International Conveyors Ltd. dominates the global conveyor belt market, with specialized products meeting industry demands. Strong financial performance and market position distinguish it as a key player poised for growth amidst expanding industry demand.

International Conveyors Ltd.: A Leading Player in Conveyor Belts

The Growing Demand for Conveyor Belts

In today’s industrial landscape, the need for efficient conveyor belt systems is undeniable across various sectors including automotive, aviation, retail, and food and beverage. This demand is reflected in the global conveyor belt market, which reached approximately USD 4 billion in 2023 and is projected to grow at a significant 4.1 per cent Compound Annual Growth Rate (CAGR), ultimately reaching a valuation of USD 6 billion by 2033. This surge is primarily fueled by the increasing adoption of conveyor belt systems in crucial industries.

Market Share and Engineering Advancements

International Conveyors Ltd., a prominent player in this arena, holds a notable market share, standing at an impressive 45 per cent in the Indian PVC mine conveyor belt market. The company specializes in the manufacturing and distribution of solid woven fabric reinforced PVC impregnated and PVC-covered fireretardant, anti-static conveyor belting. Notably, their offerings are well-positioned to cater to the escalating demand witnessed in key industrial segments such as automotive, aviation, logistics, and retail.

Growth Projections and Regional Expansion

The conveyor belt market is poised for accelerated growth, particularly fueled by the burgeoning industrial sectors in rapidly developing economies such as India and China. This anticipated expansion is bolstered by the increasing prevalence of belt conveyor systems within various industries, including logistics, food and beverages, and retail. As such, International Conveyors Ltd.’s strategic positioning within these high-growth markets bodes well for its future prospects in the industry.

Expanding Global Reach and Product Offerings

International Conveyors Ltd. (ICL) has a strong foothold in the global market, exporting PVC belts to key regions such as the US, Canada, South Africa, and Australia. What sets ICL apart is its commitment to developing PVC conveyor belting that adheres to stringent regulatory requirements, including those set by US MSHA, CAN CSA, Test Safe Australia, and SABS. Moreover, the company stands out as a premier global manufacturer of solid woven belting, boasting an extensive lineup of conveyors, tying and doubling machines, and carcass-making machines. Notably, ICL prides itself on operating one of the widest beaming machines globally, with a beam width of 2,400 mm.

Operational Excellence and Strategic Alliances

ICL’s strong engineering capabilities position the company for efficient and timely manufacturing to uphold customer satisfaction. The company has secured long-term contracts with trusted suppliers and customers, providing clear order visibility and fostering repeat business. Furthermore, ICL has carved a niche in producing tailored products to align with unique country and customer specifications, aiming to ramp up its manufacturing share to 25% by 2025. Specifically, the company places a strategic emphasis on technology development to drive enhanced operational efficiency and productivity.

Financial Performance and Market Position

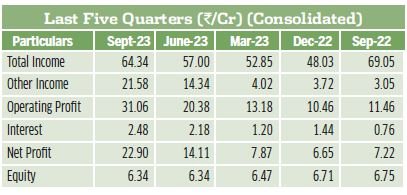

During Q2FY24, ICL reported stable consolidated net sales of ₹42.76 crore, mirroring the figures from the prior quarter. However, on a year-over-year (YoY) basis, net sales experienced a dip of 35.21%. Notably, the company witnessed robust performance in terms of PBIDT excluding other income, marking a remarkable 56.95% increase to ₹9.48 crore, compared to the previous quarter of the same year. On a YoY basis, this metric surged by 12.72%.

In a significant upturn, the company’s net profit soared by an impressive 217.17%, reaching ₹22.90 crore, up from ₹7.22 crore in the corresponding quarter of the previous year, and displaying a sequential increase of 62.30%. The net profit margin exhibited substantial growth, climbing by 2,047 basis points (bps) on a quarter-over-quarter (QoQ) basis and by 4,211 bps on a YoY basis, culminating in an impressive 53.55%.

Investment Performance

Emphasizing its appealing investment proposition, ICL has delivered a commendable 66% annual return to its investors, closing at ₹95.10 per share as of January 18, 2024.

International Conveyors Ltd.: A Financial Analysis

International Conveyors Ltd. (ICL) is currently trading at a PE (price-to-earnings) ratio of 11 times, indicating undervaluation compared to its three-year median PE of 22.4 times. This suggests a potential opportunity for investors to consider. The company has consistently maintained a three-year return on equity (ROE) and return on capital employed (ROCE) at 11.3% and 14.6%, respectively, reflecting stable financial performance.

Over the past three years, ICL has demonstrated robust growth, with a compounded sales and profit increase of 30% and 50% respectively. These figures underscore the company’s ability to expand its market presence and generate healthy profits amid industry dynamics.

Furthermore, the company’s financial health is noteworthy, as evidenced by its debt-to-equity ratio of 0.47 times, indicating a moderate level of leverage, and an interest coverage ratio of 10 times, signifying its capacity to meet interest obligations comfortably.

Outlook

The future looks promising for International Conveyors Ltd. as the global demand for conveyor systems is projected to rise in tandem with the growth in manufacturing activities worldwide. This favorable industry outlook positions ICL for potential growth and market expansion.

Conclusion

Considering the company’s undervaluation in relation to its historical PE ratio, consistent financial performance, strong growth metrics, and the positive industry outlook, it is prudent for investors to keep a close watch on International Conveyors Ltd. This stock exhibits good investment potential given its attractive valuation and growth prospects.

In conclusion, International Conveyors Ltd. appears to be an appealing investment opportunity, supported by its sound financial indicators and favorable industry trends. As always, investors should conduct further due diligence and consult with financial advisors before making investment decisions.

Disclaimer: This content is purely for informational purposes and does not constitute a recommendation for stock investment. Any decision related to investments should be made in consultation with a qualified financial advisor.