Discover the unseen hazards lurking in 2024’s market with our insightful guide to the stocks most at risk. Will SME stocks, small-caps, or crypto lead the potential financial busts? Dive into the dynamics shaping the SME exchange and its astounding growth.

I don’t claim to have a crystal ball, nor do I tout myself as an oracle of the stock market’s future movements – those are secrets perhaps known only to the trading gurus. However, speculating is open to all, and speculate I shall.

What’s my forecast for the major flop of 2024?

Pondering on small-caps, cryptocurrencies, or perhaps defense and infrastructure-related stocks?

These are all plausible candidates. Though plenty of predictions abound, I’m particularly convinced by my own hunch.

I’m pointing towards the SME stocks: the less-talked-about players listed on the Small and Medium Enterprise stock exchanges.

For those not versed in the SME market, here’s the backdrop you’ve been missing out on:

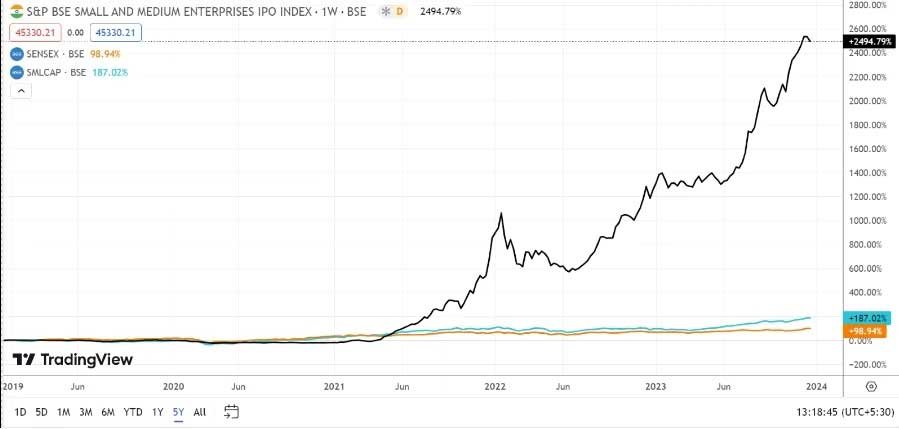

Over the past five years, the BSE SME IPO Index (signified by the black line on graphs) has skyrocketed approximately 26-fold, delivering a staggering return of 2,495%. When you place it beside the BSE Sensex (represented by the orange line), it paints a starkly subdued picture, with the latter only doubling in value, equating to a 99% return. The BSE Smallcap Index (denoted by the blue line) edges out slightly ahead with a 2.9 multiple, yielding a 187% return.

For those who punted on stocks without catching wind of these developments, you’ve likely missed out on what could be the monumental investment opportunity of the last ten years. Although the NSE also sports an SME market, our focus will zero in on the BSE SME marketplace.

So, what exactly is the BSE SME IPO Index? It’s India’s pioneering index for SMB stocks, conceived to monitor the prevailing conditions in the primary segment of India’s capital market and to gauge the accumulation of investor wealth over time. It’s exclusively constituted by SMBs listed on the BSE SME platform.

With clarity on the topic, we turn to the frenetic activity within the SME exchange. What exactly is sparking off such fervor?

The answer is a mix of exuberance, perhaps tipping towards the irrational.

To give perspective, BSE reports suggest that the price-to-earnings ratio (P/E – a key valuation measure) for the BSE SME Index is an exorbitant 44.5 times. Its counterparts, the BSE Sensex and BSE Smallcap, stand lower at 25.2 times and 31.2 times, respectively.

The SME Index, a cluster of arguably the most volatile stocks on the market, commands a substantial premium even over the already spirited smallcap shares. This phenomenon can only be attributed to the sheer zeal of investors flocking towards the SME sector, indicating an oversaturation of capital influx into these lesser-known stocks.

Here’s a crucial indicator to consider—the extent to which these IPOs were oversubscribed:

Benchmark Computer Solutions astonishingly reached 484 times its offering, Siyaram Recycling wasn’t far behind with an oversubscription rate of 385 times, and SJ Logistics followed closely at 316 times. Accent Microcell and Deepak Chemtex also witnessed overwhelming interest at 362 and 403 times, respectively.

It’s noteworthy that Net Avenue Tech experienced an exceptional oversubscription level of 511 times—a figure that’s hard to overlook (be mindful that some could trade on the NSE SME platform).

Moreover, it’s interesting to observe that all these SME IPOs wrapped up in December. This cluster of activity could signal market excitement. Is this not a clear reflection of investor frenzy?

The influx of investments into SME stocks is undeniable, yet it’s also true that the surging interest is forging a precarious situation. Should any adverse events unfold, investors might be at the onset of a sizeable financial setback. A concerning possibility is the aftermath of the hype—when the tides turn and exits are sought, investors may encounter the harsh reality of holding onto illiquid assets amidst a diving market, primarily due to the SME exchange’s limited trading volumes.

