Foreign investors are returning to Indian equities with a refined strategy focused on earnings quality over momentum. Discover how global capital is targeting India’s domestic growth engines—financials, infrastructure, and consumption—in this analytical deep dive into the FII rebalancing phenomenon of 2025.

Indian equity markets entered 2025 navigating treacherous waters. A massive withdrawal of foreign institutional capital that commenced in autumn 2024 created severe market disruptions, testing investor nerves across the board. However, domestic institutional firepower emerged as an unexpected hero. Armed with unprecedented capital reserves, local investors stepped into the breach, neutralizing aggressive foreign liquidation and demonstrating remarkable market maturity. Today, as volatility subsides, foreign investors are quietly returning—but their approach reflects calculated precision rather than speculative enthusiasm, targeting the fundamental drivers of India’s economic transformation.

The Capital Flight Phenomenon

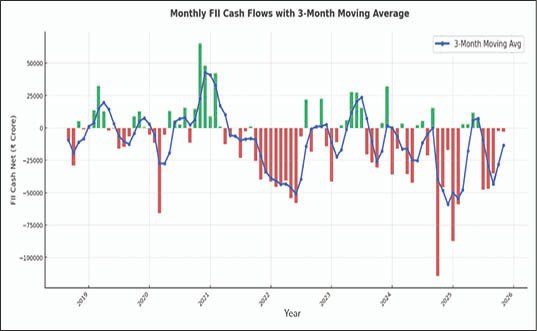

Foreign selling pressure that emerged in late September 2024 escalated into a full-blown exodus by early 2025. Beginning October 2024, international investors dumped over ₹4.34 lakh crore worth of Indian stocks, with January 2025 witnessing catastrophic outflows exceeding ₹87,000 crore. Mid-February 2025 figures revealed calendar year withdrawals surpassing ₹1.1 lakh crore. Cumulatively, from September 2024’s market zenith, approximately USD 51 billion fled Indian shores—representing one of history’s most intense capital evacuation episodes. What triggered this unprecedented foreign disinvestment?

Foreign investment patterns emerge from intricate combinations of macroeconomic conditions, geopolitical developments, and market-specific variables. These investors continuously monitor India’s profit trajectories and pricing metrics while responding dynamically to global liquidity conditions and comparative attractiveness versus competing emerging economies.

Let’s examine how international dynamics and local market conditions shape foreign investment decisions.

International Forces Driving Capital Movements

Worldwide conditions establish the foundation for foreign risk tolerance toward developing economies like India.

▪️American Monetary Policy and Currency Strength: As the world’s largest economy with its currency serving as global reserve standard, America exerts disproportionate influence on worldwide markets including India. Elevated U.S. interest rates combined with dollar appreciation historically trigger caution among international investors regarding emerging markets, driving substantial capital repatriation. Higher bond returns eliminate incentives for deploying funds in riskier territories. Additionally, strengthening dollars reduce emerging market investment appeal as local currency depreciation diminishes overall returns.

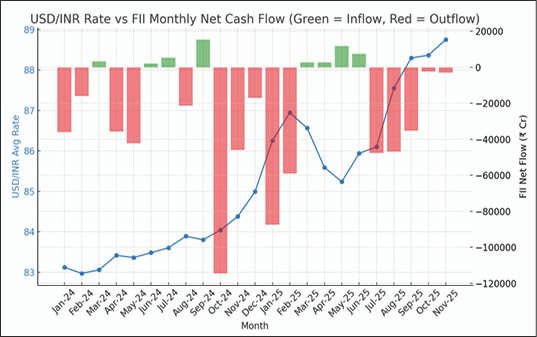

The visualization above demonstrates the relationship between foreign capital flows and rupee-dollar exchange rates from January 2024 onwards. Notice the clear inverse correlation between international investment and currency performance. Heavy foreign withdrawal periods, particularly October 2024 through February 2025, align precisely with sustained rupee weakening, evidenced by climbing USD/INR levels. The Indian currency during these months slid from ₹84 per dollar toward ₹87 per dollar. This pattern suggests foreign fund withdrawals from Indian stocks generate dollar demand that pressures the rupee downward—or conversely, rupee weakness triggers foreign equity liquidation. Meanwhile, March through June 2025 showed rupee stabilization or modest appreciation coinciding with foreign capital return, indicating exchange rate steadiness amid renewed international participation.

