A prominent player in the railroad industry, focuses on producing freight cars, auto car wagons, locomotive bogies, passenger coach bogies, hydro-mechanical equipment, and steel casting.

As a significant entity within the Adventz Group, Texmaco specializes in the manufacturing of freight cars, auto car wagons, loco bogies, coach bogies, hydro-mechanical equipment, and steel casting. Moreover, the company plays a pivotal role in the design, supply, installation, and commissioning of mainline railway and metro tracks, thus contributing significantly to the growth and development of railway infrastructure.

Texmaco operates five manufacturing facilities in West Bengal and Chhattisgarh, solidifying its position as one of the primary suppliers of freight cars in India. Its products are renowned for their quality and reliability, serving various prominent entities including Indian Railways, Grasim, Vedanta, ACC Cement, Adani Ports, and SAIL.

Despite its prominent position in the market, Texmaco has experienced fluctuating profits over the years. This variation can be attributed to the impact of fluctuating prices of crucial raw materials, particularly steel and other commodities, which have intermittently influenced the company’s profit margins.

In conclusion, Texmaco Rail stands as a vital contributor to the railway sector, showcasing its prowess in manufacturing and supplying essential components while adapting to market fluctuations and challenges.

Keywords: Texmaco Rail, railway sector, manufacturing, freight cars, auto car wagons, loco bogies, coach bogies, hydro-mechanical equipment, steel casting, metro tracks, railway infrastructure, West Bengal, Chhattisgarh, Indian Railways, Grasim, Vedanta, ACC Cement, Adani Ports, SAIL, fluctuating profits, raw materials, steel, commodities, market fluctuations, challenges.

| Texmaco Rail & Engineering Ltd: Standalone Financial Summery | |||||

| (All figures In Rs.Cr.) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 |

| Sales | 11,133.59 | 13,421.02 | 15,770.47 | 20,299.26 | 23,891.83 |

| Other Income | 0 | 0.07 | 0.39 | 2.33 | 40.8 |

| Operating Profit | 11,085.10 | 13,355.25 | 15,657.62 | 20,178.96 | 23,798.28 |

| Interest | 8,183.10 | 10,162.70 | 11,237.05 | 14,074.78 | 17,447.21 |

| Depreciation | 0.42 | 0.46 | 4.43 | 14.03 | 14.06 |

| Taxation | 646.84 | 0 | 0 | 0.32 | 0 |

| Net Profit / Loss | 2,254.75 | 3,192.10 | 4,416.13 | 6,089.84 | 6,337.01 |

Texmaco Rail Initiates Strategic Measures to Boost Performance and Optimize Costs

Texmaco Rail, a leading player in the rail manufacturing industry, has embarked on a series of strategic initiatives aimed at enhancing operational efficiency and driving down costs. This concerted effort is visibly reflected in the notable uptrend in profit margins witnessed over the past three years, signaling a positive trajectory for the company.

Ramping Up Production Capacity

Currently, Texmaco Rail boasts a monthly output of 500 wagons and has set its sights on doubling its production capacity to reach the milestone of 1,000 wagons per month within the near future. This ambitious expansion plan underscores the company’s commitment to meeting burgeoning market demand while concurrently bolstering its competitive position in the industry.

Exploring Export Opportunities

In a proactive bid to diversify its revenue streams and broaden its global footprint, Texmaco Rail is actively exploring potential export avenues in African and European markets. By capitalizing on export opportunities, the company aims to fortify its export revenue and cultivate a more resilient revenue base, thus mitigating overreliance on domestic markets.

Backward Integration for Cost Efficiency

Texmaco Rail has also embarked on a strategic journey towards backward integration, aiming to streamline its production processes and realize cost savings that can contribute to bolstering profit margins. By fostering a leaner and more efficient operational framework, the company endeavors to fortify its financial resilience and enhance its competitive edge in the sector.

Equity Infusion to Support Growth

In a significant development, Texmaco Rail recently secured an equity infusion through preferential allotment and a successful Qualified Institutional Placement (QIP) issue, yielding an injection of Rs 7.5 billion into the company. This capital infusion is poised to fuel the company’s growth ambitions and provide requisite financial muscle to execute its expansion and diversification strategies effectively.

Remarkable Stock Performance

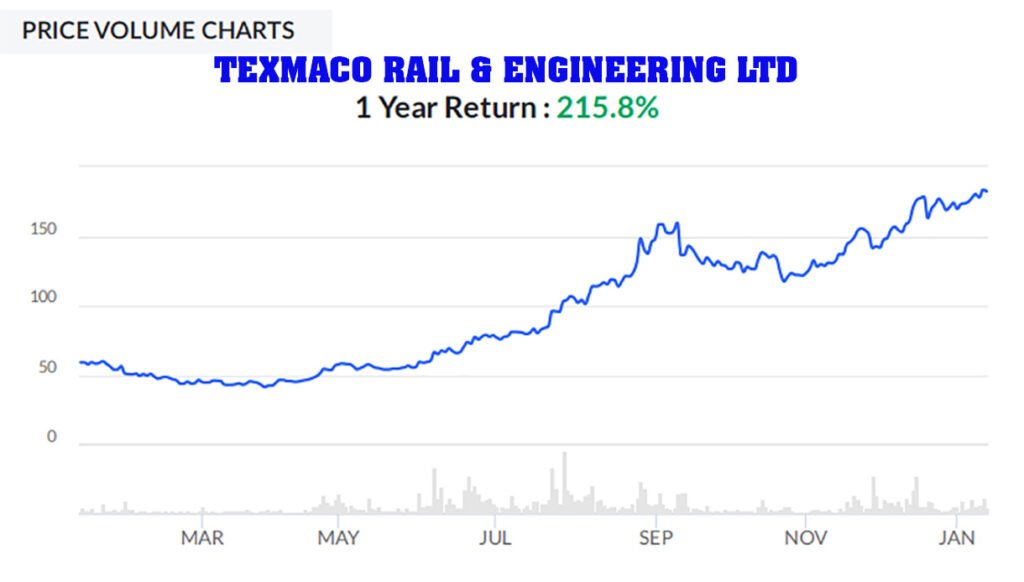

Notably, Texmaco Rail’s stock has witnessed a remarkable surge, with its shares registering an impressive growth of over 220% in the past year. This surge underscores investor confidence in the company’s future prospects and its strategic initiatives, reflecting positively on its market standing and growth trajectory.

In the past one year, shares of the company have surged over 215%.

Texmaco Rail’s proactive measures to augment production capacity, explore international market opportunities, streamline operations, and secure vital capital injections position the company favorably for sustained growth and resilience in the dynamic rail manufacturing landscape.