Navigating India’s Market Cap Explosion: Why Cash Generation Trumps Size

India’s equity landscape has undergone a seismic transformation. Between fleeting market rallies and genuine wealth creation lies a critical distinction that separates enduring winners from temporary champions. This comprehensive analysis explores why investor focus must shift from market capitalization milestones to cash generation capabilities—a transition essential for portfolio survival in today’s frothy markets.

Market dynamics have shifted dramatically over the past eight years. Recent analysis by investment professionals reveals a transformation so profound it reshapes how investors must evaluate opportunities.

Consider this: Back in 2017, India’s largest small-cap enterprise barely touched ₹8,500 crore in market valuation. That company sat precariously at the boundary between small and mid-cap categories, much like a professional awaiting career advancement.

Jump to 2025, and these figures appear quaint by comparison. The company ranked 251st by market capitalization now stands at approximately ₹32,274 crore—representing nearly 3.5x growth from the previous benchmark. Even the smallest mid-cap player at position 250 commands around ₹32,482 crore in market value. These shifts demonstrate fundamental changes across India’s corporate valuation landscape.

Yet the most striking revelation emerges elsewhere. Eight years ago, merely 112 Indian companies exceeded ₹5,000 crore in market value. Today? Nearly 693 enterprises surpass this threshold—a sixfold multiplication. The 500th-ranked company alone carries a valuation of approximately ₹10,900 crore, placing even the market’s “tail end” comfortably above the $1 billion mark.

This re-rating extends far beyond elite corporate names. It represents a comprehensive, market-wide elevation.

These statistics inspire optimism for many observers. They symbolize entrepreneurial vigor, operating efficiency gains, economic formalization, renewed investment momentum for Indian corporations, and maturing capital markets that appropriately reward performance. All these interpretations hold validity.

However, beneath this celebratory narrative lurks a sobering question investors can no longer sidestep: As companies increasingly breach higher valuation thresholds, how do we identify businesses built for longevity versus those destined for mediocrity?

When size alone ceases being an adequate screening criterion, investors must pivot toward quality—not the superficial kind constructed through compelling narratives, but measurable quality demonstrated through cash generation, capital allocation discipline, corporate governance excellence, and return metrics that endure across economic cycles.

This represents the fundamental challenge within the ₹5,000-crore ecosystem. Entry has become easier; staying power remains rare.

Decoding Corporate Cash: Beyond the Balance Sheet Illusion

For generations, substantial cash reserves have projected an appealing image. They suggest financial stability. They imply strategic flexibility. They indicate organizational strength sufficient to secure financing on demand.

Corporate finance reality, however, proves far more nuanced.

At its core, corporate cash—comprising actual cash plus liquid short-term investments—typically generates returns significantly below a company’s weighted average cost of capital. Idle cash becomes an anchor. It suppresses Return on Invested Capital (ROIC), diminishes valuation attractiveness, and frequently encourages management teams toward value-destructive activities. Shareholders benefit most when every rupee works productively, not when capital languishes in low-yield instruments.

Conversely, inadequate cash reserves create equal danger. Without financial cushions, companies become exposed to economic downturns, working capital disruptions, regulatory surprises, unexpected strategic opportunities, or sudden credit market freezes. Cash provides optionality—the capacity for decisive action when competitors remain paralyzed. For corporations, cash functions like emergency funds for households: not profit centers, but essential stabilizers.

Corporate cash therefore represents a capital allocation decision requiring surgical precision. Excess destroys value. Deficiency threatens survival. The distinction between being genuinely cash-rich versus cash-bloated typically depends on the intentions and discipline of controlling management.

Within the expanding ₹5,000-crore universe, this distinction increasingly separates companies capable of multi-cycle growth from those collapsing under their accumulated weight.

Anatomy of a True Cash-Generating Compounder

A legitimate cash-rich compounder extends far beyond businesses maintaining high cash balances. It describes companies that:

- Generate sustainable free cash flow consistently

- Earn returns substantially exceeding their cost of capital

- Deploy capital with unwavering discipline

- Convert accounting profits into tangible cash

- Avoid governance pitfalls that obliterate long-term value

Building such an enterprise requires years. Destroying this status takes mere quarters.

Free Cash Flow (FCF) stands as the most transparent indicator of genuine financial health because it reflects what defies manipulation: actual cash movement. While net profit fluctuates based on accounting methodology choices, FCF eliminates illusions. It exposes how much cash remains after satisfying salaries, suppliers, taxes, and capital expenditure obligations.