This analysis reveals clear foreign investor sensitivity to rupee-dollar dynamics. However, the correlation isn’t perfectly linear; broader macro factors significantly influence foreign behavior alongside currency movements.

▪️Volatility and Global Instability: Markets fundamentally resist uncertainty. Worldwide instability stemming from geopolitical conflicts (such as Russia-Ukraine tensions) and major power rivalries maintain foreign investor risk aversion.

▪️Trade Framework Developments: Macroeconomic and tariff uncertainties (including U.S.-China trade friction or speculation about Indian tariff adjustments) impact corporate planning, especially export-oriented sectors. Clarification on international trade frameworks and geopolitical stability represents critical catalysts for foreign investment revival.

▪️Emerging Market Positioning and Comparative Pricing: Foreign selling frequently reflects capital redeployment toward markets perceived as more stable or attractively priced. Recently, international investors redirected substantial resources toward China as Indian equities commanded relatively elevated valuations compared to historical norms and Chinese market pricing.

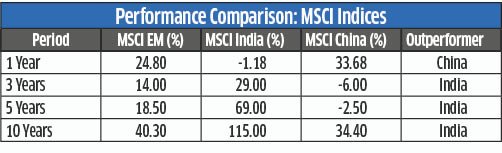

Indian equity markets traditionally attracted global investors through reasonable valuations relative to emerging market peers and superior Indian corporate performance, generating consistent foreign inflows. This strategy consistently delivered as India outperformed competing markets.

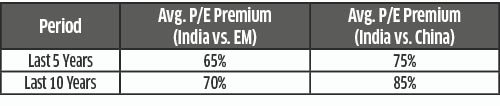

Following a decade commanding among the world’s steepest valuation premiums, India’s relative pricing advantage is experiencing subtle recalibration. The valuation differential between India and broader emerging markets has narrowed meaningfully over the past year, primarily following relative underperformance. This compression makes Indian stocks appear more reasonable, rekindling interest among global fund managers previously underweight due to stretched multiples.

Historically, Indian markets traded at premiums versus emerging and Chinese markets—reflecting superior corporate governance, earnings resilience, and long-term return profiles. However, after sharp rallies through 2023 and early 2024, Indian equities entered consolidation while several emerging market peers, particularly China, rebounded from depressed levels. This relative underperformance compressed India’s valuation premium from record peaks, approaching historical averages.

While MSCI India’s valuation multiple remains elevated, the premium has moderated to approximately 55 percent versus the emerging market basket—down from nearly 75 percent twelve months prior. This normalization follows subdued market performance: over the past year, MSCI India delivered modest -1.2 percent returns compared to emerging markets’ 24.8 percent and China’s 33.7 percent. Yet across longer timeframes, India remains the undisputed champion, with 10-year cumulative returns of 115 percent versus 40.3 percent for emerging markets and 34.4 percent for China.

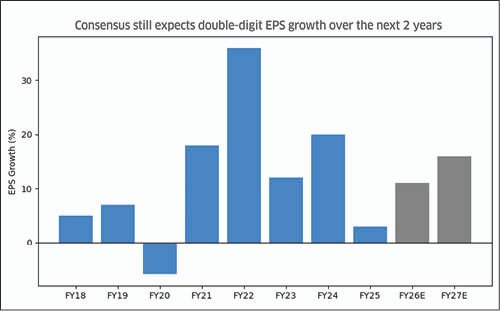

Despite near-term valuation adjustments, India’s structural growth narrative remains robust. GDP expansion averaging above 6 percent continues outpacing emerging market averages (4 percent) and China (4.5 percent). Corporate profits compounded at roughly 16 percent CAGR during FY22–25, with consensus forecasting 11 percent for FY26 and 16 percent for FY27. An expanding domestic investor ecosystem—through mutual funds, systematic investment plans, and pension participation—further cushions volatility from foreign withdrawals.

This period represents healthy consolidation rather than correction. India remains a ‘core holding’ for emerging market portfolios—supported by earnings clarity, policy consistency, and maturing retail investor participation. While near-term risks persist from global rate cycles or geopolitical tensions, the medium-term case for India as structural outperformer remains intact.

