Fintech firms specializing in individual loans are experiencing rapid growth, yet they grapple with the crucial challenge of maintaining asset quality while striving for profitability.

The Indian fintech lending sector experienced significant growth during the Covid-19 pandemic and continued to expand post-lockdown. However, achieving profitability remains a challenge for these companies.

In the fiscal year 2022-23, fintech companies disbursed consumption loans totaling ₹84,000 crore, encompassing personal loans, consumer durable loans, and credit cards, as per TransUnion Cibil. In comparison, the entire financial sector, including banks and non-banking financial companies (NBFCs), issued consumption loans worth ₹11 trillion in the same period.

Despite being in its infancy and relatively small-scale, the fintech landscape is already highly competitive. The count of fintech firms approving over 5,000 loans annually more than doubled from 24 in 2018-19 to 54 in 2022-23. Similarly, the number of fintech companies issuing over 100,000 loans per year soared six-fold to 36 in the same time frame. Conversely, the growth in other categories of lenders offering similar types of loans was more gradual.

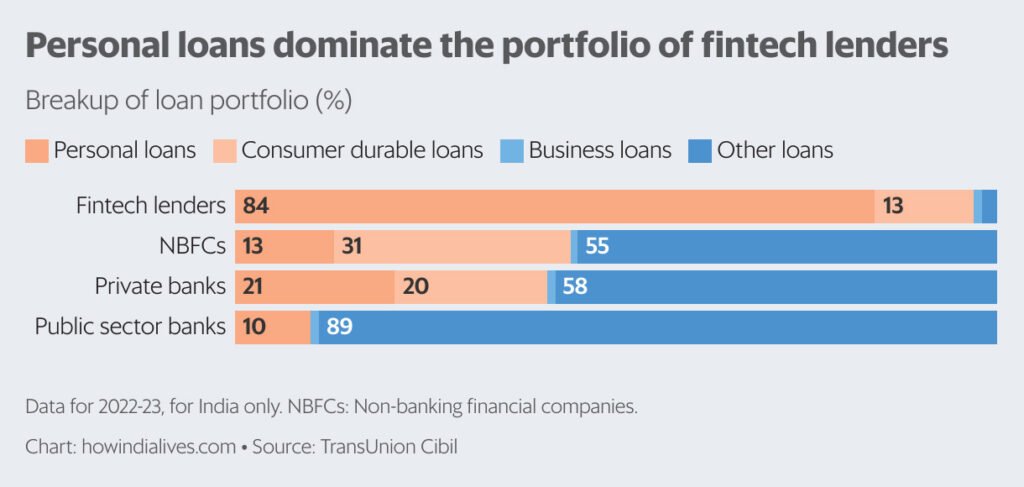

The majority of fintech lending focuses on personal loans and consumer durable loans, which constitute approximately 97% of fintech loan portfolios. In contrast, for NBFCs and private banks, this percentage is around 41-44%, while for public sector banks, it is approximately 10%.

Fintech Lending: Finding Balance

Fintech companies heavily focus on specific types of lending, like buy-now-pay-later (BNPL) loans. BNPL loans offer zero-interest options for purchases, allowing repayment in installments. Although these loan products are gaining popularity, the journey to profitability presents challenges, as highlighted in a global context by the Bank for International Settlements, an institution owned by central banks of various countries.

Fintech’s Loan Focus

Originally, fintechs aimed to leverage technology to offer traditional financial products to consumers. In India, their primary offering was the BNPL loan. This model allowed consumers to make purchases, such as smartphones and other durable goods, from e-commerce platforms with ease and repay the cost in multiple installments, seemingly without additional expenses. Merchants found BNPL appealing as it attracted customers who might not have been able to afford high-value purchases in one go.

