Dive into this week’s “Plain Facts” as we uncover India’s economic shifts, from a narrowed CAD to a soaring mutual fund industry, alongside a potential monumental hike in agricultural funding. Discover how these changes could redefine India’s financial and farming landscapes.

Every Friday, our feature, Plain Facts, distills the week’s most significant stories into digestible data-focused insights, enriched with clear, informative charts. This past week, India witnessed its current account deficit (CAD) narrow down to 1% of the gross domestic product for the September quarter—a drop from the previous 1.1%. Meanwhile, the mutual fund industry celebrated a record-breaking 2023, with assets under management reaching unprecedented heights. This surge reflects a robust increase in folio numbers and record inflows from systematic investment plans (SIPs), signalling a bullish investor sentiment.

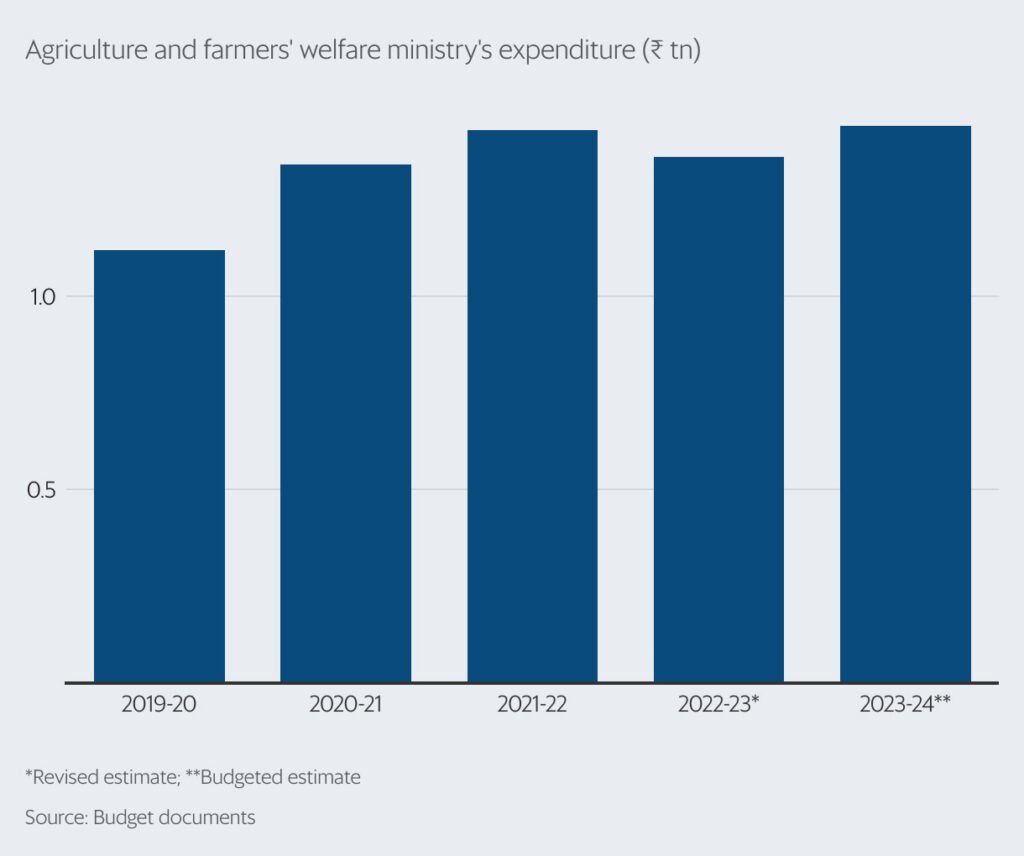

Agricultural Sector Set for Significant Funding

The anticipated Union budget for 2024-25 proposes a substantial increase in agricultural funding, potentially earmarking ₹2 trillion for the agriculture ministry, which represents a 39% hike from last year’s budget. This enhanced allocation aims to amplify the government’s key policies, supporting income and crop insurance initiatives for farmers. In the previous fiscal year, the ministry benefited from ₹1.44 trillion. Moreover, officials suggest there is a strong likelihood that the Centre will boost the farmers’ annual income support from the current ₹6,000 to ₹9,000 per household, evidencing a renewed commitment to agrarian welfare.

