

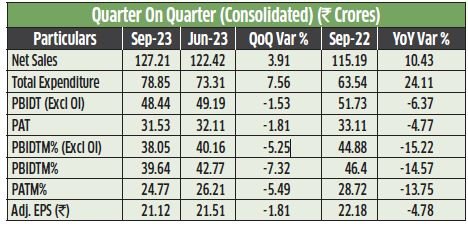

Financials: Reflecting on the quarter ended September 30, 2023, the company reported a net revenue of ₹127.29 crore, showcasing a 10.44% year-on-year (YoY) growth from the previous year’s corresponding quarter, in contrast to ₹115.26 crore. However, its net profit experienced a YoY decline of 4.80% at ₹31.52 crore compared to ₹33.11 crore. Additionally, the EBITDA margin witnessed a YoY decline of 677 basis points, resting at 39.6%.

Valuation and Growth Triggers: ASI shares are currently trading at a price-to-earnings (PE) ratio of 17.5 times based on trailing twelve months (TTM) data. This figure is lower than its long-term historical median of 22.8 times. Notably, the company has demonstrated steady improvements in operating margins over the last three years, escalating from 29.5% to 39.5%, resulting in a healthy compounded bottom-line growth rate of 13.44%.

The company’s revenue trajectory has remained subdued over the past three years, yet its average return on equity (ROE) and return on capital employed (ROCE) stand at an impressive 31.8% and 39.9%, respectively. While the company has maintained robust financial health without significant debt, the evolving needs of the airline and travel industry, alongside its resurgence post-pandemic, position Accelya Solutions India to benefit from heightened demand for new industry-relevant platforms.

Considering these pivotal factors, the recommendation stands to include Accelya Solutions India Ltd. in the model portfolio, bolstered by its promising standing within the dynamic airline and travel industry.

Aptus Value Housing Finance India

CMP (₹ ): 329.25

BSE CODE : 543335 I Face Value (₹ ) : 2

Mcap Full ( ₹ Cr.) : 16,397.14

Aptus Value Housing Finance (AVHF) is a retail-focused housing finance company that caters to the housing needs of self-employed, low-income, and middle-income families, primarily in semi-urban and rural areas. The company exclusively targets first-time home buyers, with a strong presence in South India, and focuses on providing finance for self-occupied residential properties. Notably, AVHF refrains from providing loans to builders or for commercial real estate, maintaining a strict focus on its retail clientele.

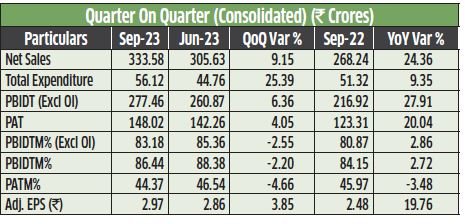

Financial Strength: In Q2FY24, AVHF reported a robust profit after tax of ₹148.01 crore, a significant increase from the previous fiscal quarter. The net consolidated total income rose by 24.33% to ₹344.46 crore. Disbursements of ₹1,391 crore in the first half of the year resulted in a notable 28% growth in assets under management (AUM), reaching ₹7,604 crore.

Market Performance: With a market capitalization of ₹16,183 crore, AVHF’s current stock price is ₹324, featuring a PE ratio of 29.4 and a book value of ₹71. The company’s financial indicators include a dividend yield of 1.23%, ROCE at 14.6%, and ROE at 16.1%. The three-year EPS growth is -23.7%, while the five-year EPS growth is 3.53%. The company’s financial health is evident in an OPM of 83.6%, a debt-to-equity ratio of 1.22, and a quick ratio of 12.4. The PEG ratio stands at 0.59, and the price-to-sales ratio is 13.2, instilling confidence among investors.

