Successful investment in turnaround companies requires in-depth analysis of financial fundamentals and market conditions. The cases of Inox Wind and Delhivery highlight how strategic management and operational improvements can lead to profitable recoveries. Investors should engage in thorough research to differentiate between temporary gains and sustainable growth opportunities.

Investing in turnaround companies can be a lucrative opportunity, but it requires a deep understanding of the sector, meticulous evaluation of financial fundamentals, and, importantly, patience. By recognizing authentic recovery stories early, investors can position themselves to gain significant long-term benefits from these promising ventures.

The Rise of Turnaround Stories

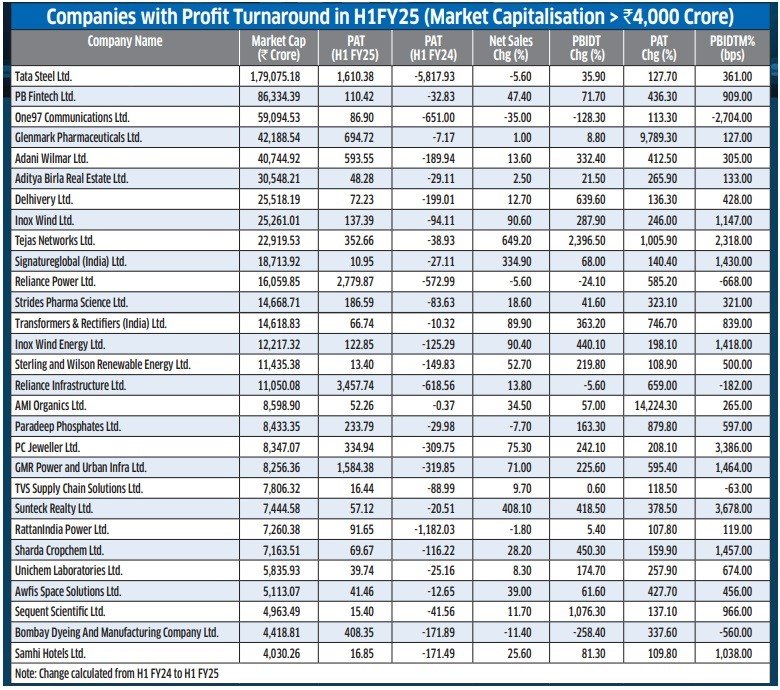

The recent half-year results season for major publicly listed companies has sparked enthusiasm among investors eager to uncover businesses that are reversing their fortunes. While these turnaround stories can be incredibly rewarding, differentiating genuine, sustainable recoveries from fleeting setbacks necessitates a thorough approach. A fundamental method to identify turnaround companies is to compare their recent financial metrics with those from the same period in the previous year.

For instance, if a company reports profits in the first half of FY25 after experiencing losses in the same timeframe of FY24, it may be worth considering as a turnaround candidate. However, this straightforward approach often uncovers numerous companies, some of which might not be able to maintain their newfound profitability. Therefore, conducting a more detailed analysis is essential, as profits can sometimes stem from one-off incidents rather than improvements in core operations.

The Importance of In-Depth Analysis

To effectively spot sustainable turnarounds, investors should focus on companies that have achieved profitability after enduring multiple quarters of losses. Even with this criterion, it is crucial to understand the underlying reasons for these recoveries to determine their sustainability. Factors such as sector-wide trends, operational efficiencies, and financial health must all be meticulously examined.

For example, companies in the wind energy sector have recently shown significant progress due to favorable policy changes, making their recoveries more credible.

Valuation Matters

Valuation is another critical component when investing in turnaround stocks. The most substantial returns are often realized when a company is still posting losses but exhibits clear signs of recovery. Identifying such firms early allows investors to benefit from the price movements that typically follow improved financial performance. However, this requires sector knowledge, diligent monitoring, and a great deal of patience.

While investing in turnaround companies presents significant potential, it is essential to remember that not all recoveries are sustainable. For example, Dish TV was once expected to recover but has continued to report losses. This reality emphasizes the necessity of thorough research and ongoing monitoring. Investors must comprehend the driving factors behind a company’s turnaround and remain vigilant for any signals of a possible relapse.

Sustainable Turnaround Success Stories

Inox Wind Ltd.: A Remarkable Recovery

BSE Code: 539083

Face Value: ₹10

52-Week High / Low: ₹262.10 / ₹86.51

Market Capitalization (₹ Crore): 27,073.28

Current Market Price (CMP): ₹207.65

Inox Wind Ltd. has successfully transitioned from six consecutive years of losses to reporting its first profit in Q3 FY24. This turnaround is attributed to India’s growing commitment to renewable energy and strategic financial maneuvers within the company. The challenges began in 2017 when India shifted from feed-in tariffs to competitive bidding in the wind energy sector, significantly impacting demand and leading to an industry-wide crisis that reduced the number of active players from 35 to a select few survivors.