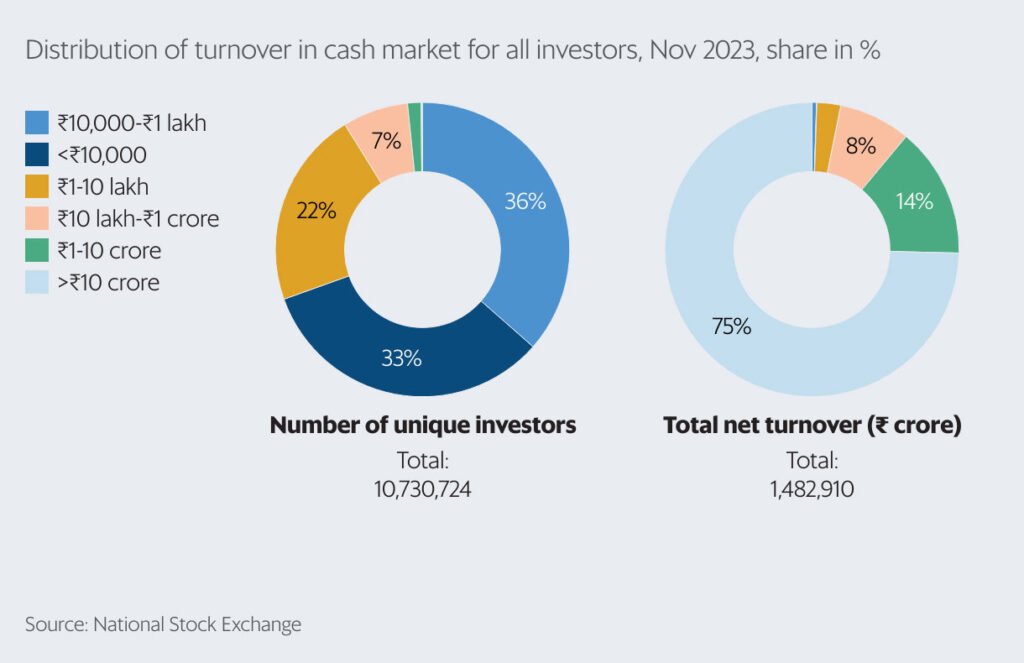

The Growth of Small Retail Investors in India

India’s stock markets are experiencing an influx of petite investors who have begun dipping their toes into the share market waters, particularly since the onset of the pandemic. Recent figures from the National Stock Exchange highlight an intriguing trend; individuals investing a maximum of ₹10,000 have swelled to constitute one-third of the entire investor population by November 2023. While their numbers are burgeoning, their market impact remains modest. Combined, the trade value from this demographic stands at ₹530 crore, which, when placed in the context of the market’s vast ocean of transactions, contributes a slender 0.04% to the total market turnover.

NBFCs: Evaluating Loan Dynamics

Non-banking financial companies (NBFCs) currently sport a sizeable bank debt reliance at 37.8% of their total borrowings, according to the latest Reserve Bank of India data as of September 2023. The central bank introduced an uptick in risk weights on bank loans to NBFCs, alongside those on unsecured loans issued by NBFCs, hiking them by 25 percentage points each in November. This step, taken amidst growing competition for bank credit, suggests that non-bank lenders – particularly those heavily dependent on commercial banks for loan capital – might have to consider broadening their funding bases in the coming year.

