Synopsis

The recent ‘correction’ arose from an alteration in the P/B ratio computation method utilized by the NSE.

Is the Indian Market More Affordable Now?

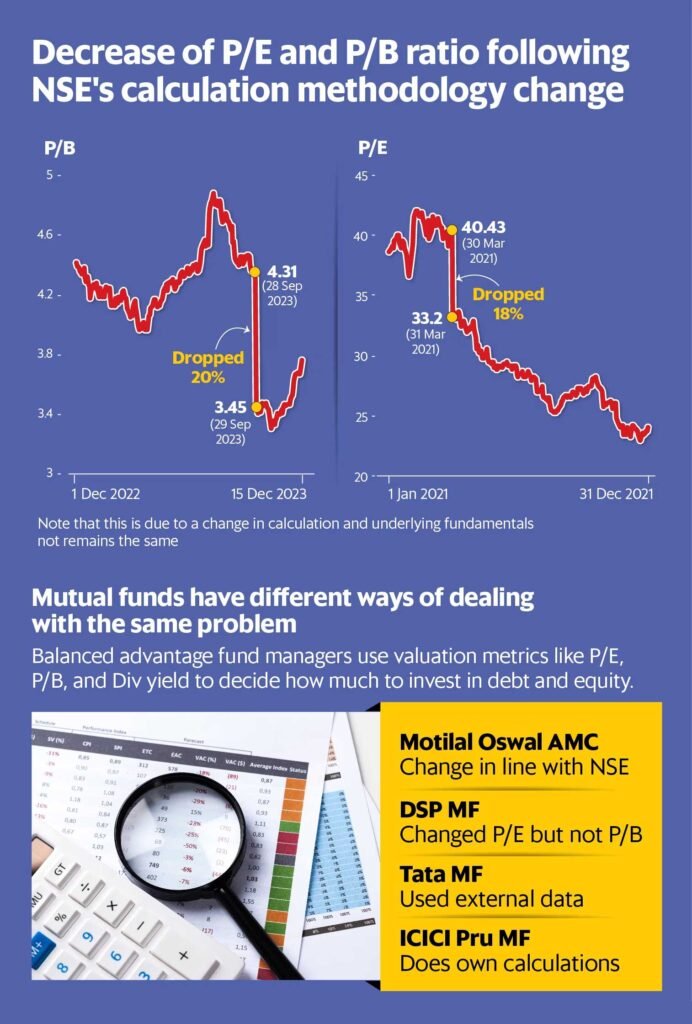

Recent data suggests that Indian markets might be presenting investors with a prime opportunity. A significant metric, the Price-to-book (P/B) ratio, indicates the Nifty 50 index has entered into a more enticing territory, declining sharply to 3.45 on September 29 from 4.31 just a day prior. This ratio is fundamental for stakeholders to assess the market’s appeal; a decline implies a lower valuation and potentially a smarter investment window, with the P/B ratio now adjusting to 3.76.

Why Shouldn’t You Rush to Invest?

