The abrupt shift to limit sugar diversion for ethanol and its subsequent reversal within a mere 10 days has left the industry bewildered and uncertain.

Every October, as the world prepares to celebrate another journey around the sun and officially start a new revolution, the sugar industry in India gears up for action. The arrival of autumn signals the beginning of the sugar season, when sugarcane is ready for harvesting across vast expanses of tropical and subtropical states, particularly Uttar Pradesh, Haryana, Punjab, Maharashtra, Karnataka, and Tamil Nadu. The process continues until the onset of summer in April, with the full sugar season ending in September.

Another significant month in the calendar of every sugar mill owner in India is November, which marks the commencement of the ethanol supply season. Ethanol, a renewable fuel derived from fermenting plant materials like sugarcane juice, holds immense potential to replace a portion of petroleum in transport fuels. This, in turn, could decrease India’s reliance on imported crude oil, garnering significant government support.

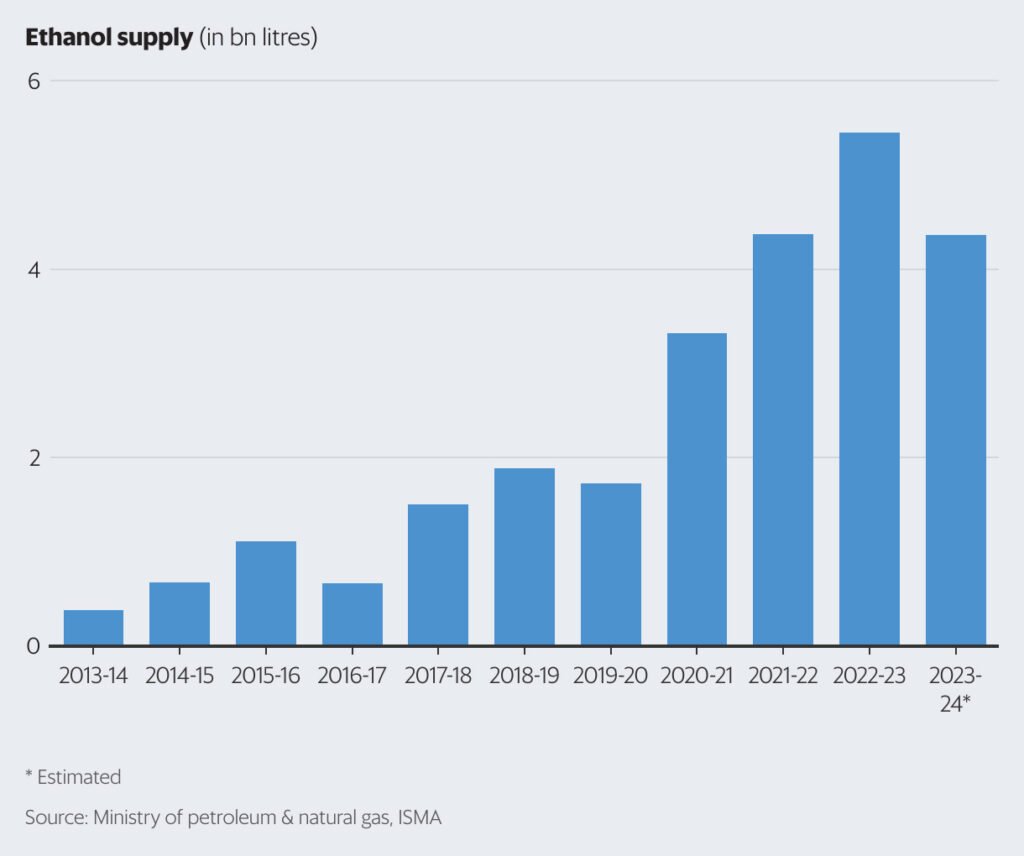

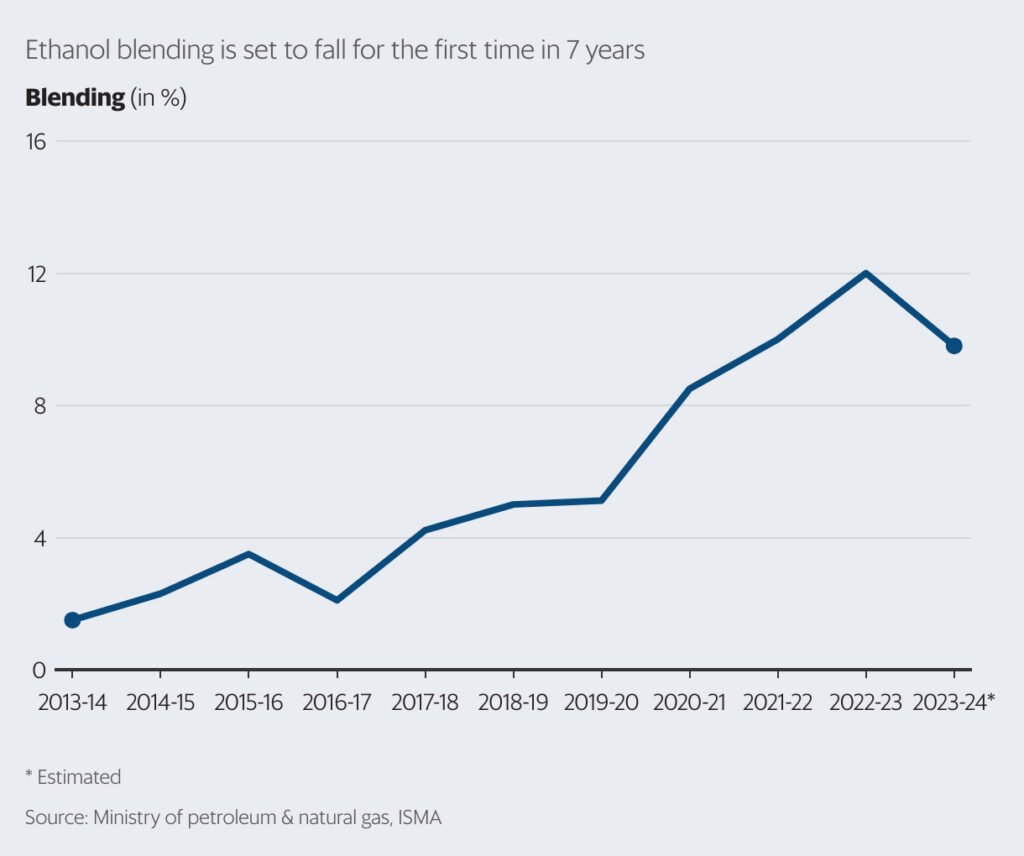

India initiated its ethanol blending program in 2003, and since 2014, the program has gained substantial momentum, achieving a 10% blending rate by June 2022. Consequently, the target for achieving a 20% blending rate was brought forward from 2030-31 to 2025-26.

Every year, sugar mill owners eagerly await the start of the supply year to determine the proportion of sugarcane in their mills that can be diverted toward ethanol production.

However, this year brought an unexpected twist. On December 7, the Ministry of Food Processing imposed a ban on using sugarcane juice and syrup for ethanol production in the ongoing supply year (November-October). This decision was made following the government’s estimation of an approximate 11.5% decrease in sugar production during the season due to insufficient rainfall in the sugarcane-growing regions of Maharashtra and Karnataka, sparking concerns about potential supply shortages and price hikes. The unexpected consequence of this situation is that ethanol production will bear the brunt of it.

Sachin Raole, Chief Financial Officer and Director (Resources) at Praj Industries, a biofuel technology company, expressed surprise at the recent directive. He noted, “With the advancement of the program target of achieving 20% ethanol blending by 2025, moving it up from 2030, and a roadmap to accomplish India’s goal of energy self-reliance by 2070, the recent directive is an unexpected move. Though we understand the reasoning behind the step, it has taken all the participants by surprise.”