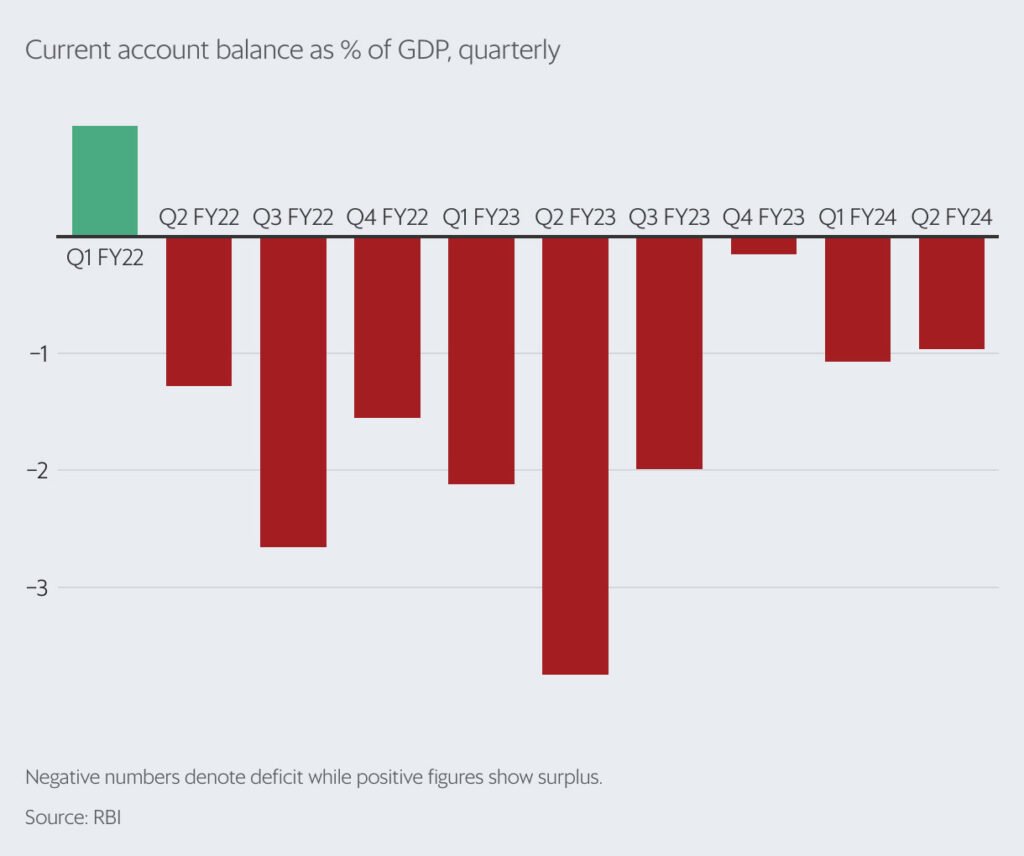

Shifting Current Account Trends

There’s a slight yet notable shift in India’s economic landscape – the current account deficit has contracted to 1% of the GDP, falling to $8.3 billion in the period ending September, down from 1.1% in the earlier quarter, and a more substantial 3.8% in the previous year. This contraction is primarily driven by a substantial decline in the merchandise trade deficit, which has reduced from $78.3 billion in the second quarter of the financial year 2023 to $61 billion in the same quarter of FY2024. For context, during the September quarter of 2022-23, the deficit figure stood at a more pronounced $30.9 billion.

