Prioritizing rural spending, the government responds to ongoing discussions about economic disparities between rural and urban India.

Higher Allocations for Key Welfare Schemes in 2024-25 Budget

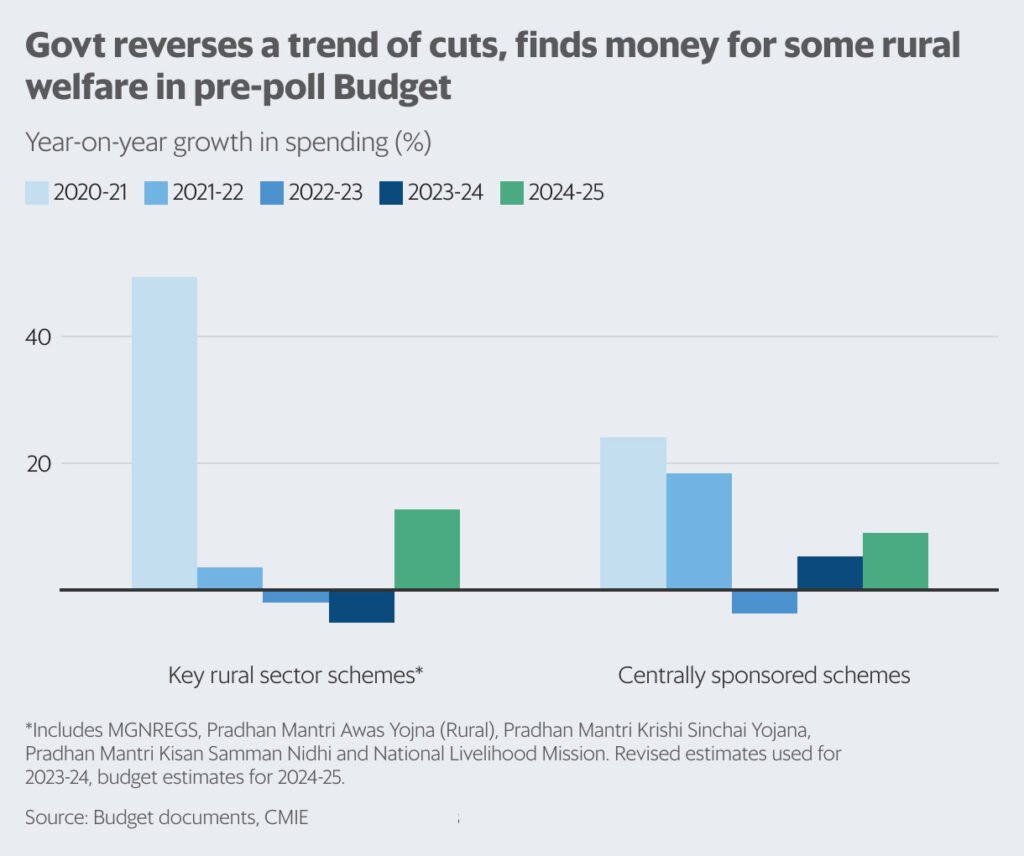

The recently announced pre-election budget may not have included major big-bang announcements, but it did see an increase in allocations for crucial welfare schemes for the year 2024-25. This shift marks a departure from the previous trend of spending cuts that followed the substantial government expenditure during the Covid years.

In the past two years, the government prioritized capital expenditure at the expense of welfare schemes. However, this pattern is set to change in the upcoming year. The total budget of ₹2.27 trillion for centrally-sponsored schemes represents an 8.9% increase over the planned expenditure for 2023-24. Notably, the overall government budget is expected to grow by 6.1%. Rural welfare has been specifically addressed, with a noteworthy 12.6% rise in the outlay for key schemes related to employment, irrigation, and housing, among others. This is in contrast to the 5.2% decline in 2023-24 and the 2.0% decrease in 2022-23, as indicated by a Mint analysis.

The astute reallocation of funds towards welfare schemes in the 2024-25 budget reflects a strategic move by the government to prioritize social welfare alongside capital expenditure. This shift signifies a shift towards a more balanced approach to budgetary allocations, affirming the government’s commitment to addressing the needs of the rural population and bolstering key welfare initiatives.

With the upcoming election on the horizon, the increased allocations for vital welfare schemes reinforce the government’s focus on rural development and social welfare. This move is likely to have a discernible impact on rural communities, providing much-needed support and impetus for essential welfare schemes.

