Explore the top 5 ELSS funds of 2024 and tax-saving advantages of Equity Linked Saving Schemes (ELSS) and their ability to provide deductions of up to Rs 46,800 under Section 80C of the Income Tax Act, 1961. Uncover a comprehensive overview of ELSS workings and find top-tier market options to optimize your investment strategy.

Exploring Tax-Saving Investments: Prashant’s Discovery of Equity Linked Saving Scheme (ELSS)

Upon receiving a notice to submit investment proofs under Section 80 C, Prashant Mehta, a professional working with a multinational IT company, decided to explore new tax-saving investment options beyond the traditional choices. While researching, he stumbled upon the Equity Linked Saving Scheme (ELSS) and found it to be a compelling alternative that stood out from the rest.

Shortest Lock-In Period and Potential for Higher Returns

The standout feature of ELSS is its exceptionally short lock-in period of just three years, contrasting with the longer commitments required by PPF and fixed deposits. This means investors have the freedom to access their funds sooner, making it a highly appealing option for those seeking flexibility. Additionally, ELSS boasts the potential for significantly higher returns, fueled by the dynamic nature of the stock market. This contrasts with traditional options that may struggle to keep pace with inflation, making ELSS a potentially lucrative choice for investors.

Tax-Free Benefits and SIP Flexibility

Another compelling aspect of ELSS is the tax benefits it offers. The first ₹1 lakh of ELSS returns are entirely tax-free, easing the burden of tax liability for investors. Moreover, ELSS allows for investment through a systematic investment plan (SIP), enabling individuals to invest in small monthly payments. This flexibility proves advantageous for young professionals, facilitating a gradual and effortless approach to wealth-building.

Get Top 5 ELSS Funds with in-depth analysis in your email box right now by dropping your email in below form.

ELSS: Undisputed Champion Among Tax-Saving Investments

When compared to its counterparts, ELSS emerges as a clear frontrunner. While PPF offers guarantees, it lacks the potential for substantial growth. ULIPs come with high charges and long lock-in periods, limiting their appeal. Tax-saving FDs, though secure, often struggle to surpass inflation rates. In contrast, ELSS stands out due to its combination of a shorter lock-in period, potential for higher returns, tax-free benefits, and SIP flexibility, making it a compelling choice for investors seeking tax-saving opportunities.

As Prashant Mehta discovered the unique benefits of ELSS, it presented an attractive option for diversifying his investment portfolio and maximizing his tax-saving potential. With its shorter lock-in period, potential for robust growth, and tax benefits, ELSS offers a compelling proposition for investors looking to optimize their tax-saving investments.

Evolution of ELSS in the New Tax Regime

The landscape of tax-saving options has been altered by the implementation of India’s new tax regime, sparking a debate on the future of Equity Linked Saving Schemes (ELSS). Once a preferred choice for investors seeking long-term wealth creation and tax benefits, ELSS now faces new challenges in light of the changes in direct taxes as per the Union Budget 2023.

Changes in Tax Regime and ELSS Impact

Under the previous tax regime, investors could avail tax rebates by investing in ELSS, with savings of up to ₹1.5 lakhs falling under Section 80 C. However, the new tax regime, marked by alterations in direct taxes, operates without such provisions. In the new regime, income tax exemption is applicable on earnings up to ₹7 lakhs, after which government-defined tax slabs come into effect. Notably, the new regime disregards savings or investments in its calculations, rendering such financial instruments irrelevant.

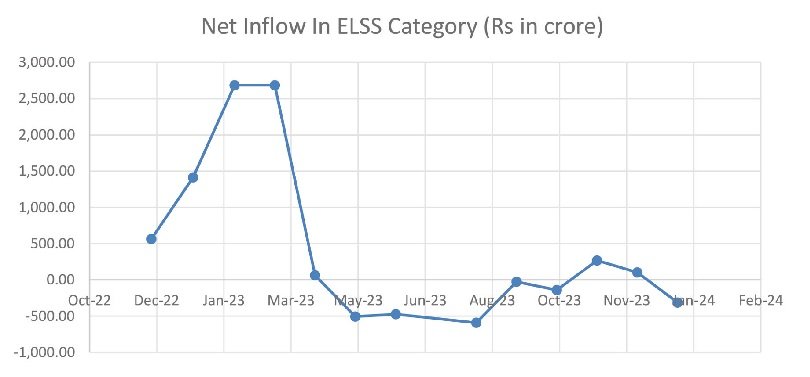

Impact on ELSS Inflows

The repercussions of the new tax regime are evident in the inflows of funds in the ELSS category. From April 2023 to December 2023, outflows were observed in six out of nine months, with a total withdrawal of ₹1,620 crore during the nine months of FY24. This trend reflects the shifting tides in investor behavior and the impact of the altered tax landscape on investment decisions.

