India’s IPO boom drives $50B FDI repatriation, collapsing net FDI to $1B and pressuring the rupee—yet signals a maturing capital market poised for FY27 revival.

Market Paradox: Success Becomes Currency Challenge

India’s capital markets face an unprecedented contradiction — the robustness and sophistication of its equity ecosystem have emerged as the dominant force weakening the national currency. While the rupee confronts persistent headwinds, the underlying cause isn’t waning investor confidence in India’s prospects. Instead, international capital providers are finally monetizing years of patient investment.

The phenomenon of net foreign direct investment sliding toward negligible levels represents the core driver behind currency depreciation, overshadowing concerns about delayed bilateral trade agreements with the United States.

The Exit Revolution Reshaping Capital Flows

India’s private equity and venture capital landscape endured years of criticism for its inability to provide liquidity events. That narrative has fundamentally shifted. The nation’s thriving initial public offering ecosystem has positioned India among the world’s elite markets where investors can execute substantial, transparent exits.

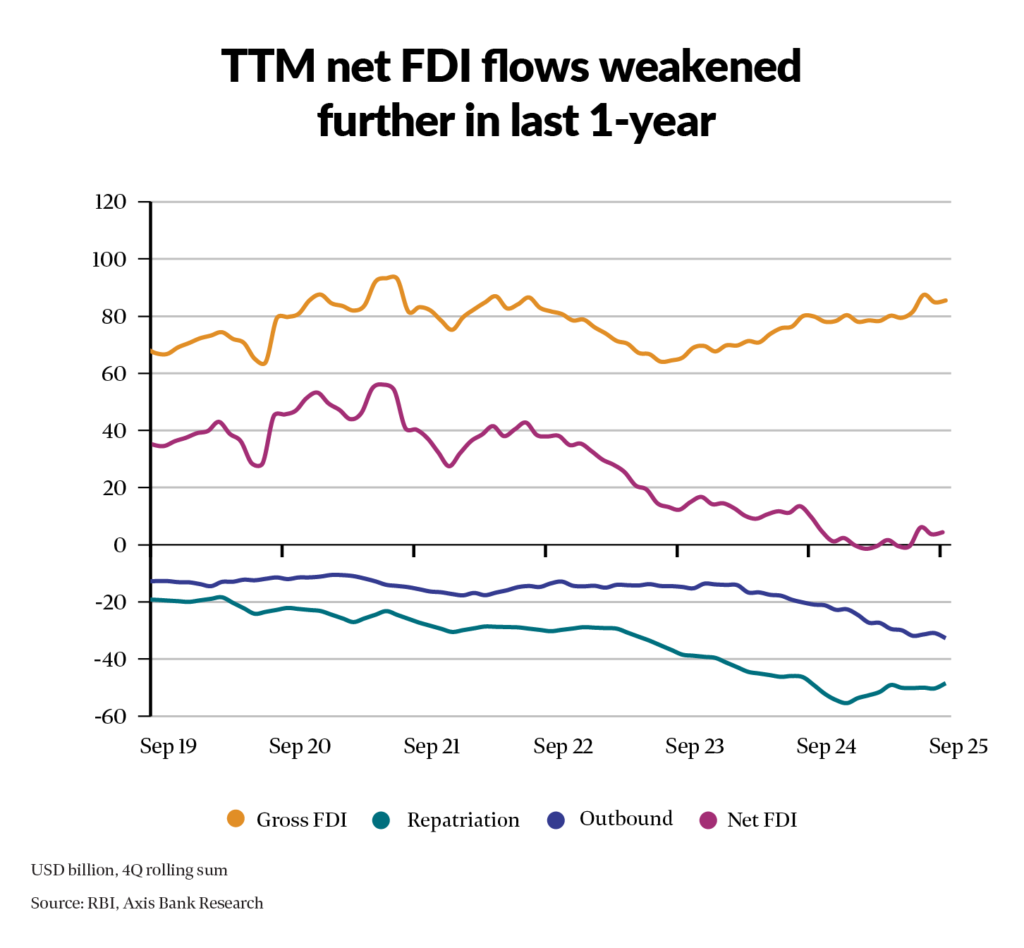

Yet this achievement carries consequences for the capital account balance. Throughout FY25, net FDI plummeted to merely USD1 billion — a dramatic contraction from the USD33 billion annual average recorded between FY20 and FY24, according to financial institution data. The pattern persisted through the initial six months of FY26 with continued weakness in net investment figures.

The primary catalyst? FDI repatriation surged explosively from its historical baseline of USD20 billion annually to an extraordinary USD50 billion during FY25.

“The Indian equity market’s vitality has unleashed a wave of public listings, enabling venture capitalists and private equity firms to realize returns,” explains a senior economist at a leading financial services firm. “India stands virtually alone as a major economy offering genuine exit pathways — contrast this with the US market where investors frequently resort to secondary transactions among themselves before reaching IPO stage.”

This dynamics is galvanizing fresh capital commitments. Industry observers note that virtually every major private equity player is currently raising dedicated India-focused funds with aggressive deployment targets. The withdrawal of certain multinational corporations paradoxically signals opportunity to incoming investors.