Valuation and Growth Triggers: AVHF is strategically expanding its market presence in regions like Odisha and Maharashtra, aiming to enhance operational efficiency, reduce credit costs, and target ticket sizes ranging from ₹5–₹15 lakhs. The focus on diverse customer profiles ensures business growth while effectively managing risks, providing flexibility and outreach in the retail segment. Given these promising factors, we recommend including this company in the model portfolio.

Bharat Petroleum Corp. Ltd

CMP (₹ ): 446.65

BSE CODE : 500547 I Face Value (₹ ) : 10

Mcap Full ( ₹ Cr.) : 96,835.44

Bharat Petroleum Corporation Limited (BPCL) is a key player in the refining and marketing of petroleum products, with operations spanning across refineries in Mumbai and Kochi, along with various additional facilities. Its extensive infrastructure includes LPG bottling plants, lube blending facilities, installations, depots, retail outlets, aviation fuel stations, and LPG distributors.

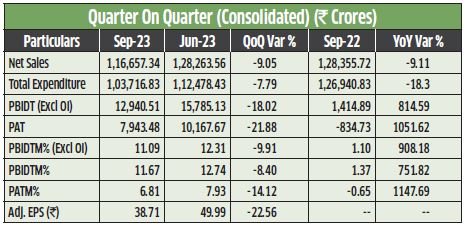

Financial Performance: In the quarter ending September 2023, BPCL demonstrated a striking 1,051 per cent growth in its consolidated net profit, amounting to ₹7,943 crore, a notable contrast to the loss of ₹834 crore reported in the corresponding period last year. However, the revenue from operations experienced a 9.1 per cent decline, totaling ₹1.17 lakh crore as compared to ₹1.28 lakh crore in the previous year’s quarter. The decrease was attributed to lower refining throughput, which stood at 9.4 MMT in Q1FY24 in comparison to 10.4 MMT, due to a planned maintenance shutdown at the Bina refinery in Madhya Pradesh.

Valuation and Future Outlook: Looking ahead, BPCL has outlined plans to add 1,000 retail outlets in FY24, having already incorporated 300 outlets in 1HFY24. The management has highlighted the superior gross refining margin (GRM) of the Bina refinery, surpassing that of other refineries, owing to its capacity to process up to 90 per cent of high sulfur crude in its basket. The upcoming quarter is expected to see strong performance by oil marketing companies (OMCs) like BPCL, driven by improved gross marketing margins on petrol and diesel. The Singapore GRM for the current quarter stands at USD 4.5 per barrel, surpassing the Q1FY24 figures despite the ongoing Middle East conflict and a 15 per cent decrease in Brent crude since September end.

Given these developments, investing in OMCs like BPCL is considered advantageous. With current levels standing at 1.4 times the P | BV, the downside potential appears limited in comparison to historical trading patterns of around 2 times. Considering these factors, we recommend including this company in the model portfolio.

Bigbloc Construction Ltd

CMP (₹ ): 164.55

BSE CODE : 540061 I Face Value (₹ ) : 2

Mcap Full ( ₹ Cr.) : 1,162.34

BigBloc Construction Limited, with a current market price (CMP) of ₹164.55 and a BSE code of 540061, holds a face value of ₹2 and boasts a market capitalization of ₹1,162.34 crore. The company is a key player in the Indian aerated autoclave concrete (AAC) block manufacturing industry, with a robust production capacity of 825,000 CBM/PA distributed across three state-of-the-art facilities. Leveraging its position as a leading manufacturer of sustainable building materials, the company has garnered a marquee clientele of over 100 realtors and offers a diverse product portfolio, solidifying its status as one of the largest AAC block manufacturers in India.

Financials: In Q2FY24, BigBloc reported a revenue of ₹58.9 crore, marking a substantial 21% year-on-year (YoY) growth from ₹48.5 crore in Q2FY23. Furthermore, its earnings before interest, taxes, depreciation, and amortization (EBITDA) stood at ₹14.9 crore, indicating a 7% YoY increase. However, the company’s profit after tax (PAT) for Q2FY24 amounted to ₹7.5 crore, reflecting a decline of 11.8% YoY. The management’s focus on EBITDA margins over net profit margins is driven by factors such as capital expansion, where control is limited. Notably, the net debt-to-equity ratio has seen a slight increase from 1.1 times in FY23 to 1.2 times, attributed to a minor rise linked to internal accruals for capital expansion.