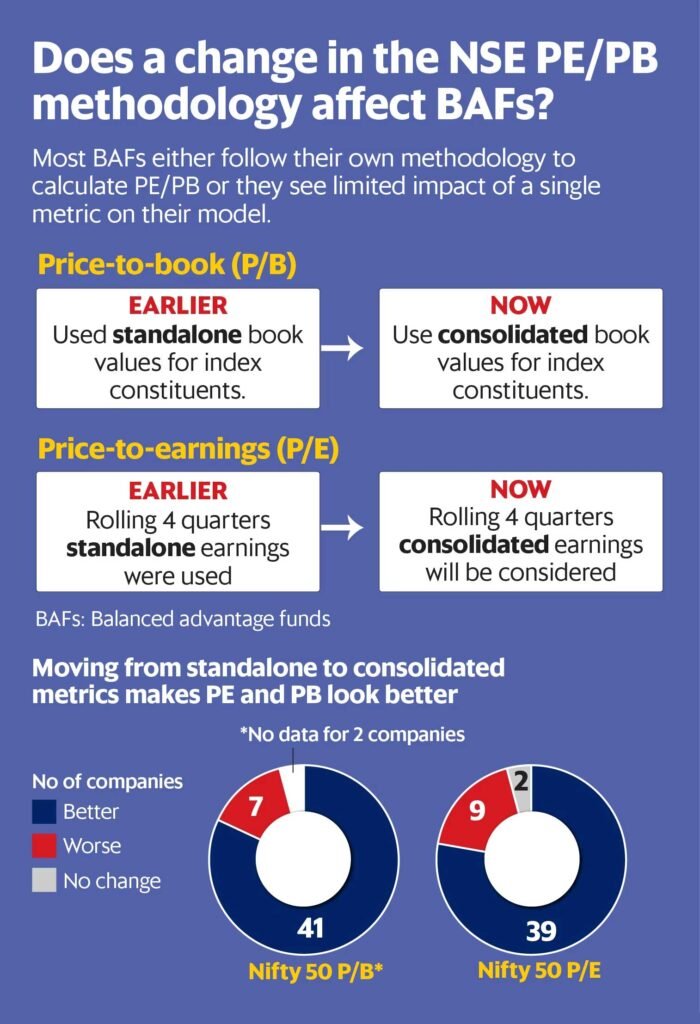

The decline in the P/B ratio isn’t due to a sudden surge in market attractiveness. The drop is attributed to a technical revision rather than a reflection of the market’s fundamentals, which have remained unchanged. The National Stock Exchange (NSE) switched their P/B ratio calculation, shifting from the stand-alone book value to a consolidated book value approach, which accounts for this change.

How Is the P/B Ratio Calculated?

The method to ascertain the P/B ratio involves dividing the share’s current price by its book value. Previously, firms provided only their stand-alone book values in financial reports, but regulatory shifts now mandate companies to submit consolidated earnings quarterly. In response, the NSE has recalibrated its P/B calculation to align with these new reporting requirements.

Did Similar Valuation Adjustments Happen Before?

Indeed, the price-to-earnings (P/E) ratio, another crucial market valuation measure, experienced a comparable modification in 2021. Consequently, the Nifty 50 P/E ratio appeared 18% lower when the change was enforced. Like the P/B ratio dip, a stronger consolidated earnings report from large corporations expanded the denominator, dragging down the ratio. Lower P/E ratios typically signal increased investment potential.

Can Historical Data Affects Current Valuation Metrics?

A sudden shift has hit our understanding of valuation metrics, as their relevance hinges on consistent comparisons with historical data. NSE’s decision not to revise past records might lead to skewed investment models, hint experts. Beyond this abrupt change, the recent obligation for consolidated financial statements further muddies the waters. With a history of companies publishing stand-alone reports, stitching together a comparable timeline becomes increasingly complex.

How Are BAFs Adapting to Valuation Changes?

So, what’s the strategy for balanced advantage funds (BAFs) amid these valuation shifts? These funds recalibrate their equity-debt mix based on market valuations. Metrics like P/B, P/E, and dividend yield serve as their compass in gauging market appeal. Yet, the question looms: how do they navigate when historic data diverges from the current framework?

Motilal Oswal’s Guide for Investment: What is MOVI?

Motilal Oswal Asset Management Company leverages a unique indigenous index—the Motilal Oswal Value Index (MOVI)—to dictate their equity and debt allocation decisions. This index harnesses three pivotal factors: Price to Book (P/B), Price to Earnings (P/E), and dividend yield, granting each an equal role in the decision-making process.

How Does MOVI Impact Equity and Debt Allocation?

Santosh Singh, the astute fund manager behind the Balanced Advantage Fund (BAF), discloses that they’ve recently adjusted their P/B and P/E ratio computations to stay in step with updates from the National Stock Exchange (NSE), seamlessly integrating these into their model. Despite these alterations, Singh assures that their model remains unfazed, prompting no significant shifts in their suggested asset mix.

Singh elucidates, “The range within which I must rebalance is broad. Even when we reassess every half-year, this minor shift didn’t warrant any recalibration.”

Can Fund Managers Adapt MOVI’s Advice?

The fund management team isn’t shackled to MOVI’s verdicts. Should the model indicate a notable shift, proposing a novel allocation plan, the fund managers are well within their right to apply their expert judgment, refining the model as needed.

How Do They Scrutinize Individual Firms?

When unraveling the financial fabric of each company, the decision to analyze stand-alone versus consolidated statements lies with the fund managers. Singh exemplifies with Bajaj Finserv, noting its superficial appearance in stand-alone statements as opposed to its significant holdings in Bajaj Finance—hence the preference for a consolidated review.