Local Market Factors Influencing Foreign Participation

Foreign flows closely track fundamental health and pricing within Indian markets.

▪️Elevated Valuations Trigger Exits: International investors typically reduce exposure when domestic valuations appear excessive or ‘richly priced’. During late 2024 and early 2025, foreign investors engaged in broad, indiscriminate liquidation, prioritizing profit-taking over fresh deployment. We analyzed this dynamic comprehensively above.

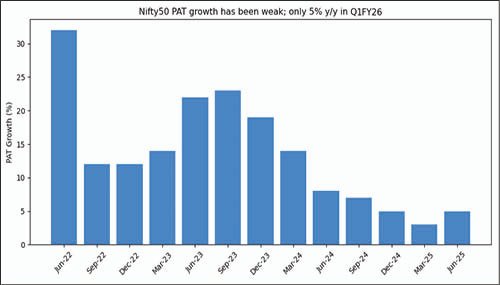

▪️Profit Growth Deceleration: Muted earnings expansion and softer corporate results (exemplified by weaker Q2, Q3, and Q4 FY25 performance) discourage foreign buying, maintaining sideline positioning. Nifty 50 profit after tax growth, previously exceeding 30 percent in mid-2022, steadily decelerated to approximately 5 percent year-on-year by June 2025. This corporate profitability moderation—driven by margin pressures, uneven consumption recovery, and global demand softness—prompted foreign investor caution. Even Q1FY26 earnings season failed meeting elevated expectations, triggering profit-booking across key sectors.

However, reversal appears imminent. Consensus projections suggest the earnings cycle remains far from exhausted. Following a brief FY25 pause, analysts anticipate double-digit earnings growth resumption, forecasting 11 percent and 16 percent EPS expansion in FY26E and FY27E respectively. This optimism stems from stable macro fundamentals, easing input costs, and improving operating leverage across manufacturing, banking, and consumption sectors. As corporate earnings regain momentum, foreign investors likely reverse selling patterns and re-enter Indian equities, attracted by structural growth narratives and long-term profitability prospects. Simply put, recent foreign inflow pauses resemble tactical retreats rather than structural exits.

▪️Targeted Earnings Revisions Signal Sectoral Strength: Recent earnings forecast adjustments among large-cap companies reveal selective upgrade patterns rather than broad-based improvement. Market leaders including Reliance Industries, Larsen & Toubro, Bharti Airtel, and Maruti Suzuki witnessed upward EPS revisions, supported by strong operational performance, healthy order momentum, and margin expansion. Reliance continues benefiting from robust retail and Jio segment growth, while L&T’s expanding order book and execution strength prompted analyst estimate increases. Similarly, Bharti Airtel’s steady average revenue per user growth and Maruti’s improved product mix reflect sectoral resilience despite broader market caution.

Profit Recovery Trajectory

Visible corporate earnings recovery establishes foundations for the next market growth phase. Foreign institutional investors likely increase inflows once earnings recovery gains broader momentum, expected from Q3FY26 onwards. However, they remain selective, awaiting clear sustained and widespread earnings growth signals before aggressive positioning.

Domestic factors attracting foreign buying include policy continuity, robust capital expenditure, and supportive monetary conditions. India’s solid economic fundamentals, including strong domestic demand, digital transformation, and infrastructure emphasis, represent long-term drivers supporting foreign interest.

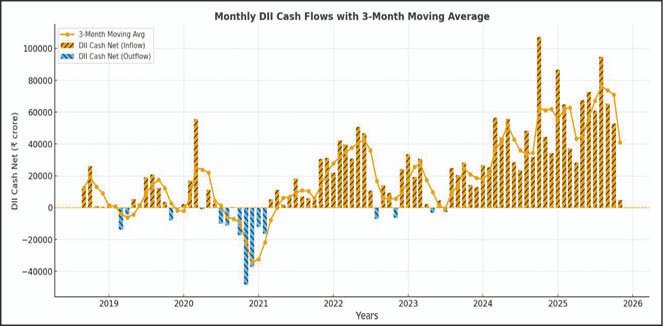

The Domestic Capital Fortress

Throughout this intense battle, domestic investors held firm. Local institutions, comprising mutual funds, pension funds, and insurers, intervened with historic force, deploying a record USD 73 billion during calendar year 2025’s first ten months. Their conviction manifested in January when they purchased approximately ₹86,000 crore worth of equities, nearly offsetting the ₹87,000 crore foreign liquidation. This domestic resilience culminated in a landmark transition—as of March 31, 2025, local institutional shareholding in NSE-listed companies (17.62 percent) surpassed foreign holdings (17.22 percent) for the first time historically, marking emergence of a ‘domestic capital fortress’ that has since redefined market dynamics.