Companies generating substantial and growing FCF achieve self-sufficiency. Their expansion gets financed through internal engine power, not external borrowing. During economic contractions or elevated interest rate environments, FCF becomes especially critical. Enterprises demonstrating 30%+ FCF yields often represent early-stage compounders that institutional investors identify well before share prices reflect inherent potential. These companies avoid unnecessary debt. They resist shareholder dilution. They reward patient capital.

ROCE and ROIC trajectories further reveal authentic business quality. A company’s fundamental obligation appears deceptively straightforward: generate higher returns on invested capital than the cost of raising that capital. Firms consistently delivering ROIC above 12-15% across Indian economic cycles—not isolated periods—demonstrate genuine value creation capability. Conversely, declining businesses frequently generate negative ROIC, destroying value annually they continue operating.

Corporate lifecycle stages prove critical here. Growth and maturity phases typically exhibit aggregate ROIC around 10-11%. Decline phases often plummet into double-digit negatives. Rising ROIC trends therefore transcend mere metrics—they narrate businesses moving directionally correct.

Governance then becomes the ultimate multiplier. Cash amplifies governance quality: under disciplined promoters, cash transforms into shareholder value weaponry. Under ego-driven leadership, it fuels empire-building exercises. Research demonstrates public companies, due to agency conflicts, maintain nearly double the cash of comparable private enterprises. Markets also assign premium valuations to cash held by well-governed versus opaquely-managed companies.

Poor governance manifests through value-destroying acquisitions, questionable related-party transactions, buybacks at unreasonable valuations, and fundamental misalignment between promoter objectives and shareholder outcomes.

Hidden Dangers Within the Market Cap Boom

Rising market capitalizations create investor numbness, fostering beliefs that price appreciation equals business progress. Recent years have repeatedly shattered this illusion. As more companies breach higher thresholds, dangers multiply exponentially.

Weak cash conversion represents one such landmine. Companies with extended cash conversion cycles trap excessive capital in receivables and inventory. They expand revenue but annihilate operational liquidity. Over time, such enterprises become dependent on external financing despite apparently healthy headline profits.

Valuation-driven rallies present another hazard. When share prices race ahead of fundamental performance, companies sometimes resort to buybacks for “confidence signaling” or EPS engineering. Research confirms buybacks motivated by EPS considerations rarely generate long-term shareholder value and typically transfer wealth from continuing shareholders to those exiting at inflated prices.

Promoter-related red flags constitute the most potent compounding destroyers: elevated pledging levels, related-party lending, opaque cash reporting, mysterious acquisitions, or sudden margin expansions lacking credible explanation—all serve as early warning systems. Historical evidence shows cash-rich, poorly-governed enterprises create some of mid and small-cap segments’ biggest value traps.

The ₹5,000-crore club expands, but so does the minefield. Investors conflating momentum with merit face highest probability of collateral damage when market sentiment reverses.