Valuation and Growth Prospects: BigBloc Construction is strategically positioned to capitalize on the growth potential within India’s construction industry, bolstered by government initiatives and the increasing acceptance of AAC blocks. Its collaboration with the Siam Cement Group has significantly enhanced the company’s technological expertise. Looking ahead, the company anticipates commissioning its second phase plants by FY25. The improved margins, driven by the cost advantage of AAC blocks being 15-20% cheaper than traditional bricks, have augmented the company’s assets, which doubled since FY22 due to capital expansion of ₹75 crore as of November 2023.

Following its expansion, BigBloc Construction aspires to emerge as India’s largest AAC block manufacturer, targeting revenues of ₹500-₹600 crore over the next five years. The company’s strong financial performance is underscored by a three-year revenue compound annual growth rate (CAGR) of 19% and a three-year EBITDA CAGR of 69%. Therefore, based on these promising indicators, we recommend including this company in the model portfolio.

Garden Reach Shipbuilders & Engineers Ltd

CMP (₹ ): 819.65

BSE CODE : 542011 I Face Value (₹ ) : 10

Mcap Full ( ₹ Cr.) : 9,388.11

Garden Reach Shipbuilders & Engineers Limited (GRSE) is a premier warship-building company in India, operating under the administrative control of the Ministry of Defence. GRSE, since 1960, has built more than 107 warships for various roles, starting from state-of-the-art frigates and corvettes to fast patrol boats. The main businesses of GRSE include shipbuilding and ship repairing, engine assembling and testing, and engineering products.

Financials: Garden Reach Shipbuilders & Engineers Limited reported a strong second quarter for FY24, with net sales growth of 31.74 per cent to ₹ 897.91 crore, compared to ₹ 681.60 crore in the same quarter last year. The net profit for the quarter stood at ₹ 80.74 crore, which was ₹ 58.73 crore in the previous year’s same quarter. The company has a return on capital employed (ROCE) of 20.3 per cent and return on equity (ROE) of 16.4 per cent.

Valuation and Growth Prospects: It has an order book of ₹ 23,739.59 crore, including projects for the Indian Navy, the Government of Bangladesh, and the DRDO. The order book is expected to last for the next five years, and the revenue recognition peak could be in FY25 or FY26. The Indian Navy and Indian Coast Guard will be coming up with new projects in the coming years and months, which will benefit the company. GRSE is currently trading at a PE of 35.5 times, which is high when compared to its industry peers, but it can be justified due to the growth of the company.

In the last three years, the sales of the company have increased at a CAGR of about 21 per cent with profit growth of 10 per cent. The stock trades at 6.29 times its book value and has a PEG ratio of 1.75 times. The company has achieved a healthy average ROE and ROCE of 20.3 per cent and 16.4 per cent, respectively. It is debt-free with an interest coverage ratio of 30.9 times over debt-to-equity of 0.01 times.

Given all these factors and the fact that its order book is well-positioned, we recommend this company to include in the model portfolio.

HDFC Bank Ltd

CMP (₹ ): 1,670.85

BSE CODE : 500180 I Face Value (₹ ) : 1

Mcap Full ( ₹ Cr.) : 12,68,143.20

HDFC Bank Limited, headquartered in Mumbai, stands as India’s largest private sector bank of the country by market capitalisation. The bank caters to a wide range of banking services covering commercial and investment banking on the wholesale side and transactional or branch banking on the retail side. The bank has three key business segments: wholesale banking, treasury and retail banking. In April 2022, HDFC Bank announced a merger with India’s largest housing finance company, HDFC Limited.