Assessing the Future of ELSS

The evolving tax regime has cast a shadow of uncertainty on the future of ELSS as a tax-saving and wealth-building option. With the shift away from tax benefits associated with investments, ELSS now contends with a changed investment dynamic. Investors are reevaluating the efficacy of ELSS within the new tax framework and seeking alternative avenues for tax savings and wealth creation.

The changes in the tax regime have undeniably brought about a paradigm shift in the investment landscape, prompting investors to reconsider their strategies for tax savings and wealth creation. The impact on ELSS serves as a testament to the far-reaching consequences of the altered tax regime, necessitating a reevaluation of investment options and tax-saving instruments in light of the evolving financial landscape.

Insights into ELSS Funds’ Net Inflows Over the Last 13 Months

The introduction of the new tax regime has brought about lower tax rates for different income brackets, but it comes at the cost of disallowing deductions permitted under the old tax regime. Under the old tax system, deductions were available for specific investments or expenses under various sections of the Income Tax Act, 1961, including Sections 80 C (which covers ELSS), 80 CCD (NPS), 80 D (health insurance), and 24 (home loan interest payments). The choice between the old and new tax regimes largely depends on an individual’s eligibility to claim these deductions. For those who can claim these deductions, sticking with the old tax regime may prove more financially advantageous.

Get Top 5 ELSS Funds with in-depth analysis in your email box right now by dropping your email in below form.

Unraveling the Essence of ELSS

ELSS, also known as Equity Linked Saving Schemes, are mutual funds that offer tax-saving benefits under Section 80 C of the Income Tax Act, 1961. Investors can allocate funds to ELSS up to a maximum limit of Rs 150,000 per year. This investment amount is eligible for deduction from the total taxable income, providing tax relief of up to Rs 46,800 for taxpayers in the highest tax bracket. According to a SEBI circular, 80 percent of the investments made by ELSS mutual funds are in equity and equity-related instruments. The scheme has a lock-in period of three years, during which no redemptions are permitted. This feature works to the advantage of investors as the funds continue to generate compounded returns during this mandatory lock-in period, potentially offering capital appreciation that can support long-term financial objectives such as building a retirement corpus.

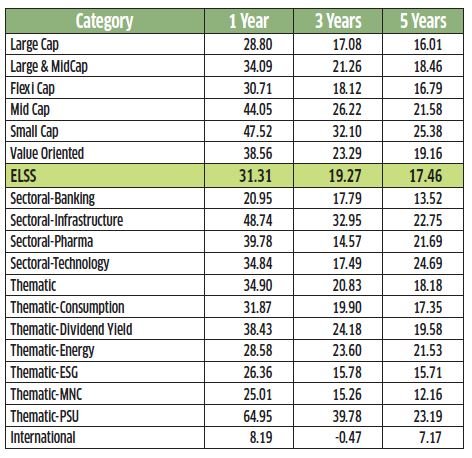

Unveiling the Performance of Equity Linked Saving Scheme (ELSS) Funds

Equity Linked Saving Scheme (ELSS) funds have garnered attention as a compelling investment avenue owing to their consistent and competitive performance. The 3-year and 5-year average annual returns stand at an impressive 19.27% and 17.46% respectively, positioning them as a lucrative option for not only tax-saving but also wealth creation. In comparison to other mutual fund categories, ELSS funds have demonstrated remarkable resilience, outperforming sectors such as banking, pharmaceuticals, energy, as well as Large-Cap and flexi-cap funds across various timeframes.

Get Top 5 ELSS Funds with in-depth analysis in your email box right now by dropping your email in below form.

Tax-Saving Efficiency and Performance

The allure of ELSS funds lies in their capacity to deliver enticing returns while also serving as an effective tax-saving instrument, making them an attractive prospect for investors. It is important to note, however, that ELSS funds have exhibited underperformance across other categories over the last three, five, and ten-year periods, potentially attributed to their relatively longer lock-in period and exposure to Capital Gains Tax.

Wealth Creation and Flexibility

Even in the event of transitioning to a new tax regime, investing in ELSS funds with the sole objective of wealth creation remains a viable choice. Beyond tax savings, ELSS funds can align with broader long-term financial goals. Despite evolving tax landscapes, ELSS funds retain their potential as a tool for wealth accumulation, providing investors with the flexibility to adapt to changing tax scenarios while staying focused on their financial objectives.

Methodology: Identifying the Top ELSS Funds

Our approach to identifying the best ELSS funds involved utilizing a proprietary screener to assess quantitative factors such as long-term performance over 5 years, performance consistency based on three-year rolling returns, risk analysis using rolling maximum drawdown, and short-term performance via one-year rolling returns. Subsequently, based on their overall score, we categorized all funds into four quartiles, with the top two quartiles undergoing qualitative assessment. Furthermore, the qualitative analysis involved scrutinizing the fund’s portfolio, concentration, sector allocation, and the proficiency of the fund manager. Ultimately, we selected the five best ELSS funds based on a meticulous blend of quantitative and qualitative criteria.

Get Top 5 ELSS Funds with in-depth analysis in your email box right now by dropping your email in below form.