From Concept to Evidence: Rigorous Quantitative Screening

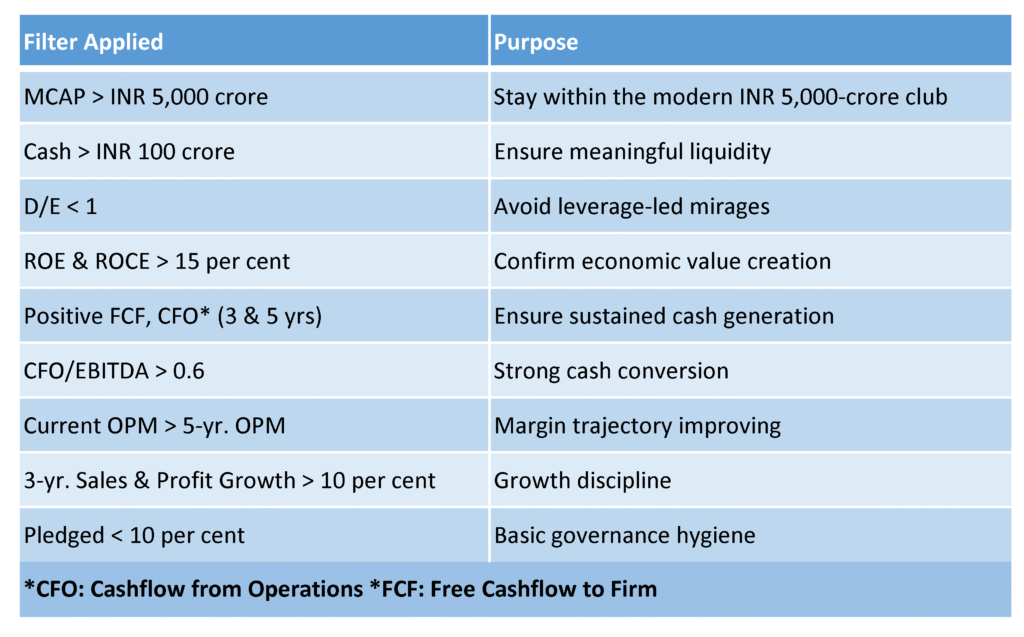

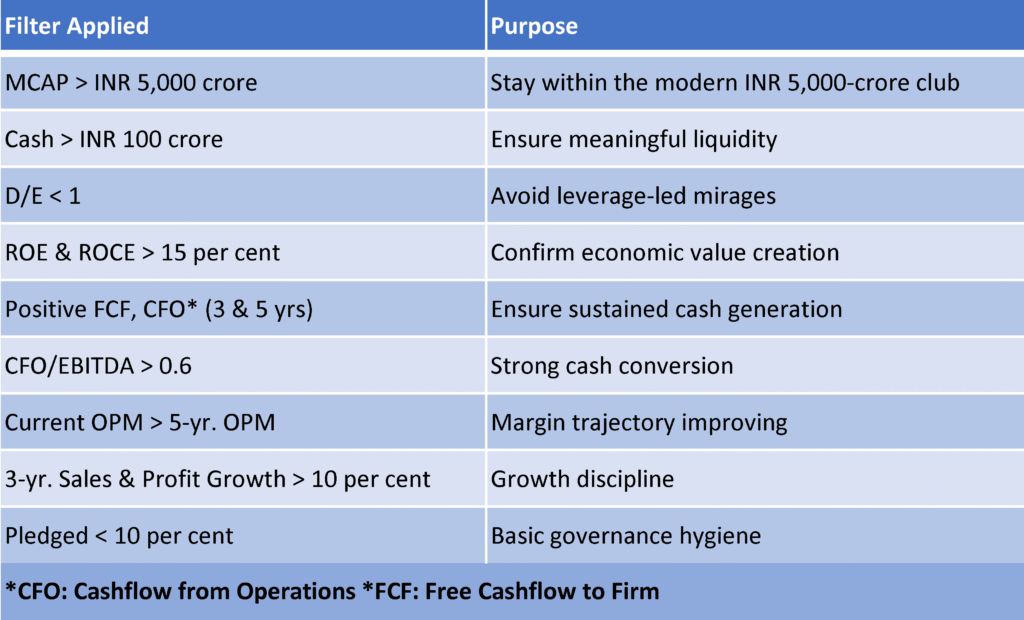

To validate the cash-rich compounder framework’s legitimacy, we executed two comprehensive quantitative screens utilizing multi-year cash flow, profitability, leverage, and growth parameters.

These screens transform conceptual principles into actionable investment universes.

Screen One: Established Cash Compounders

This filter identified companies already demonstrating sustained cash compounding patterns.

Selection Criteria:

Resulting Universe: Reliable compounders spanning pharmaceuticals (Sun Pharma, Torrent Pharma, JB Chemicals), engineering (Cummins India, Elecon Engineering), electrical equipment (CG Power, GE Vernova, Schneider Electric), consumer companies (Metro Brands, Blue Star), IT services (Hexaware), hospitality (Indian Hotels), healthcare (Narayana Health, Global Health, Kovai Medical), and industrials (Solar Industries, Gallantt Ispat, Welspun Corp.).

What unifies these companies transcends sector, size, or valuation—it’s cash creation consistency. These enterprises mastered growth without compromising balance sheet integrity. They achieved this across extended periods rather than fortunate single-year spurts.

Strategic Insights from Screen One

The presence of multiple capital-intensive sectors (industrial products, auto components, engineering) within this list highlights cash discipline’s power even within asset-heavy business models. Solar Industries, Cummins India, and Elecon Engineering demonstrate that operational excellence combined with disciplined working capital management can transform heavy machinery businesses into cash engines.