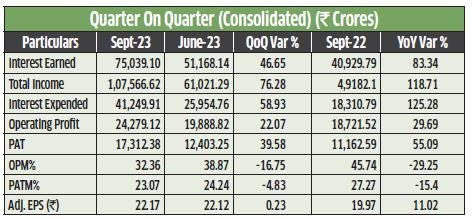

Financials: In Q2FY24, on a consolidated basis, the company’s net interest income was ₹ 75,039.10 crore, increasing from ₹ 40,929.79 crore with growth of 83.34 per cent YoY. On a YoY basis, its other income showed growth of 294.16 per cent to ₹ 32,527.52 crore from ₹ 8,252.31 crore in the same quarter. The net profit for Q2FY24 rose by 55.09 per cent YoY to ₹ 17,312.38 crore compared to ₹ 11,162.59 crore from the same quarter the previous year.

Valuation and Growth Triggers: The current account saving account (CASA) deposits grew by 7.6 per cent. Its gross non-performing assets were at 1.34 per cent of the gross advances as on September 30, 2023 as against 1.41 per cent on a pro forma merged basis as on June 30, 2023 and 1.23 per cent as on September 30, 2022. The net nonperforming assets were at 0.35 per cent of the net advances as on September 30, 2023.

HDFC’s group companies provide synergistic benefits and avenues for future growth in the areas of asset management and insurance. The merger of HDFC Bank and HDFC Limited offers substantial growth opportunities, especially considering the bank’s competitive advantage in mortgage financing and the potential for cross-selling to existing HDFC customers. In the last three years, the bank has delivered average ROE of 16.8 per cent and ROCE of 6.13 per cent. Given the strong financials, we recommend this company to include in the model portfolio.

Hero Motocorp Ltd

CMP (₹ ): 3,935.70

BSE CODE : 500182 I Face Value (₹ ) : 2

Mcap Full ( ₹ Cr.) : 78,677.58

Hero MotoCorp Limited is a pioneering twowheeler manufacturer. It manufactures and sells motorised two-wheelers up to 350 cubic centimetres (cc) engine capacity, spare parts and related services. As the world’s largest manufacturer of two-wheelers in terms of unit volumes for over two decades, Hero MotoCorp boasts a significant market share in the Indian motorcycle market. The company features strong brands such as Splendor, Passion and Glamour in the bike segment, and Pleasure and Maestro in the scooter segment.

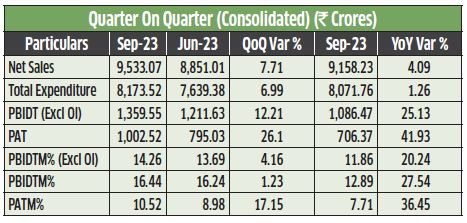

Financials: Looking at the consolidated quarterly financial performance of Hero MotoCorp, in Q2FY24 the company reported revenue of ₹ 9,533 crore, registering growth of 4.09 per cent as compared to ₹ 9,158 crore in Q2FY23, while the EBITDA of the company surged by 28 per cent and stood at ₹ 1,360 crore as against ₹ 1,062 crore in Q2FY23. Similarly, the net profit of the company increased 47.65 per cent to ₹ 1,007 crore as compared to ₹ 682 crore in Q2FY23.

Valuation and Growth Triggers: Hero MotoCorp’s ‘Win in Premium’ strategy is thriving, fuelled by strong bookings for Harley-Davidson X440 and Karizma models. The company plans to open 100+ premium stores and upgrade existing ones, part of a broader expansion in the electric two-wheeler business covering 100+ cities. With a focus on infrastructure development, Hero MotoCorp’s electric vehicle (EV) business, including an investment in Ather, is gaining momentum. Moreover, global business volumes reached 52,500 units in Q2, with heightened production for premium models. The company targets market share growth in the scooter segment through strategic interventions and portfolio strengthening. Improved gross margins, coupled with a consistent capital expenditure guidance of ₹ 1,000 crore, further underpin the positive outlook. Additionally, the company’s valuation metrics, including a PE multiple of 22.8 times and EV/EBITDA of 14, align with historical trends and industry benchmarks, indicating a fair valuation. Hence, we recommend this company to include in the model portfolio.