Realigning Rural Spending: Addressing Economic Disparity

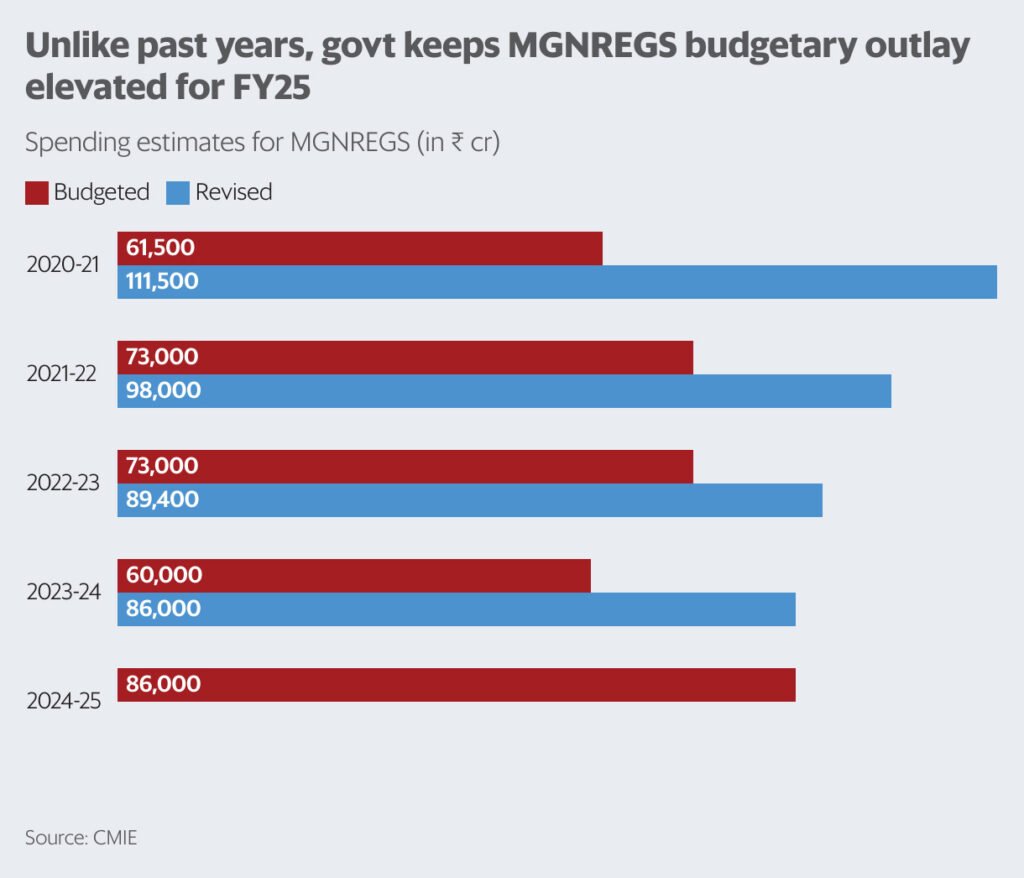

In the context of the ongoing debate about the uneven pace of economic progress between rural and urban India, there has been a notable shift in the approach to rural spending. The persistent high demand for jobs through the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) serves as a clear indicator of the sustained rural economic challenges. Consequently, the government has consistently surpassed its initial budget allocations for the scheme, indicating a trend of escalating rural distress. Notably, in a departure from the prior practice of under-budgeting followed by subsequent over-expenditure, the government has for the first time in six years aligned its budget allocation with the revised estimate for the ongoing year.

The Economic Disparity Dilemma

The stark discrepancy in economic growth and development between rural and urban areas has fueled a critical discourse. The persistent demand for jobs under the MGNREGS highlights the enduring struggle faced by rural populations. Contributing to this narrative is the government’s recurrent overspending on the scheme, reflecting the severity of rural distress. In a notable departure from past budgetary practices, the government’s decision to align budget allocations with revised estimates signifies a significant policy shift.

Implications of the Policy Shift

The realignment of budget allocations with the revised estimates denotes a substantive departure from previous fiscal strategies. This adjustment indicates a heightened awareness of the pressing need to address rural economic challenges. By shunning the traditional approach of underestimating budgetary needs for rural schemes, the government is signaling a proactive stance in mitigating rural distress and fostering equitable economic growth.