Let’s consider the case of Deepak Chemtex to understand the post-IPO trajectory:

It’s undeniably clear that trading volumes have plummeted, while the market watched the stock tumble from its peak of roughly ₹160 per share to ₹113. This steep decline represents a 30% loss in under a month. However, it is essential to point out that relative to its Initial Public Offering (IPO) price of ₹80, the stock has witnessed a 40% increase. Therefore, early investors who secured shares at the IPO stage remain profitable. Conversely, those who were eager to purchase shares on the inaugural trading day—a conclusion drawn from the high trading volumes at the time—may now be facing substantial losses.

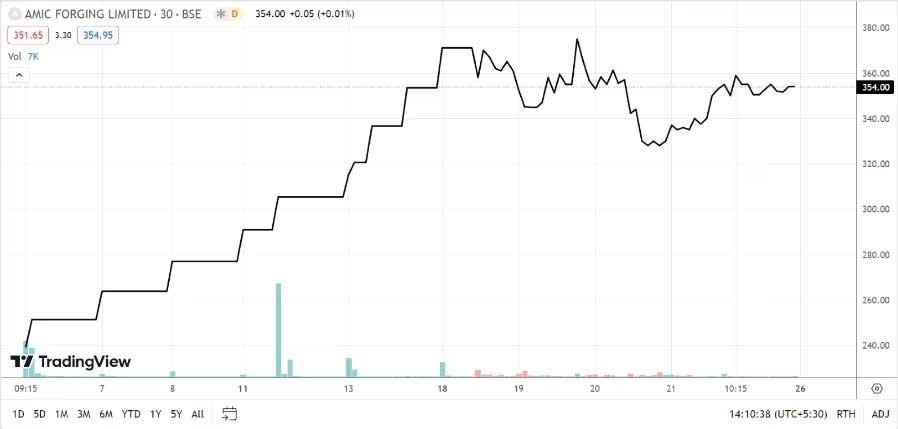

Turning our attention to AMIC Forging, which was met with an overwhelming response at its IPO, being oversubscribed by 289 times, the scene is quite different. Since its debut on the market about a month ago, the company’s shares have soared, showing an impressive gain of over 47%. However, it’s important to scrutinize the trading volumes, which are currently low. When measured against the IPO price, AMIC Forging’s stock price has remarkably climbed by an astounding 181%.

The “IPO lottery” concept appears to be quite beneficial for investors. If your application hits the mark, it’s like striking gold! However, acquiring shares after the IPO doesn’t come with the same assurances.

As I’ve mentioned earlier, there’s an inherent risk owing to the potential for limited liquidity, leading to sharp price swings—both gains and losses—in these securities. This characteristic can be advantageous for someone equipped with ample resources and patience. On the flip side, it poses a significant risk for traders aiming for a swift in-and-out.

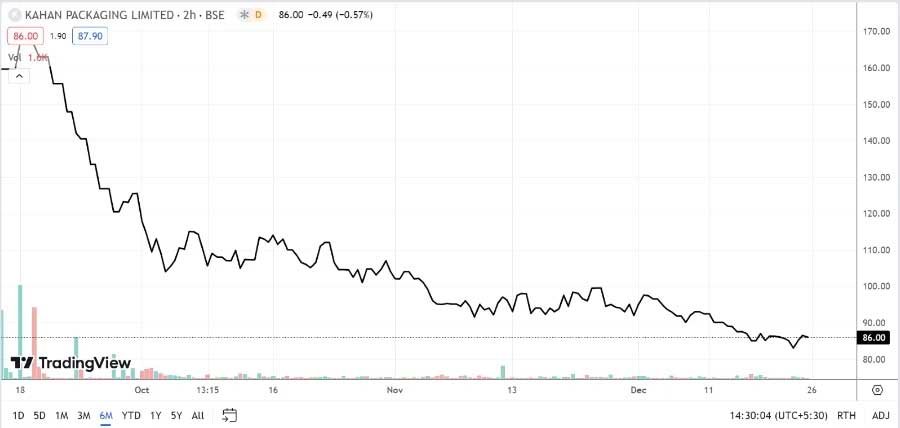

Let’s delve into another example. Consider the case of Kahan Packaging, which made its market debut in September. The public offering was exceedingly well-received, with demand soaring to 730 times the number of shares available.

That’s quite the statistic. But does the post-listing performance live up to the hype? And importantly, are the trading volumes able to keep up with such fervent initial demand?

Intriguingly, the stock that soared in popularity is currently trading just over 7.5% above its initial price, although it has plunged by more than 45% from its soaring debut on the exchange. That first surge offered a fleeting opportunity – if only one could have seized it. But declining trade volumes may have complicated the picture.

Navigating the SME market segment often feels akin to playing the lottery. Even with the winning numbers, you’re left hoping for another stroke of luck: converting those paper profits into tangible cash by finding the right moment to sell off. This may not apply to you if you’re an investor in for the long haul, equipped with substantial resources and remarkable perseverance. In such cases, holding onto promising SME stocks until they ascend to the main market could yield substantial returns.

A word to the wise: tread carefully in this terrain.

In this analysis, I’ve chosen not to delve into the intricate fundamentals of SME stocks. As I sift through the data, it’s apparent that the ‘SME’ category harbors more than potential pitfalls. Over the next few weeks and months, I aim to share insights into the fundamental aspects of these stocks. This, I hope, might pique your curiosity – enough to at least explore the essence of SME stocks and what they have to offer.