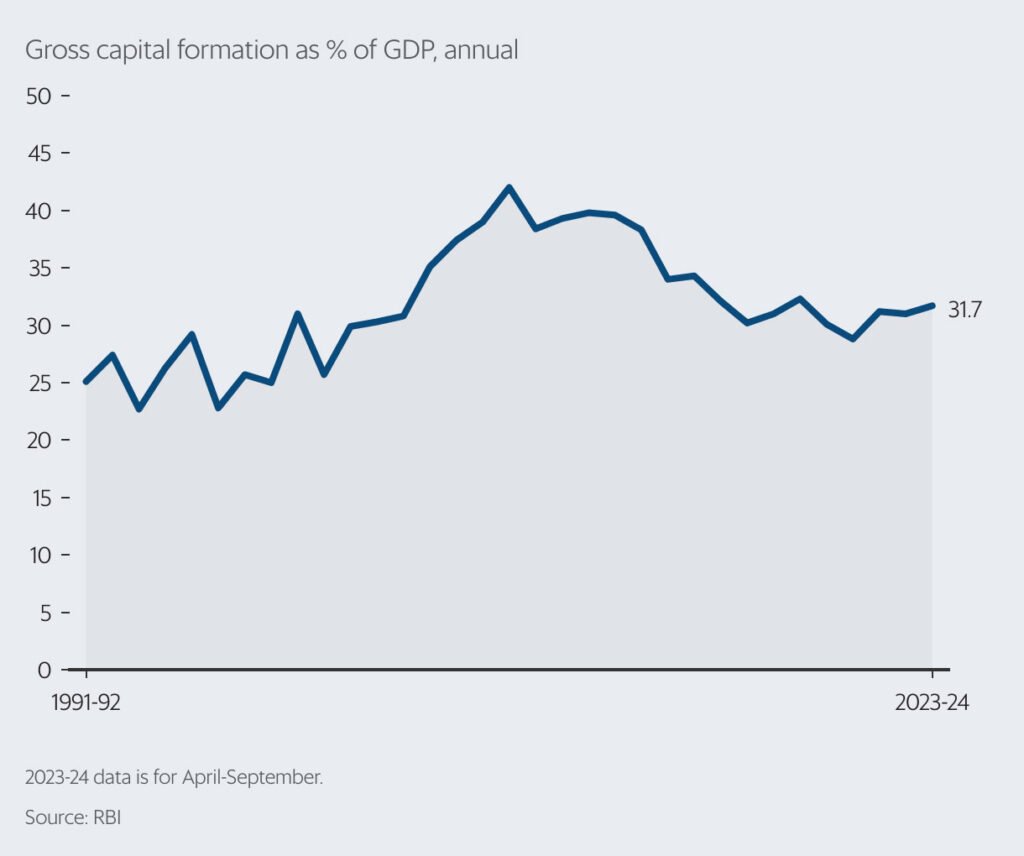

A New Era for Indian Investments

India has taken significant strides in boosting investments according to a year-end review, with the latest Union budgets prioritizing higher capital expenditure. In 2022-23, fixed investments made a notable leap, comprising 31% of the nation’s GDP, revealing a vast unlocked potential within the economy. While private corporations upped their envisaged capital expenditure (capex) during the fiscal years of 2021-22 and 2022-23, it’s been the government that’s surged ahead with investment initiatives. There’s a growing sentiment in the business community that while the appetite for investment is strong, many are poised for the completion of the general elections in 2024 before making substantial financial commitments.

Rail Network Expansion Ambitions

In an ambitious move, Indian Railways has earmarked an astounding $7 trillion for infrastructure development over the next decade. This massive investment aims to lay down an unprecedented 50,000 km of new tracks, a transformative effort set to modernize India’s railway network and accelerate train velocities. The imminent ‘mission mode’ approach seeks to enhance nationwide connectivity with up-to-date rail lines suited for high-speed trains like the Vande Bharat. These efforts fall under the grand Vision 2047, which anticipates the integration of an additional 100,000 km of novel rail alignments, among other advancements.