Outbound foreign direct investment by domestic Indian enterprises represents an additional contributing factor to the net FDI equation.

The forward-looking perspective? This exit-driven cycle may ultimately drive gross FDI figures substantially higher in coming years. The demonstrated ability to monetize investments provides crucial downside protection for international investors contemplating significant India exposure.

Capital Account Transformation

Between April and October 2025, net FDI flows registered at USD6.2 billion. September and October witnessed negative net FDI as outward investment and profit repatriation accelerated, per central bank statistics. Singapore, Mauritius, the United Arab Emirates, and the United States emerged as primary destinations for outbound capital.

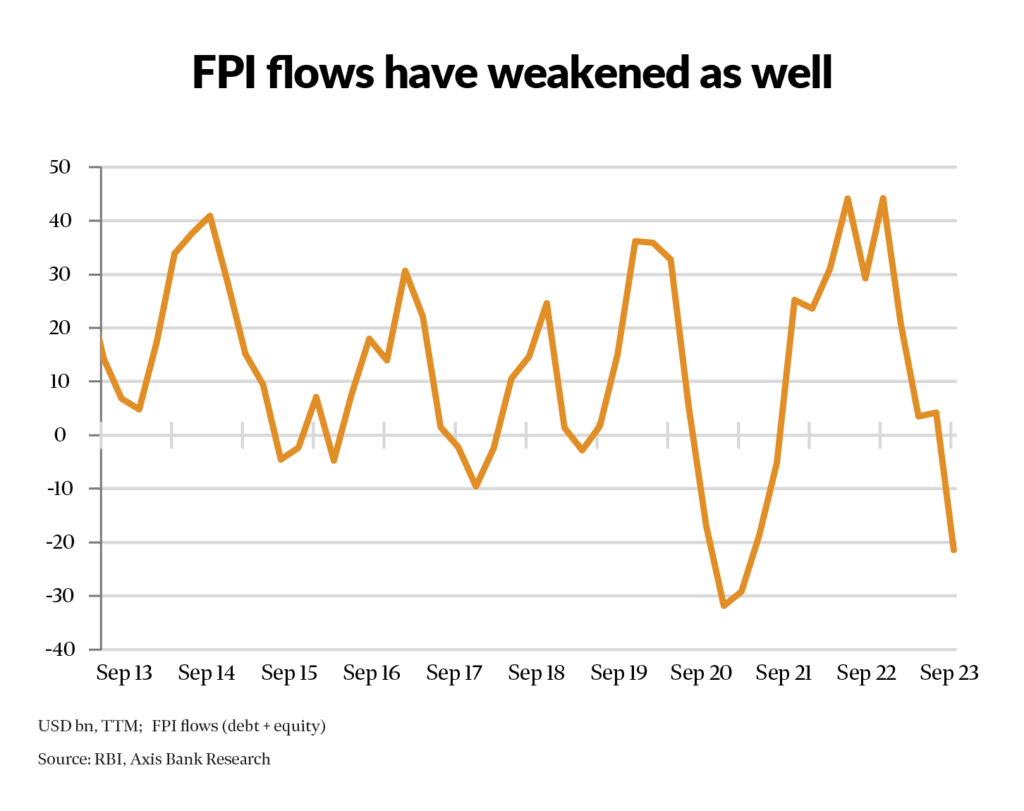

Traditionally, consistent net FDI inflows funded India’s current account deficit (CAD), establishing currency stability. Today, the rupee’s fortunes depend increasingly on foreign portfolio investors (FPIs). Beyond IPO-related exits, FPIs have divested Indian equities worth INR1,71,514 crore through 2025, intensifying downward pressure on the currency.

The rupee declined over 5.8% versus the dollar across the past twelve months, while the real effective exchange rate (REER) weakness reached 12.1% — reflecting more severe underlying depreciation.

Twelve-Month Net FDI Inflows Show Continued Deterioration

Data Visualization: Foreign Portfolio Investment Streams Display Weakness

Dual Forces Driving Capital Rotation

Over the past fifteen months, two significant developments triggered capital reallocation away from Indian markets:

1. Corporate Earnings Deceleration

Following robust growth, moderating earnings momentum caused India’s allocation within emerging market portfolios to contract from 19.5% to 16%. This compression forced mechanical selling by index-tracking funds. Financial analysts project that stabilizing earnings trajectories (measured in USD terms) position India for outperformance against global benchmarks throughout 2026.