Pharmaceutical and healthcare names appear frequently—JB Chemicals, Narayana Health, Global Health, Sun Pharma, Kovai Medical—reconfirming their structural advantages in pricing power and cash returns.

Screen Two: Emerging Compounders (20%+ FCF Yield)

The second screen reveals emerging enterprises with 20%+ free cash flow yields—clear signals that markets haven’t fully recognized their cash-generating potential.

These companies exhibit striking patterns defining authentic compounders:

- Ascending Operating Cash Flow: Five-year trajectories showing steady operational cash generation growth

- Double-Digit Expansion: Consistent double-digit profit and revenue growth

- Conservative Leverage: Debt-to-equity ratios frequently below 0.5, maintaining financial prudence

- Minimal Promoter Pledging: Negligible pledged stakes ensuring shareholder alignment

- Capital Discipline: Reduced investment in low-return capex; increased focus on high-return innovation

- Downturn Resilience: Navigate economic contractions without requiring distress capital

- Cash-Aligned Market Cap Growth: Market capitalizations expanding proportionally with cash flow, not speculation

Conversely, companies recently crossing ₹5,000 crore driven by sentiment or liquidity display weak cash flow, rising working capital requirements, pledged promoter stakes, and value-destroying acquisitions. The market cap boom creates strength illusions. Cash flow exposes authentic reality.

High FCF-Yield Candidates Identified

Companies ranging from consumer brands like Varun Beverages to power sector players like KP Energy share strong cash generation capabilities relative to current valuations. Despite underlying potential, markets haven’t fully rewarded these stocks yet.

This second screen functions as a development system for next-generation mid-cap compounders. Not all will succeed, but companies combining high ROCE, low leverage, and robust FCF yields often experience multi-year re-rating cycles once markets acknowledge their strength.

Building an Investment Framework, Not Just a Stock List

This analysis doesn’t constitute investment recommendations—it provides an investment framework. Evidence demonstrates portfolios benefit when tilted toward:

✓ Proven cash-rich compounders (identified through quantitative screen one)

✓ Emerging high-FCF-yield companies (from quantitative screen two)

Focusing exclusively on market cap expansion without evaluating cash flow exposes investors to value-destructive traps. However, following this systematic checklist enables portfolio construction that thrives through cycles, volatility, and liquidity disruptions.

India’s market cap universe will continue expanding, but those mastering free cash flow, capital discipline, and robust governance will emerge as genuine survivors.

Why Cash-Centric Analysis Matters More Today Than Ever

India’s equity market in 2025 bears little resemblance to 2015 or even 2017. Value creation velocity has reached exponential levels. Wealth distribution beyond large-caps has achieved unprecedented breadth. Market capitalization thresholds once considered aspirational now represent routine milestones for competently-managed mid-sized firms.

However, market cap expansion breeds narrative expansion. More companies pitch growth stories. More sectors command valuation premiums. More analysts justify lofty multiples by stretching future projections. Within such euphoric landscapes, cash becomes the sole stabilizing force—the anchor preventing upward drift into fantasy.

The ₹5,000-crore club expands rapidly, but not every entrant deserves permanent membership. Some companies will revert toward mean when liquidity tightens. Others face exposure when growth normalizes. Still others succumb to governance failures or management overconfidence. True survivors will be those whose financial metrics support their narratives—not the reverse.

In environments characterized by elevated valuations, frequent volatility, and shortening cycles, optimal defense transcends diversification alone. It demands disciplined stock selection rooted in cash behavior, not price action.

The Essential Call to Strategic Action

This analysis doesn’t celebrate India’s market cap boom, though the expansion proves real and merits acknowledgment. It presents a cautionary framework urging investors to fundamentally rethink company evaluation in environments where size no longer guarantees safety.

The core message remains straightforward yet critical:

Stop fixating on which company reaches ₹10,000-crore or ₹50,000-crore next.

Start asking which companies can:

- Self-fund growth sustainably

- Protect ROIC across cycles

- Convert accounting profits into actual cash

- Deploy capital without ego or recklessness

This approach creates long-term wealth.

This methodology ensures portfolio survival during downturns.

This framework helps investors avoid capital-destroying traps.

The ₹5,000-crore club will continue expanding. But only a fraction of members will become enduring wealth creators. Armed with disciplined, cash-centric frameworks—supported by the quantitative screens shared here—investors possess reliable compasses for navigating this transformed market.

Survival in the age of abundant market caps will belong not to the biggest, but to the most financially self-reliant.