SJVN’s Growth Strategy Focuses on Diversifying into Renewable Energy Sources, Aiming to Capitalize on Government Initiatives and Increase Market Share.

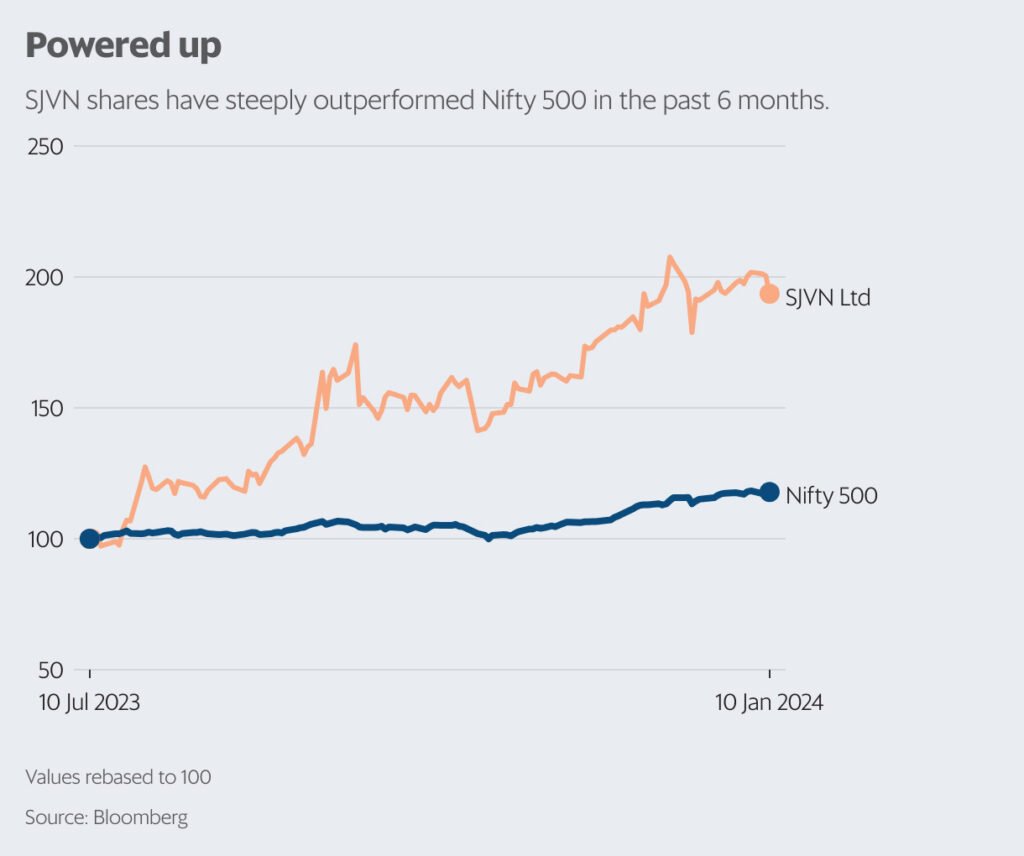

Over the past six months, the stock of state-run power generation company SJVN Ltd has witnessed a remarkable surge, appreciating by approximately 94% to reach ₹91 per share. This commendable performance has caught the attention of investors and industry observers alike.

Government’s Renewable Energy Focus

Amidst SJVN’s primary role as a significant hydro power generator, the government’s emphasis on transitioning towards renewable energy presents a promising opportunity for SJVN to expand its footprint in the solar and wind power segments. The trajectory of renewable energy development aligns with SJVN’s growth strategy, positioning the company to leverage these initiatives for sustained growth.

The recently announced electricity generation tariff norms by the Central Electricity Regulatory Commission (CERC) have further contributed to an optimistic market outlook for SJVN. Notably, the CERC has maintained the regulated return on equity at 16.5% for existing hydroelectric power projects. Moreover, for projects commissioned after 1 January 2024, the rate has been increased to 17%. These revised norms are set to be effective for a duration of five years from 1 April, 2024.

According to Elara Securities (India), SJVN is expected to benefit from a 50-basis point improvement which is projected to stimulate investments in pumped storage projects.

Earnings Outlook and Project Progress

The earnings outlook for SJVN is contingent upon the progress of significant projects. Timely execution of four hydro units of 225 MW each on river Arun in Nepal, and two thermal units of 660 MW each at Buxar in Bihar could potentially lead to a substantial increase in SJVN’s profit after tax by FY27. Analyst Sudhanshu Bansal from JM Financial Institutional Securities underscores the critical nature of these projects for SJVN’s future financial performance.

Key Project Milestones

The commissioning of all Arun-3 units by mid-FY25 is anticipated, with the first unit of the Buxar plant likely to be operational by June. Additionally, the progress of the Naitwar Mori hydro project, which comprises two 30 MW units in Uttarakhand, holds significant importance for the company’s growth trajectory.

Capacity Expansion and Capital Expenditure

SJVN aims to enhance its capacity by 10 GW by FY26, across various energy projects including hydro, thermal, solar, and wind energy. The company has set a capital expenditure (capex) target at ₹10,000 crore for FY24, with only ₹3,800 crore utilized in H1. The performance and utilization of the remaining capex in H2 will significantly impact the company’s financial position.

Earnings Growth Outlook and Concerns

The company’s earnings growth outlook hinges on new project wins, timely signing of power purchase agreements, and SJVN’s role as a renewable energy implementation agency (REIA). Acting as a facilitator between developers and state discoms through REIA will enable SJVN to earn trading margins. However, potential downsides may arise from delays in project completions, elevated receivables, and high debt weighing in at ₹16,993 crore as of September end.

Conclusion

In conclusion, while SJVN stands to benefit from positive market conditions and potential project successes, it also faces inherent risks associated with project delays, receivables, and debt concerns. Keeping a close eye on these factors will be pivotal for investors and stakeholders.