Embark on a financial journey with IRFC as it breaks barriers, achieving a 17% stock surge. Explore the dynamics of market cap records, government-supported projects, and investor optimism driving this exceptional rally.

Unveiling the Surge in IRFC Share Price

In a noteworthy development, Indian Railway Finance Corporation (IRFC) has not only eclipsed the market capitalization of Tata Steel in today’s intraday trade but has also outshone other major players like Jio Financial Services and Varun Beverages. With an impressive 17% surge, IRFC shares have reached an unprecedented all-time high at Rs 134, exhibiting a remarkable ascent of over five times from its IPO price. This article delves into the compelling factors propelling this surge and unravels the prospects of the multibagger stock in 2024.

Catalysts Behind Surge in IRFC Share Price in 2024

Potential Fundraising Plans

- Reports suggest IRFC’s intention to raise up to Rs 25 billion, including a greenshoe option of Rs 20 billion through bonds maturing in five years and three months.

- The company, having invited bids from investors and bankers, holds an 86.36% stake owned by the Indian government, potentially leading to fundraising and stake dilution.

- Approximately 20% of IRFC’s outstanding equity may become eligible for trading post the lock-in period ending on January 29, 2024, introducing an element of potential volatility.

Optimism Ahead of Budget

- Railway stocks, especially IRFC, are in the spotlight preceding the upcoming Budget.

- Anticipation of a fresh government infusion into railway infrastructure development, coupled with expected robust Q3 results, has fueled positive sentiments.

Strong Growth Prospects

- IRFC shares rally amidst speculation about potential fundraising, supported by the government’s massive Rs 7 trillion investment in rail infrastructure.

- As the dedicated financing arm for Indian Railways, IRFC stands to benefit significantly from the capital-intensive projects outlined by the government.

- Solid financials, reported success in the September 2023 quarter, and analysts’ optimistic expectations further bolster IRFC’s growth prospects.

Prudent Considerations and Market Outlook

- Post-lock-in period, potential share price volatility is anticipated, though it doesn’t guarantee immediate market sales.

- Cautionary notes are sounded for investors, especially in an election year (2024), emphasizing the need to manage expectations in alignment with potential earnings growth.

Recent Performance Metrics of IRFC Share Price

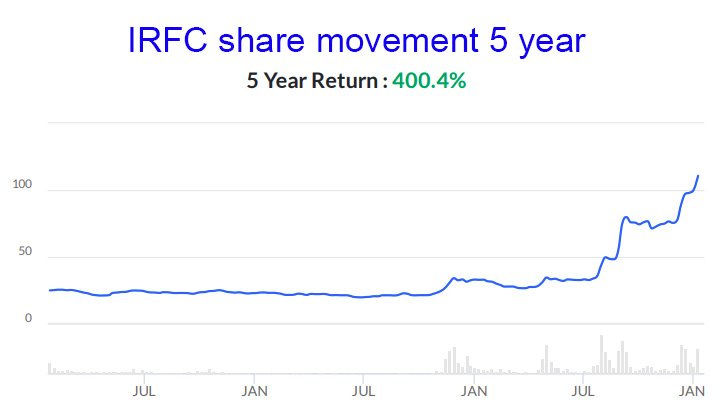

- Today’s remarkable 17% surge to Rs 134 establishes a new pinnacle for IRFC shares.

- Over the last month, a substantial gain of over 40%, and an extraordinary surge of over 283% in the past year, position IRFC as a bullish favorite among investors.

- Since its IPO three years ago at Rs 26, the stock has exhibited exceptional growth, surpassing 5x since listing and 6x since its historic lows.