Landmark Cars Ltd

CMP (₹ ): 811.30

BSE CODE : 543714 I Face Value (₹ ) : 5

Mcap Full ( ₹ Cr.) : 3,332.87

Landmark Cars Limited, with a current market price (CMP) of ₹811.30 and a market capitalization of ₹3,332.87 crore, is a significant player in India’s premium automotive retail sector. It boasts dealerships for prestigious brands such as Mercedes-Benz, Honda, Jeep, Volkswagen, and Renault. In addition to the sale and purchase of pre-owned passenger vehicles, the company offers a diverse automotive portfolio. Its collaboration with Ashok Leyland has expanded its presence in the commercial vehicle sector. Offering a comprehensive automotive experience, including new vehicle sales, after-sales service, repairs, and facilitation of pre-owned vehicle sales, Landmark Cars has been delivering top-notch services in the premium and luxury automotive sectors since 1998.

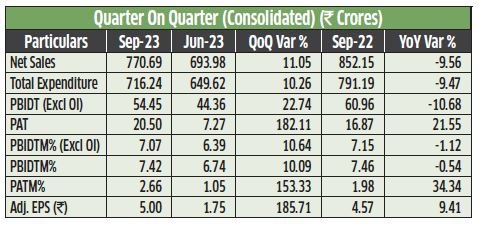

Financials: In September 2023, Landmark Cars experienced a decrease in net sales, dropping to ₹770.69 crore from ₹852.15 crore in September 2022, marking a decline of 9.56%. The profit before interest, depreciation, and tax (PBIDT) excluding other income also decreased from ₹60.96 crore in September 2022 to ₹54.45 crore in September 2023, a 10.68% reduction. On a positive note, the net profit saw an improvement, increasing from ₹16.87 crore in September 2022 to ₹20.50 crore in September 2023, representing a growth of 21.55%. The calculated earnings per share (EPS) rose from ₹4.57 to ₹5.00, indicating a 9.57% increase.

Valuations and Growth Triggers: The company plans a routine capital expansion of ₹10-₹15 crore, prioritizing strategic investments for ongoing operations and allocating additional capital for organic or inorganic growth opportunities. The focus on new car models aligns with the growth strategy. Strategic partnerships with MG Motors and Mahindra & Mahindra aim to boost overall growth and market positioning. With rising automobile sales, the company is poised for success. Hence, including this company in the model portfolio is recommended.

Lincoln Pharmaceuticals Ltd.

CMP (₹ ): 620.15

BSE CODE : 531633 I Face Value (₹ ) : 10

Mcap Full ( ₹ Cr.) : 1,236.33

Established in 1979, Lincoln Pharmaceuticals Limited has distinguished itself as a key player in the realm of branded generics, renowned for providing cost-effective and innovative medications that contribute to improved well-being. The company is a dynamic pharmaceutical manufacturer committed to advancing the industry through innovative breakthroughs, effective business strategies, and unwavering customer satisfaction.

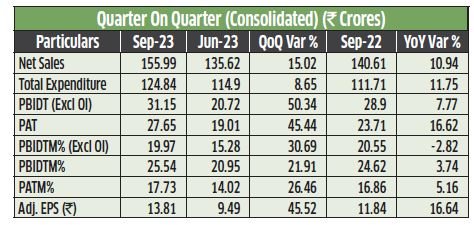

Financials: In Q2FY24, the company reported consolidated revenue of ₹155.99 crore, indicating a nearly 11 per cent year-on-year (YoY) increase from ₹140.61 crore, and a sequential rise of approximately 15 per cent. Its PBIDT (excluding other income) rose by 7.8 per cent YoY, standing at ₹31.15 crore from ₹28.90 crore, while on a sequential basis, it recorded a substantial jump of 55 per cent from ₹20.72 crore. The company’s net profit stood at ₹27.65 crore compared to ₹23.71 crore, signifying a YoY growth of 16.6 per cent, while on a sequential basis, it grew by almost 42 per cent.