During the period from 2017 to 2023, Inox Wind’s debt surged from ₹600 crore to ₹3,000 crore. However, a capital infusion of ₹900 crore by its promoter, Inox Wind Energy Limited, in July 2024 helped alleviate external term debt, strengthen the balance sheet, and lower interest costs. By September 2024, the company achieved a net cash position of ₹278 crore, with interest expenses on track to approach zero by Q4 FY25.

In Q2 FY25, Inox Wind showcased its best financial performance in eight years. The company reported consolidated revenue of ₹742 crore, marking a 93% year-on-year increase, while EBITDA soared by 171% to ₹189 crore. It also posted a net profit of ₹90 crore, in stark contrast to a loss of ₹27 crore during the same period the previous year.

Future Outlook

Inox Wind now boasts a record order backlog of 3.3 GW, including 1.2 GW of new contracts secured in H1 FY25. Management has reiterated its execution targets of 800 MW for FY25 and 1,200 MW for FY26, presenting further growth potential. The company expects EBITDA margins to improve to 17% in FY25 due to backward integration, the cessation of royalty payments for 3 MW turbines, and the introduction of larger turbine blades.

Additionally, Inox Wind is investing ₹75 crore annually over the next two years to develop larger blade molds and enhance maintenance support, thereby improving cost efficiency and solidifying its competitive position.

With a debt-free status, robust operational cash flows, and a rising demand for renewable energy, Inox Wind is well-positioned for sustained growth and long-term value creation.

Delhivery Ltd.: A Turnaround in the Logistics Sector

Company Overview

BSE Code: 543529

Face Value: ₹1

52-Week High / Low: ₹488.05 / ₹326

Market Capitalization (₹ Crore): 26,197.14

Current Market Price (CMP): ₹353.05

Delhivery Ltd. has marked a significant turnaround by posting its second consecutive quarter of profitability in Q2 FY25. The company reported an adjusted profit after tax (PAT) of ₹10.2 crore, a remarkable recovery from a loss of ₹102.9 crore during the same quarter in FY24. This turnaround has primarily been driven by robust growth in its part-truck load (PTL) and supply chain segments.

Strong Performance Metrics

Delhivery’s PTL revenue demonstrated a year-on-year increase of 27%, supported by a 23% rise in volumes. Meanwhile, the supply chain segment also experienced a notable growth rate of 20%. Operational efficiency has improved significantly, with EBITDA margins rising to 2.6%.

The company’s extensive, tech-enabled network spans over 18,000 pin codes across India, enabling it to effectively serve a diverse range of customers. Ongoing enhancements to this mesh network have further bolstered scalability and efficiency. Delhivery’s adaptability to changing market demands has positioned it as a leader in the logistics sector, with strategic expansions into value-added services such as faster regional and national delivery options, third-party shared quick commerce solutions, and tools specifically designed for small and medium enterprises (SMEs).

Strategic Investments and Operational Improvements

Operational improvements have been facilitated through effective inventory management, which included a ₹21 crore reversal related to previously imported oxygen concentrators. Additionally, better working capital management has reduced the cash conversion cycle from 27 days in March 2024 to just 22 days by September 2024.

Delhivery has also made significant capital investments to expand its PTL and express parcel capacities in anticipation of seasonal demand. Although these investments initially exerted pressure on margins, they have laid a robust foundation for long-term growth.

Future Outlook

Looking ahead, Delhivery anticipates its EBITDA margins will rise from 1.6% in FY24 to 8.1% by FY27, alongside a revenue compound annual growth rate (CAGR) of 15%. The company’s focus on prudent financial management—particularly in reducing its cash conversion cycle and optimizing working capital—positions it favorably for sustained growth.

These strategic initiatives, coupled with substantial investments in PTL and heavy freight capabilities, align with Delhivery’s long-term objectives. With an emphasis on innovation and operational excellence, Delhivery is well-equipped to capitalize on the burgeoning demand for e-commerce and logistics services in India, thereby solidifying its leadership position in the industry.

Conclusion

While turnaround stories like Delhivery’s offer significant investment potential, it is crucial for investors to remain cautious and conduct thorough research. Understanding the factors driving a company’s recovery is essential to identifying sustainable growth opportunities. In the dynamic landscape of logistics and e-commerce, companies like Delhivery exemplify how strategic decisions and operational improvements can lead to remarkable recoveries and long-term success.