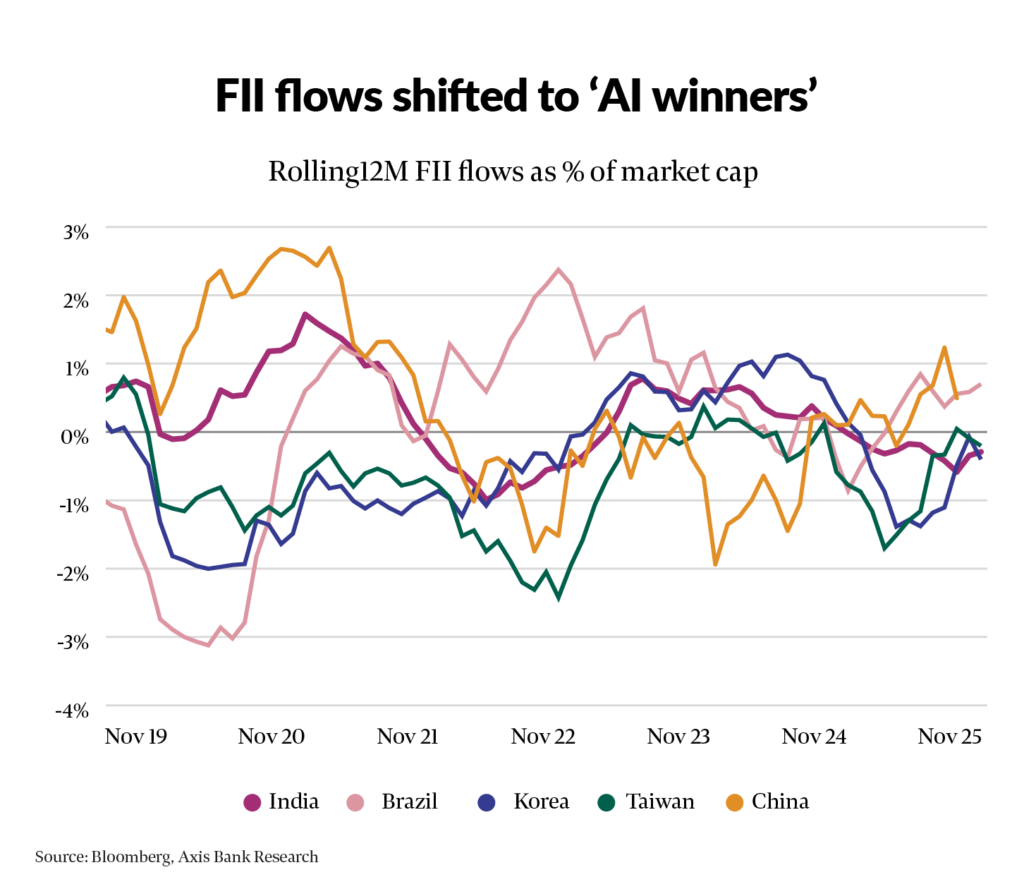

2. Artificial Intelligence Capital Migration

Investment capital has gravitated toward perceived “AI beneficiaries” — China, Taiwan, South Korea, and the United States. Indian information technology companies, representing 11% of the Nifty index, face classification as potential “AI casualties” — a characterization numerous market professionals consider premature and misguided.

Investment Flow Patterns: Foreign Institutional Capital Migrates Toward AI-Dominant Markets

Optimistic Outlook Amid Volatility

Despite current market turbulence, numerous financial experts maintain constructive views. A chief economist at a major public sector bank characterizes foreign investor fund repatriation as pressure on the currency but emphasizes this “should not be interpreted as a trend, rather as normal business conduct.

Expecting investors to perpetually reinvest 100% of their realized gains proves unrealistic. The capacity to exit positions defines market health and maturity. “Outbound FDI primarily reflects Indian enterprises achieving global scale, which represents a positive development… this forms part of the broader globalization trajectory,” the economist notes.

Currency exchange rate pressures stemming from outflows should remain contained going forward due to India’s solid macroeconomic fundamentals. Recent months have witnessed substantial foreign investment activity across India’s financial services sector.

International investors are deploying a combined USD12 billion to acquire meaningful positions in non-banking financial companies and banking institutions, including Shriram Finance, Manappuram Finance, RBL Bank, Federal Bank, Yes Bank, IDFC First Bank, and several others.

“The Real Effective Exchange Rate for the Indian rupee has depreciated substantially due to foreign portfolio outflows triggered by global financial market uncertainty and less attractive price-earnings multiples for India,” stated a member of the Reserve Bank of India’s Monetary Policy Committee at a recent policy meeting.

“However, the economy’s foundational elements – balance of payments, foreign exchange reserves, fiscal deficit metrics, debt-to-GDP ratio, corporate and banking sector balance sheets, inflation dynamics, and growth momentum – all remain strong. Therefore, I anticipate exchange rate pressures and portfolio flows to be self-correcting,” the MPC member emphasized, according to official minutes released on December 19.

The Maturation Thesis

India’s current capital account churn, while creating near-term currency volatility, may signal the transition toward a more mature investment cycle. The country’s ability to provide liquidity through a vibrant public market infrastructure addresses a critical gap that historically limited private capital deployment.

As successful exits demonstrate proof of concept, the investment community’s confidence in allocating larger capital pools to India strengthens. This creates a virtuous cycle where today’s repatriations fund tomorrow’s commitments — at potentially larger scale and more attractive valuations for the Indian economy.

The temporary stress on net FDI figures obscures the longer-term structural advantage: India has established itself as a market where patient capital can achieve profitable exits. This fundamental attribute will likely attract more substantial gross FDI inflows as the global investment community increasingly recognizes India’s unique position in the emerging market landscape.