Despite a 10% average increase in vehicle prices due to more expensive models and inputs, the rise in wholesales continued unabated.

The shift towards sport utility vehicles (SUVs) drove passenger vehicle (PV) sales beyond four million in 2023, according to a leading industry executive. Despite an average 10% increase in vehicle costs throughout the year, consumers continued to move away from sedans and hatchbacks towards SUVs.

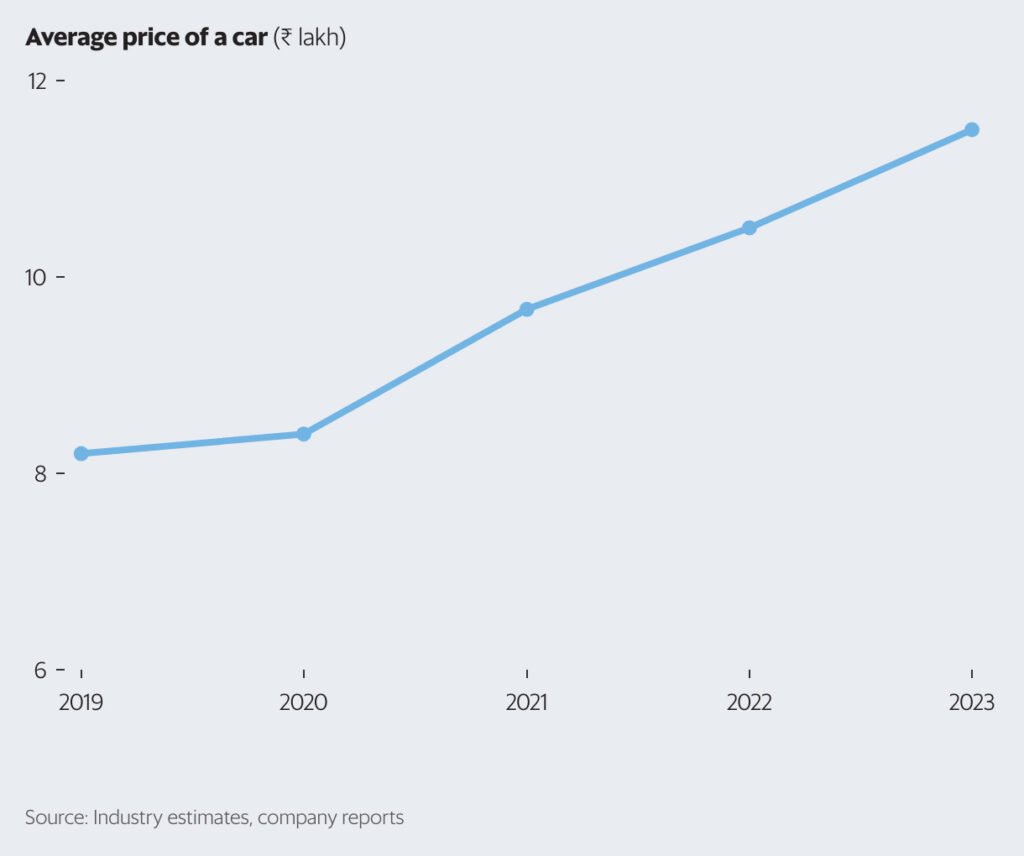

Shashank Srivastava, the senior executive director at Maruti Suzuki, the country’s top carmaker, revealed that over two million SUVs were sold last year, representing 49% of total sales, up from 42% in 2022. Srivastava also noted that the average PV carried a price tag of ₹11.5 lakh in 2023, marking a 40% increase from ₹8.2 lakh in 2019, and a 9.5% rise from ₹10.5 lakh in 2022.

The surge in average purchase prices in 2023 can be attributed to higher production costs stemming from expensive inputs and mandatory safety technology, along with an increasing preference for pricier SUVs and top models among customers.

In December, a total of 287,904 passenger vehicles were dispatched from factories to dealerships, marking the highest-ever figure for the month, surpassing the previous record of 276,000 units in December 2020 by Shashank Srivastava, with a 4.4% increase over last year’s dispatches of 275,680 units.

At Maruti Suzuki, the dispatches in December declined by 6.5% to 104,778 units from a year earlier. Meanwhile, Tata Motors witnessed a dispatch increase of 8.6% to 43,470 units, and Mahindra & Mahindra observed a notable surge of 23.7% to 35,174 units. A few manufacturers, such as Toyota and Kia, are yet to disclose their December numbers.

In December, retail sales surpassed wholesales as manufacturers endeavored to clear out stocks following three festive months ending in November. This was achieved through reduced production and substantial discounts on models with high inventory levels.

Citing data from the government’s Vahan website, Jay Kale, senior vice-president at Elara Capital, highlighted that December retail sales exhibited a slower growth rate compared to the 7% growth seen in FY24 so far. He emphasized, “We are seeing some moderation in PV growth. The real situation of pending order books reported by companies is getting tested as capacities ramp up post chip shortage at the start of the year. While the SUV segment continues to outperform, the recovery in the cars segment on a low base will be keenly watched.”

Maruti Suzuki and Hyundai Motor India indicated that their stocks at the inception of 2024 are close to two-week levels, marking a reduction to half of the levels observed at the beginning of December.

On an industry-wide scale, PV retail numbers reached a record 442,800 units in December, a surge of 7.8% over the previous year, as stated by Maruti’s Srivastava. This stands in contrast to the 287,904 wholesales in the same month.

It is important to note that the official wholesale and retail sales figures will be separately released by the auto industry body Society of Indian Automobile Manufacturers (SIAM) and the dealers’ body Federation of Automobile Dealers Associations of India (FADA) later in the month.

The automotive industry in India has witnessed a significant surge in the sales of vehicles with electrified powertrains, with electric vehicles (EVs) and hybrid vehicles experiencing a 90% and 358% increase, respectively. This growth has notably benefited companies like Tata Motors and MG Motor India, leaders in the EV segment, as well as Toyota and Maruti Suzuki, which have introduced hybrid models in specific SUV segments.

The demand for new SUV models has been remarkable, with the introduction of the micro-SUV Exter leading to a substantial increase in Hyundai’s overall SUV sales, accounting for 60% of its portfolio. Similarly, Honda’s new SUV Elevate has quickly made up half of its sales in India.

Hyundai anticipates that up to 65% of its sales will come from SUVs in the next year, with the SUV segment projected to represent 53-54% of total PV sales. Meanwhile, Maruti Suzuki aims for a 25% share in the segment by the end of FY24, currently drawing over 23% of its sales from SUVs. Mahindra & Mahindra, with a focus on SUVs, continues to experience a strong influx of new orders, despite supply chain challenges leading to prolonged waiting periods for some products.

Notably, automakers have reported robust rural sales in 2023, indicating an income disparity within the rural population despite a slowdown in rural consumption for most consumer goods makers. Maruti Suzuki, for instance, achieved its highest-ever rural sales at 776,000 units in 2023.

According to Tarun Garg, the chief operating officer at Hyundai Motor India, factors such as strong minimum support prices, improved road infrastructure, and favorable monsoons have contributed to significant growth in rural sales. He highlighted that rural contribution to Hyundai’s sales reached its highest level at 19.1% in 2023.

Looking ahead to 2024, industry experts, including Garg and Srivastava, anticipate a moderation in growth rate due to several factors, including the fulfillment of pent-up demand and pending bookings in the current year, optimal stock levels resulting from this fulfillment, and the anticipated impact of high repo rates on auto loan rates, potentially affecting demand for vehicles.