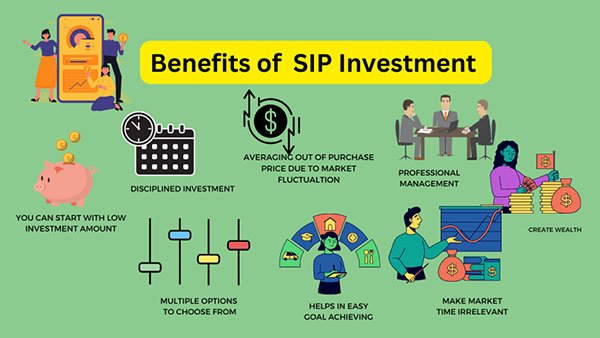

Discover The benefits of Systematic Investment Plans (SIPs) and how they empower wealth creation through concepts like rupee-cost averaging and discipline. Mitigate market fluctuations, achieve long-term financial goals, and navigate market volatility with investment strategies to ensure enduring financial success.

Rupee-Cost Averaging: A Powerful Mechanism for Long-Term Gain

The benefits of Systematic Investment Plans (SIPs) are significant and enduring, and one of the most compelling advantages lies in the concept of rupee-cost averaging. This potent mechanism operates by empowering you to acquire more units during market downturns and fewer units during market upswings. By doing so, it effectively evens out your purchase price, mitigating the impact of market volatility and potentially enhancing your long-term returns. For instance, consider initiating a SIP of Rs 1,000 per month in a mutual fund five years ago. During market downturns, you might have acquired 100 units per month, while during upward trends, you might have acquired only 50 units. Consequently, this automatic accumulation of more units at lower prices can play a pivotal role in bolstering your investment when the market experiences a correction.

Timing the Market – A Myth Dispelled

Attempting to predict market fluctuations consistently has long been considered a challenging endeavor, even for seasoned experts. Discontinuing your SIP based on the assumption that the market has peaked could lead to missed opportunities for potential future gains. It is crucial to recognize that historically, the market has exhibited an upward trend over the long term, and even missing out on a few favorable months can significantly impact your overall returns.

Compounding – Unveiling the Magic of Long-Term Investing

The renowned physicist Albert Einstein once referred to compound interest as the “eighth wonder of the world.” Through regular investments via SIPs, you not only earn returns on your initial investment but also on the reinvested earnings. The compounding effect is nothing short of magical, progressively amplifying your wealth over time. Discontinuing your SIPs disrupts this compounding process, potentially leading to the forfeiture of substantial long-term gains.

Discipline – The Cornerstone of Investment Success

Investing is akin to a marathon rather than a sprint. By adhering to your SIP, irrespective of market fluctuations, you instill discipline and remain steadfast in pursuit of your financial aspirations. Halting your SIP during market peaks can be equated to succumbing to emotional impulses and has the potential to derail your long-term investment strategy.

Focus on Long-Term Goals, Not Short-Term Noise

It is imperative to remember that market movements are transient, while your financial goals are rooted in the long term. Refrain from allowing short-term volatility to divert your attention from your long-term investment objectives. By aligning your SIP with your goals and placing trust in the power of consistent investing, you fortify your journey toward accomplishing them.

In conclusion, it is vital to recognize that SIPs are tailored for wealth creation over the long term. By remaining invested through market fluctuations, you harness the potency of rupee-cost averaging and compounding to fortify your wealth-building endeavors. Furthermore, by upholding discipline and steadfastness, you can navigate through market uncertainties and stay focused on your long-term financial triumph.