Valuations and Growth Triggers: The recent capital investments of Lincoln Pharmaceuticals have primarily focused on the expansion of the Cephalosporin plant in Mehsana, Gujarat. The company has successfully completed multiple expansion projects at this plant, expected to make a significant contribution to the company’s sales, with estimated revenue of around ₹150 crore over the next three years. Additionally, the company aims to strengthen its portfolio in the lifestyle and chronic segments, with a specific focus on women’s healthcare and dermatology. In terms of valuations, the company is currently trading at a PE of 15.7 times, whereas the industry PE is at 31.2 times. The price-to-book value of the company is currently at 2.33 times, which is lower than most of its peers. Its market capitalization to sales ratio stands at 2.36 times. Considering the growth triggers and the company’s current financial standing, we recommend including this company in the model portfolio.

Ujjivan Small Finance Bank Ltd

CMP (₹ ): 57.70

BSE CODE : 542904 I Face Value (₹ ) : 10

Mcap Full ( ₹ Cr.) : 11,281.43

Ujjivan Small Finance Bank (USFB) is a small-cap bank with a market capitalisation of ₹ 11,675 crore. The bank is a mass market-focused small finance bank in India. Its portfolio of products and services includes various asset and liability products and services. The bank’s asset products comprise loans to micro banking customers that include group loans and individual loans, agriculture and allied loans, medium and small enterprise (MSE) loans, affordable housing loans, financial institutions group loans, personal loans and vehicle loans.

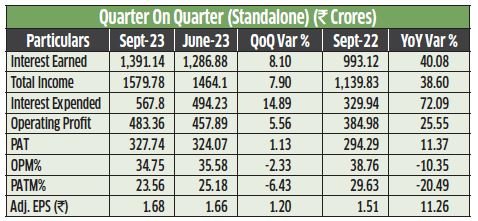

Financials: In Q2FY24, Ujjivan Small Finance Bank’s net profit rose by 40.08 per cent year-on-year (YoY) to ₹ 1,391.14 crore compared to ₹ 993.12 crore from the same quarter the previous year. On a sequential basis, its revenue grew by 8.10 per cent. The total income of the bank increased by 38.60 per cent YoY to ₹ 1,579.78 crore compared to ₹ 1,139.83 crore from the same quarter the previous year, while sequentially it increased by 7.90 per cent.

The bank’s operating profit stood at ₹ 483.36 crore compared to ₹ 384.98 crore, a YoY growth of 25.55 per cent, while sequentially increasing by 5.56 per cent. USFB reported a strong financial performance in Q2FY24 with its gross loan book witnessing impressive growth of 27 per cent YoY and 5 per cent QoQ to reach a significant ₹ 26,574 crore. Its current accounts and saving accounts (CASA) grew 28 per cent YoY, taking the CASA ratio to 24.1 per cent.

Valuation and Growth Triggers: Ujjivan Small Finance Bank (USFB) is trading at a 2.9 times price-to-adjusted book value, with a return on assets of over 3.8 per cent. With a strong brand reputation, competitive advantage, and government support, USFB is well-positioned for a strong FY 2024. The growing demand for financial services in India is a major growth trigger, and its new products, brand campaign, and reverse merger with Ujjivan Financial Services are expected to drive further growth. Hence, we recommend this company to include in the model portfolio.

Disclaimer: This article is for information purposes only. It is not a stock recommendation or portfolio recommendation and should not be treated as such. Above is the only suggested model portfolio. We don’t promise any guaranteed return. You should always consult your personal investment advisor/wealth manager before making any decisions.