Assessing the Forward Momentum

Moving forward, this shift in budgetary approach infers a potentially transformative impact on addressing rural distress and advancing economic parity. By demonstrating a more attuned fiscal response to the genuine needs of rural India, the government’s policy departure engenders a more optimistic outlook for equitable economic development.

Focused Government Strategy

The Indian government’s recent budget allocations have signaled a strategic focus on balancing welfare schemes with fiscal discipline, reflecting its caution against last-minute populism and commitment to responsible financial management, especially with impending elections. While the government refrained from succumbing to eleventh-hour populist measures, it emphasized directing funds towards schemes likely to gain public support. Notably, this is exemplified by the augmentations in the free foodgrain scheme and the gas connection subsidy for rural women, which have been significant electoral talking points. Consequently, the 2024-25 subsidy bill has surged, aligning with the earlier announcements made ahead of the late 2023 state elections, which yielded favorable electoral outcomes for the ruling party.

Striking a Balance

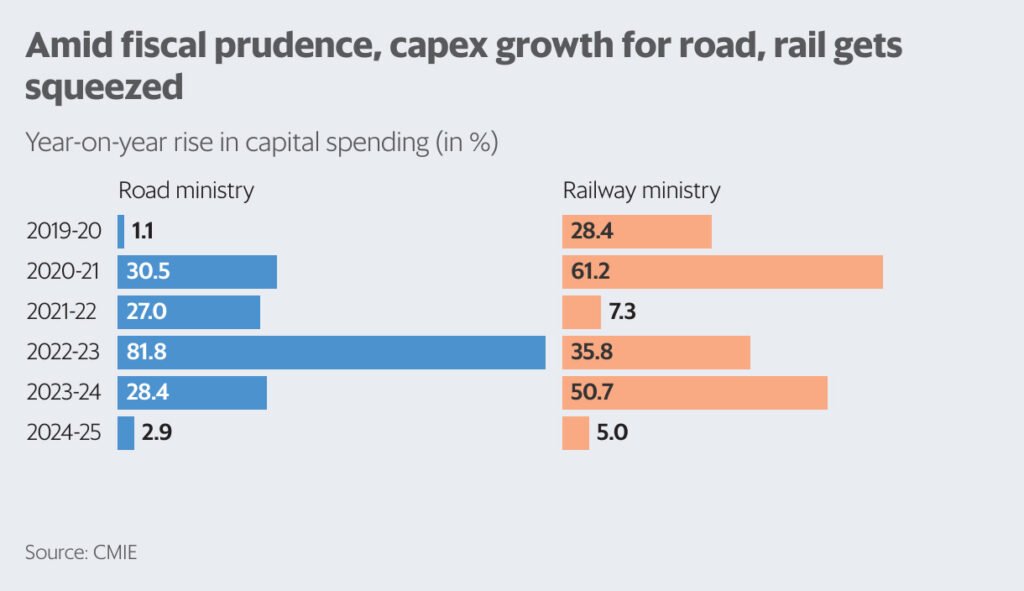

The government’s emphasis on welfare schemes reflects a calculated move to strike a balance between social welfare and the imperative to curtail the fiscal deficit. Given the forthcoming inclusion of Indian government bonds in a benchmark JP Morgan index, there has been heightened scrutiny over fiscal discipline, necessitating a demonstration of attainable consolidation. Rather than substantial augmentations in capital expenditure, the budget has opted for a more modest 17% increase, as opposed to the nearly 30% annual rise witnessed over the last four years. This approach underscores the government’s ambitious objective of reducing the fiscal deficit to 5.1% of GDP from the present 5.8%.

Impact of Capital Expenditure

In the wake of the pandemic, the government has heavily relied on capital expenditure (capex) to sustain the economy, with a significant proportion allocated to roads and railways. However, these sectors have observed nominal increases in funding this time. Despite the shift in focus towards welfare, the budget’s reliance on a combination of capex and rural spending to stimulate economic growth has been recognized as prudent and non-inflationary by financial analysts. Notably, a substantial portion of the rural support allocations, including the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), rural housing, and rural roads scheme, are intended to generate employment and create valuable assets.

Prudent Fiscal Approach

Amidst the gearing up for elections, the government has maintained fiscal prudence while strategically making electoral overtures. The capital expenditure remains at a two-decade high as a share of GDP and is poised to remain a primary driver of headline growth, as noted in a report by Nomura. This balanced approach underscores the government’s endeavor to enhance social welfare provisions without compromising on fiscal stability, thereby fostering sustainable economic growth and favorable electoral prospects.