For six consecutive quarters, domestic institutions maintained their lead over foreign investors, with ownership reaching 18.4 percent by September 2025, up from 18 percent previously. Meanwhile, foreign institutional shareholding declined to 15.6 percent in Q2 FY26, down sharply from its Q3 FY21 peak of 20.1 percent, with absolute holding values falling from ₹77.6 trillion yearly to ₹70.3 trillion. Bolstered by decisive policy support (GST and income tax reforms), potential RBI monetary easing, and benign liquidity, India’s macroeconomic landscape now favors equities. Corporate earnings appear bottoming, valuations have become more reasonable, and domestic asset allocation strategies increasingly reflect ‘overweight’ equity stances. The message is unmistakable: Indian investors are no longer passive observers in their own market—they now control it.

Stronger domestic institutional participation acts as stabilizing ballast for India’s capital markets, ultimately benefiting foreign investors too. When mutual funds, insurers, and pension funds provide consistent inflows, they cushion markets against abrupt sell-offs, reducing volatility and enhancing liquidity. This steady domestic demand improves price discovery and gives foreign investors greater confidence in market depth and resilience. Essentially, a robust domestic investor base makes Indian equities less dependent on global sentiment while creating healthier, more predictable environments that encourage long-term foreign participation.

The Inflection Point

Just when foreign investor exodus narratives seemed permanently established, momentum shifted. In March 2025, after five consecutive months of relentless selling totaling ₹3.23 lakh crore, foreign investors reversed course, becoming net buyers with ₹2,783 crore inflows. The buying trend extended three additional months, with cumulative investments approaching ₹25,000 crore. However, the subsequent quarter saw foreign investors reverting to selling, though each month’s outflow diminished progressively. By October, trends nearly reversed; except for the final two trading sessions tipping the month into modest net outflow of ₹2,300 crore, marking an end to their three-month selling streak and signaling renewed Indian equity interest.

A Strategic Wager on India’s Economic Core

From Narrative to Infrastructure

Foreign investors no longer purchase India as generic ‘growth story’. They now invest strategically—surgically, analytically, and with data-driven precision. Latest foreign portfolio investor data from June through October 15, 2025 reveals decisive rotation: international investors are wagering on India’s domestic economy core—financials, automobiles, infrastructure, telecom, and consumer services—while trimming exposure to export-driven and defensive plays like information technology, healthcare, and fast-moving consumer goods. This marks structural evolution in foreign investor behavior. Global giants no longer scatter capital across Indian markets; they make targeted allocations into real economic activity engines—credit creation, consumption, and capital expenditure.

Financial Services

The most dramatic foreign investor sentiment reversal occurred toward financial services. After relentlessly selling financials between October 2024 and February 2025, resulting in cumulative ₹31,940 crore outflows, foreign investors staged stunning comebacks. Just in April 2025’s final two weeks alone, they pumped ₹22,910 crore back into financial stocks.

This wasn’t mere bargain-hunting; it represented high-conviction endorsement of India’s credit cycle and confidence vote in bank and NBFC balance-sheet health. With corporate deleveraging largely complete, retail credit expanding at double digits, and asset quality metrics stabilizing, global capital clearly views Indian financials as the cleanest vehicle for participating in the country’s next economic upswing.

That ₹1.65 lakh crore holding increase between June and October underscores this conviction. Financials emerged as foreign investor confidence bedrock, representing the sector most closely aligned with India’s internal growth engine.

Capital Goods & Infrastructure

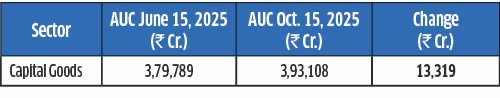

Foreign investors are also rediscovering India’s infrastructure and manufacturing momentum. Between April 16–30, 2025, foreign portfolio investors deployed nearly ₹2,944 crore in capital goods firms. This trend has since accelerated, visible in steady assets under custody rises from ₹3.79 lakh crore in June to ₹3.93 lakh crore in October.