Financial Metrics and Comparative Analysis

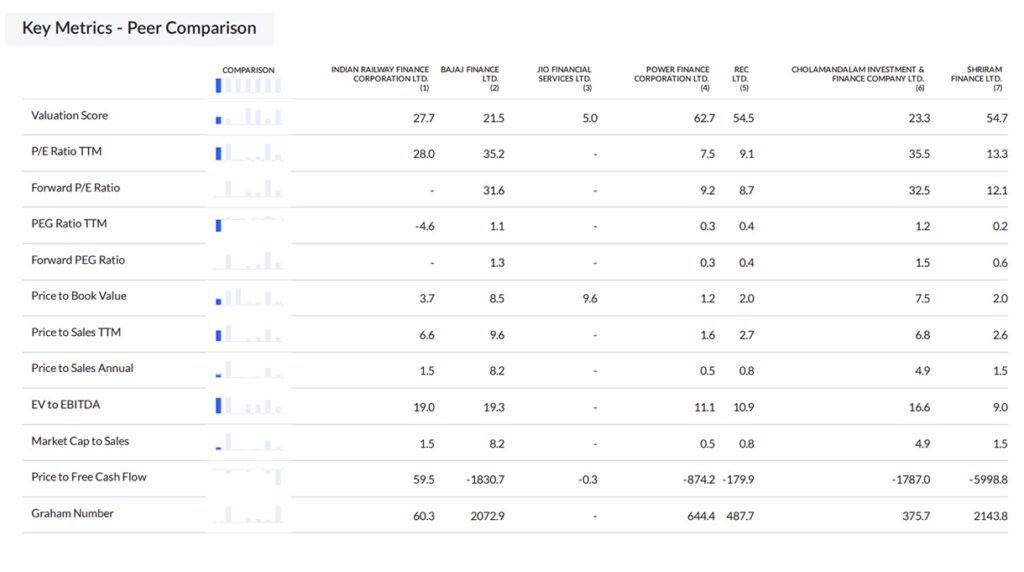

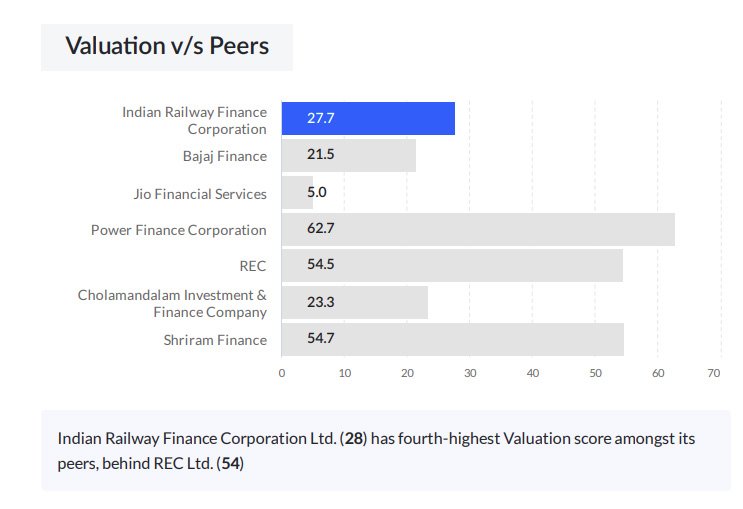

- IRFC’s market cap now exceeds Rs 1.7 trillion, accompanied by a PE ratio of 24.4x and a price-to-book value multiple of 3.1x.

- A comprehensive comparative analysis with peers (PFC, REC, Satin Creditcare) provides insights into various financial metrics, emphasizing IRFC’s standing in the market.

Understanding IRFC’s Role and Business Operations

- IRFC, dedicated to borrowing funds for asset creation and leasing to Indian Railways, operates as a vital player within the Ministry of Railways.

- With leasing and finance as its sole operating segment, the company maximizes revenue through lease income, contributing significantly to the plan outlay of Indian Railways.

Conclusion and Risk Awareness

- While celebrating IRFC’s remarkable journey, investors are reminded of potential market risks and are advised to thoroughly review related documents before making investment decisions.

Disclaimer: This content is purely for informational purposes and does not constitute a recommendation for stock investment. Any decision related to investments should be made in consultation with a qualified financial advisor.