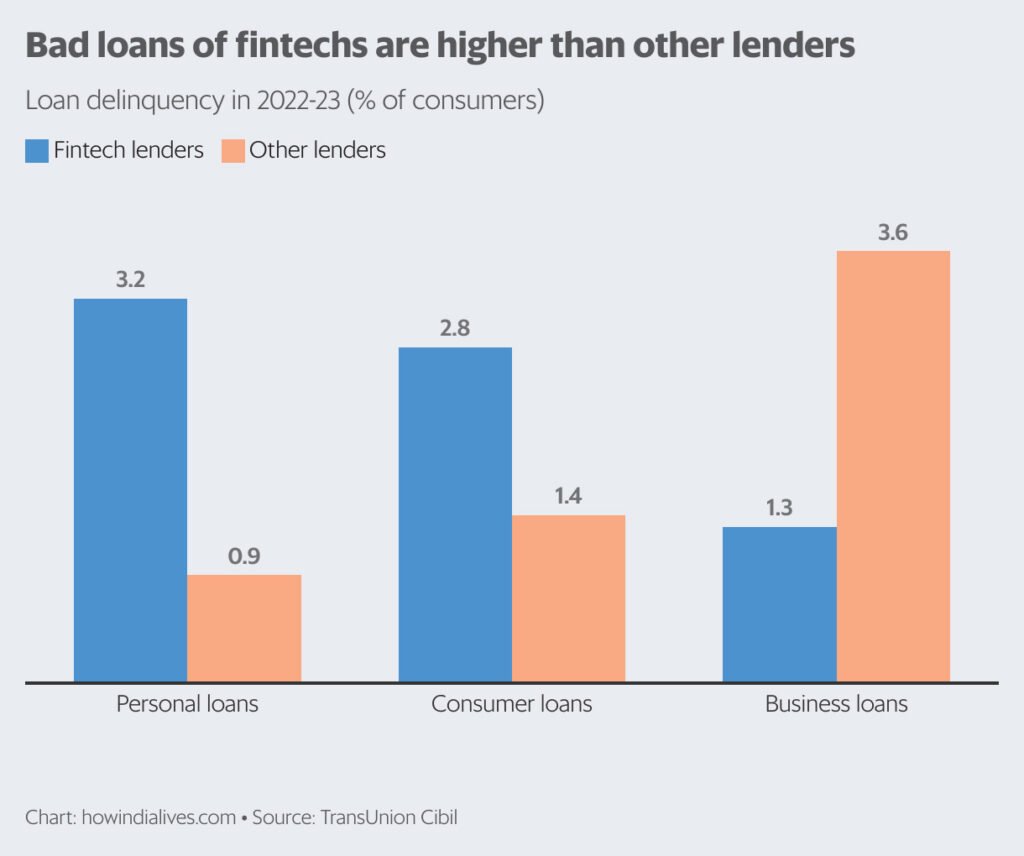

By utilizing technology, fintech firms processed nearly 70% of consumer durable loans and 57% of personal loans within a day in 2022-23, surpassing other types of lenders. However, this efficiency came at a cost. In its most recent financial stability report, released on 28 December, India’s central bank pointed out “some signs of risk build-up in consumer credit,” including more downgrades than upgrades, decreasing underwriting standards, and individuals taking out multiple loans.

Time to Sell, Potential Profits Ahead

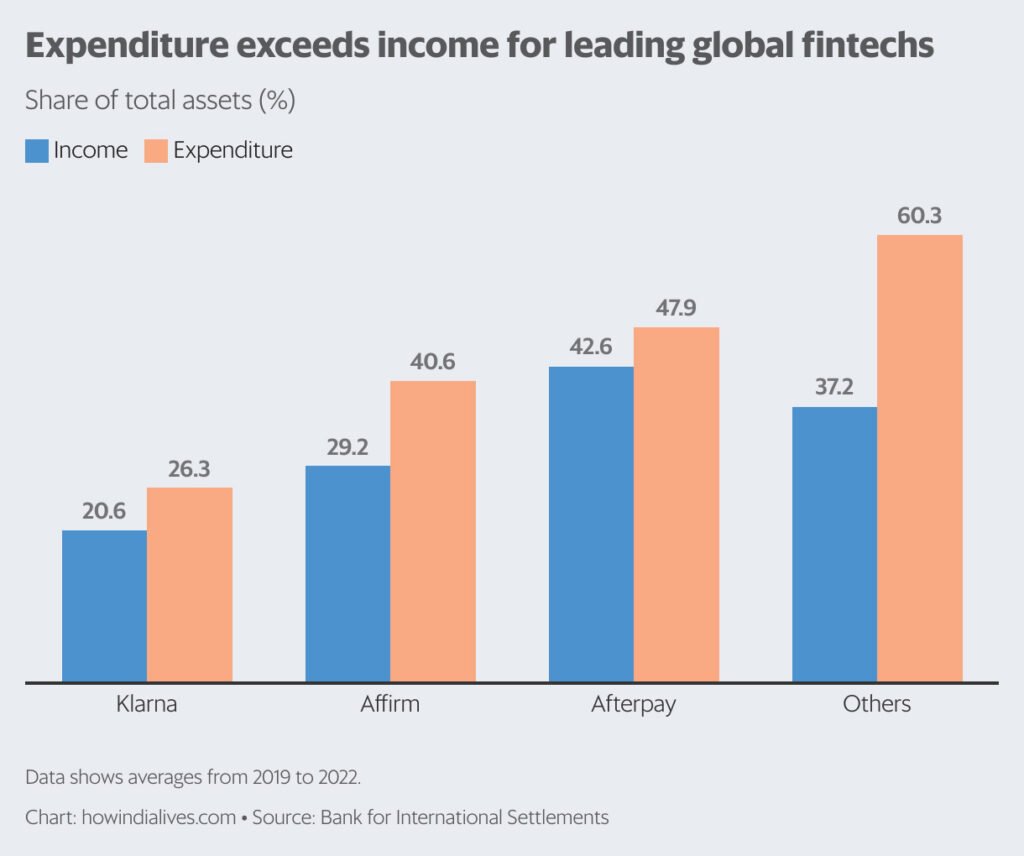

In the fast-paced world of fintech, having advanced technology is not enough to stay ahead for the long haul. According to a recent report by BIS that focused on the global BNPL market and surveyed major fintech firms like Affirm, Afterpay, and Klarna, it was revealed that these big players are facing challenges in turning a profit. The report highlighted that high operating costs for marketing, administration, and technology have prevented these platforms from breaking even since 2018. In addition, rising credit losses and increased competition from neo-banks and big tech companies entering the BNPL market have resulted in notably low return on assets for BNPL platforms in 2021-22.

For large global fintech firms, operating costs have been especially burdensome, leading them to operate at a loss. The median return on assets for the group of fintech companies examined by the BIS consistently declined between 2018 and 2022, dropping from -5.9% to -15.6%.

Risky Business: The Challenge Facing Indian Fintech Firms

Indian fintech firms are experiencing higher rates of bad loans in consumer and personal lending compared to traditional banks.

Globally, fintech firms predominantly serve younger individuals with less stable financial situations. According to the BIS report, most users of buy-now-pay-later apps are under 35 years old. These tech-savvy consumers, including Millennials and Generation Z, often lack credit cards and financial knowledge. A survey of US buy-now-pay-later services revealed that they are frequently utilized by individuals with lower incomes and less education.

In India, data from VCCEdge for 119 digital lending fintech firms in 2021-22 indicated that 46 were experiencing operational losses, while 62 were facing net losses. Looking ahead, the primary obstacle for fintech companies will be to shift focus from riskier lending and work toward building more balanced portfolios.

www.howindialives.com is a database and search engine for public data.