Within a short span of less than 10 days, the ministry made a U-turn, lifting the ban but imposing an overall cap of 1.7 million tonnes (mt) on sugar diversion. The industry breathed a sigh of relief, but the new directive still raised concerns. The Indian Sugar & Bio-energy Manufacturers Association (Isma) had earlier estimated that 3.1mt of sugar would be redirected for ethanol production this year. The cap will require adjustments and could lead to a decline in profitability. We’ll delve further into this issue.

M. Prabhakar Rao, president of Isma, stated, “The decision was initially influenced by the projection of lower sugar production for 2023-24. However, after considering more realistic estimates, the government revised its stance. Sugar is a crucial commodity, and therefore, the government’s priority to ensure food security is vital. We believe that decisions should be based on factual and realistic scenarios.”

Government’s Directive and Quick Reversal

Why did the government issue a directive and then retract it so swiftly? Despite a projected decrease in sugar production, there is a significant stock from the previous year, and there are no signs of a sudden surge in consumption.

Isma’s data indicates a healthy opening stock of 5.6mt, which is enough for over three months of consumption. Isma also forecasts a production of 32.4mt for the current sugar season, with annual consumption estimated at 28.5mt. Over the recent years, there was a growing diversion of sugar for ethanol production, but due to government regulations, this diversion will be drastically reduced, leaving an estimated closing stock of 7.8mt at the end of the sugar season in September 2024—higher than the opening balance.

Even if 1.4mt of the stock is diverted for ethanol, the closing balance will still be higher than the opening balance for this year. It seems like the government’s move was aimed at boosting domestic sugar supply and signaling a possibility of taking similar steps in the event of decreased sugar production or lower closing inventories.

Pushan Sharma, director-research at Crisil Market Intelligence & Analytics, suggests that the government’s motive was to improve domestic sugar supply and to keep the industry on edge for future similar measures.