Investment Endurance

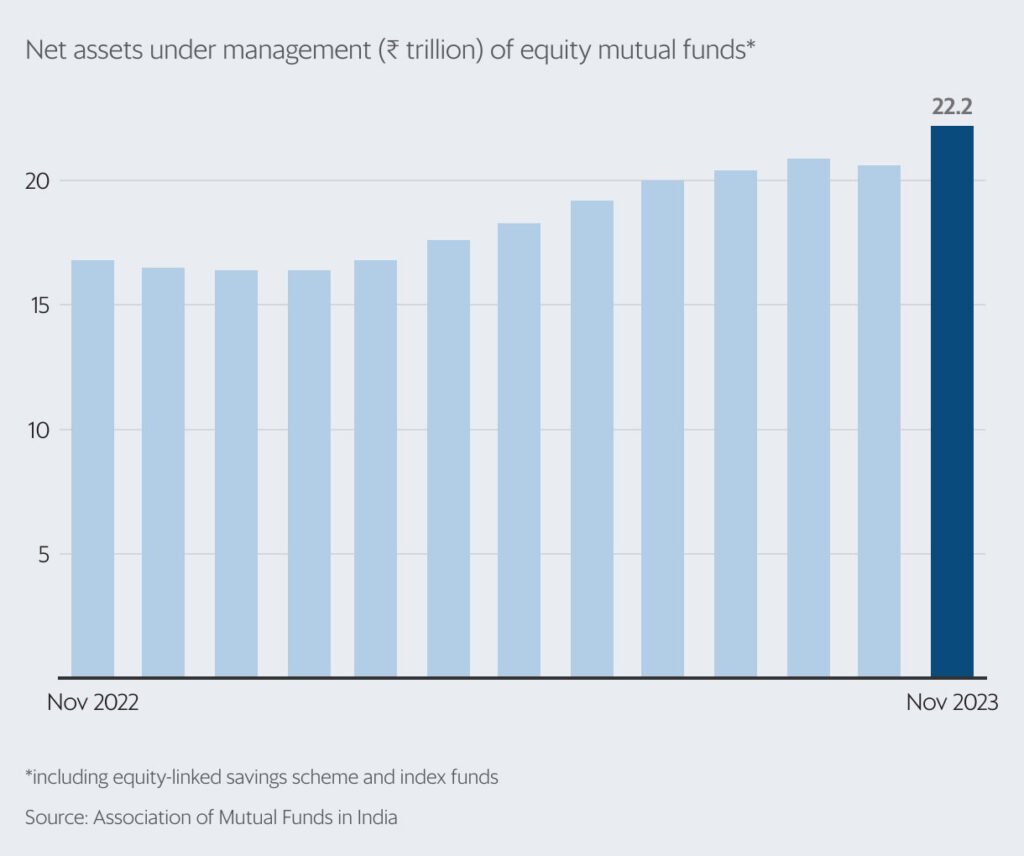

Despite the volatility that rocked equity markets in 2023, equity mutual funds have maintained their tenacity. The sector’s assets under management reached a record-setting ₹49 trillion as of November, primarily fueled by robust expansion in equity funds. This growth reflects strong market optimism and substantial fund inflows. Specifically, equity-oriented schemes have attracted net inflows totaling ₹1.4 trillion since January—only slightly behind the ₹1.5 trillion reported in the corresponding timeframe the previous year, showcasing persistent investor confidence amid uncertain times.

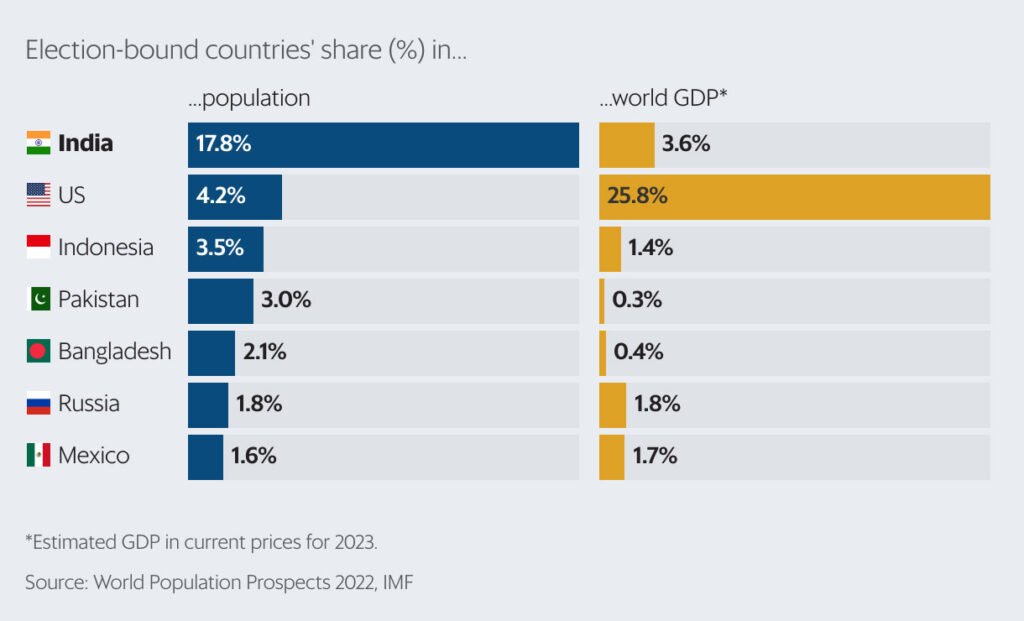

Chart of the week: Election Trends Recap – Analyzing the Week’s Poll Data

In 2024, an unprecedented 74 nations are poised to select their national leaders, according to a tally from The Economist. This group comprises seven out of the ten largest countries by population, representing more than a third of the global population and contributing significantly to the world’s economic output.