This positioning reflects:

- Sustained public infrastructure spending under Gati Shakti and National Infrastructure Pipeline initiatives

- Strong order inflows for engineering, procurement, and construction firms and capital goods companies

- Success of Make in India and Production-Linked Incentive scheme implementations

*AUC: Assets Under Custody

Foreign investors effectively position themselves to capture the capex multiplier effect, where every rupee spent on infrastructure triggers broader industrial output cycles, credit expansion, and consumption growth.

Selective Growth Opportunities

The discriminating nature of this foreign investor strategy appears evident in their selective buying within niche sectors representing India’s structural evolution.

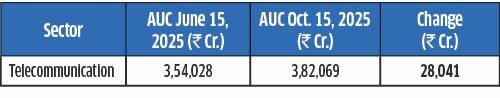

Telecommunication

With nationwide 5G deployment, surging data consumption, and fintech-digital commerce integration, telecom transcends utility status; it’s become a growth proxy. The sector attracted over ₹2,500 crore in foreign inflows during April 2025’s second half and continues gaining traction, reflected in ₹28,041 crore assets under custody jump between June and October.

Defence and Manufacturing

India’s self-reliance thrust and defence ecosystem modernization created new investable frontiers. Global investors gravitate toward listed defence and aerospace firms benefiting from government procurement, offset policies, and export opportunities.

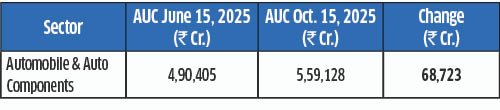

Automobiles & Auto Components

This sector transformed into high-conviction cyclical play, with foreign holdings surging ₹68,723 crore between June and October 2025, fueled by rural recovery, rising incomes, and strong festive demand supported by GST reductions.

The Abandoned Territories

The new foreign investor playbook is defined equally by exclusions as inclusions. Rotation away from export-heavy and defensive sectors reflects global consensus: India’s next growth phase will be domestically-led, not globally leveraged.

Information Technology

The IT sector continues bearing global risk aversion brunt, with cumulative foreign outflows exceeding ₹5,100 crore during June–October periods.

This caution stems from persistent macro headwinds: delayed client spending, muted deal wins, and lacking budget catalysts in global tech cycles. Still, this doesn’t imply total abandonment; selective buying in large-cap IT names indicates foreign investors are differentiating within sectors, favoring firms with strong artificial intelligence pivots and resilient margins.

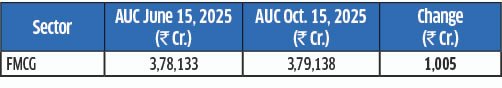

Consumer Staples (FMCG)

Once the default ‘safe haven’, the fast-moving consumer goods sector witnessed heavy profit-booking. Between April and June, foreign investors sold roughly ₹12,400 crore worth of FMCG stocks, signaling valuation fatigue.

While total holdings appear stable due to price appreciation, net investment flow remains negative, reflecting cautious positioning. Preference clearly shifted toward sectors offering higher operating leverage and cyclical momentum.

The Structural Transformation: From ‘India Story’ to ‘India Infrastructure’

Foreign capital evolves from narrative-driven to execution-driven mindset. Instead of passively ‘owning India’, foreign investors now engineer portfolios mirroring the real economy, prioritizing banking, infrastructure, and domestic consumption as sustained growth pillars.

This represents:

- Strategic rotation from global cyclicals to Indian cyclicals

- Shift from earnings momentum to earnings quality

- Transition from valuation comfort to fundamental conviction

Conclusion

Foreign investor return in 2025 isn’t a replay of past liquidity-driven cycles; it signals birth of more sophisticated and discerning investment thesis for India. The era of indiscriminate, momentum-led inflows has yielded to strategic, conviction-based capital allocation aimed squarely at India’s structural, domestically-led growth engine. This new wave of foreign participation anchors in fundamentals: reinvigorated financial sectors, robust infrastructure build-outs, and consumption formalization. Rather than chasing short-term rallies, foreign investors embed themselves within the economy’s real arteries—credit creation, manufacturing, and digital expansion.