Is MOVI Signaling a Change in Equity Allocation?

Currently, MOVI exhibits an equity allocation inclination towards the 60-70% mark, with the index teetering at 99.8. Should it nudge over the 100 threshold, investors could anticipate an equity scaling down to a 50-60% bracket. “It’s on the brink—once it hits 100, a new 50-60% allocation could be triggered. Right now, our BAF is positioned at a 60.2% equity allocation,” Singh states, indicating the sensitivity and responsiveness of their investment strategy.

How Does DSP’s Asset Fund Navigate Market Momentum?

DSP Mutual Fund’s Dynamic Asset Allocation Fund masterfully adjusts its investments in debt and equities. This balancing act is crafted through fundamental analysis leveraging the P/B and P/E ratios and technical analysis that looks closely at market trends and momentum.

Are Market Trends or Fundamentals Key in DSP’s Strategy?

Anil Ghelani, the head of products at DSP Mutual Fund, provides insight into their approach. Even when the P/E ratios shifted in 2021, DSP’s investment strategy remained steady. The key lies in the dual nature of company earnings. Some, like Tata Steel, present profits on their own but reveal losses when their global operations are factored in. Sun Pharma displays the opposite pattern.

How Did NSE’s Changes Impact DSP Mutual Fund’s Allocations?

DSP’s analysis of the Nifty 50 P/E methodology shift revealed that while the majority of companies showed improved earnings, a handful did not, influencing the P/E positively for some and negatively for others. A few saw no change.

Does DSP Mirror NSE’s P/E and P/B Ratio Changes?

With NSE’s shift to consolidated P/E calculations, DSP aligned its approach similarly. However, DSP maintains a stand-alone stance on the P/B ratio for now. Ghelani downplays the impact of these adjustments, indicating that the move to consolidated P/E didn’t significantly disrupt their numbers. Conversely, deliberation continues on how to handle the P/B ratio ahead. “The P/E adjustment was minor, and we’ve remained with stand-alone figures for P/B,” Ghelani explains.

Has Tata Mutual Fund’s Strategy Altered Post-NSE Change?

Rahul Singh, the Chief Investment Officer at Tata Mutual Fund, emphasized that their research remains unaffected by the NSE’s recent modifications. Singh pointed out that Tata Mutual Fund relies on consolidated P/E ratios sourced from Bloomberg terminals for their evaluations. Is the Inclusion of Volatility and Momentum Vital in Their Analysis? Singh believes in an approach that integrates trailing and forward earnings (based on Bloomberg consensus) with technical indicators such as volatility and momentum, which guides them in balancing their equity-debt portfolio effectively. Unlike other investment approaches, Tata Mutual Fund does not account for the price-to-book (P/B) ratio in their analysis.

Do All Nifty 50 Companies Provide Comprehensive Reports?

Singh addressed concerns about irregular consolidated reporting among companies, noting that a majority of those within the Nifty 50 sphere have been releasing consolidated financial figures for a significant period. He substantiated that although it isn’t mandatory, most large organizations disclose these numbers as part of exemplary governance protocol.

How Does ICICI Prudential AMC Approach Market Valuation?

Is ICICI Prudential AMC’s Equity Valuation Index Influenced by NSE’s Methodology Shift?

ICICI Prudential’s response indicated steadfastness in their proprietary Equity Valuation Index. This model considers an assortment of elements such as P/E, P/B, and G-sec yields integrated into the P/E ratio, as well as the market capitalization relative to GDP, potentially amended with additional factors at the asset management company’s discretion. ICICI Prudential’s consistent use of consolidated data ensures that NSE’s recent changes have not skewed their research outcomes.

What Should Investors Glean from Recent Valuation Adjustments?

Despite apparent shifts in the attractiveness of P/B valuation metrics, investors are cautioned against abrupt reactions as these do not reflect any substantive change in the intrinsic worth of businesses. Should Fund Managers Harmonize Various Valuation Measures?

The predominant takeaway for investors and fund managers alike is the importance of employing diversified sources and methodologies in valuation metrics. This strategy ensures robust preparedness for any analogous changes in the future and underscores the divergent yet effective techniques utilized by eminent fund managers in addressing common challenges.