This development has left the industry uneasy and uncertain about the government’s intentions, with concerns lingering about the possible impact of such actions.

The Need for Long-Term Measures

The Indian Sugar & Bio-energy Manufacturers Association (Isma) emphasizes the necessity for medium- to long-term measures to maintain stability within the industry. This includes establishing buffer stocks ranging from 3-5 million tonnes and enhancing production. Isma’s Rao stresses the importance of avoiding sudden and disruptive government decisions by implementing these measures.

Embracing the Ethanol Blending Program

The ethanol blending program holds significant importance for the country’s fuel security and interest. According to Isma, the sugar industry has made substantial financial commitments to augment fuel ethanol capacity. The capacity has seen a remarkable increase, from approximately 280 crore litres to 766 crore litres within just five years since 2018.

Challenges and Opportunities for Ethanol Production

Tarun Sawhney, vice chairman and managing director of Triveni Engineering and Industries Ltd., acknowledges the potential disruptions that may arise from limitations on raw materials used for ethanol production. However, he emphasizes that if the ethanol prices are attractive, it can prove beneficial for both the industry and farmers. The remunerative ethanol prices could lead to immense benefits for both stakeholders.

Optimizing Ethanol Production Capacities

Amidst the anticipated decline in sugar production this year, industry leaders stress the need to balance ethanol production while averting a potential shortfall in the domestic sugar market. Strategic investments in distillation plants and diversification of feedstocks are necessary to increase ethanol production capacities. It is essential for the industry to adopt thoughtful and wide-ranging strategies to address this balance effectively.

The sugar industry in India requires long-term measures such as establishing buffer stocks and enhancing production to maintain stability. The ethanol blending program is crucial for the country’s fuel security and has witnessed significant growth in capacity. Industry leaders emphasize the need to address the balance between ethanol production and domestic sugar market stability, necessitating strategic investments and thoughtful strategies.

The Rise in Ethanol Production for Increased Profits

The shift towards diverting more sugarcane from the mills to ethanol production has a straightforward motive: higher profits. Traditionally, sugar mills lacked an incentive to produce ethanol, as regulations only allowed production through C-heavy molasses, a by-product with no sugar residue, until the amendment of the sugarcane control order in 2018.

Following the amendment, ethanol production expanded to include sugarcane juice, syrup, and B-heavy molasses, which contain residual sucrose. The change also facilitated the establishment of dedicated ethanol production units, with mills receiving subsidized loans of ₹4,440 crore to boost ethanol capacity.

This regulatory shift prompted significant investments in ethanol production and procurement, thus increasing the blending percentage in gasoline and improving the profitability of sugar mills.

According to Crisil’s Sharma, sugar mills witnessed substantial improvements in margins after diversifying into the ethanol segment, which previously had been largely dependent on sugar prices. With ethanol sales, their margins improved significantly, marking a notable shift in profitability.

Ethanol offers a substantial advantage in terms of pricing, with distilleries earning ₹49.41 per litre for ethanol produced from C-heavy molasses, ₹60.73 per litre from B-heavy molasses, and ₹65.61 per litre from sugarcane juice or syrup, compared to the fixed minimum support price of ₹31 per kg for sugar. In the sugar season of 2023, direct sugar sales in the market resulted in a 3.7% operating margin, while distilleries garnered a 13.73% margin from ethanol sales.

According to ISMA, ethanol’s revenue-generating potential is enhanced by its shorter sales cycle, offering liquidity within days of supply, in contrast to sugar production, which occurs over 5-6 months and is marketed over 12-14 months.

The expansion of ethanol production not only offers favorable pricing based on feedstock but also supports liquidity maintenance, making it an increasingly attractive option for sugar mills looking to bolster profitability.

Ethanol Industry’s Concerns

The recent policy changes and the imposed cap on the diversion of sugar stocks for ethanol production have left the ethanol industry feeling uncertain and concerned. This could potentially lead to a reduction in further investments in ethanol blending.

The uncertainty caused by the policy changes and the unexpected limitations on diverting sugar stocks for ethanol production could deter potential investors in the industry. This could have a negative impact in the short term and may lead to doubts about future government regulations.

Ethanol for blending is primarily supplied by distilleries, with over 90% of the supply coming from this source. The majority, 73%, is derived from molasses-based distilleries, while the remaining percentage is from grain-based distilleries. Although the government is promoting alternative feedstocks like maize and rice, their contribution remains low. The sugar industry holds the key responsibility to increase production and meet the demand.

Presently, molasses-based distilleries have an installed capacity of 850 crore litres, which is anticipated to increase to nearly 1,100 crore litres to support achieving the 20% blending target by 2025. The Indian Sugar Mills Association (Isma) has projected an investment of ₹17,500 crore to establish this capacity. However, the imposed limitations may discourage sugar mills from pursuing these plans.

The continued apprehension could have detrimental effects on the sugar industry, which has been grappling with a persistent surplus in the market. Sugarcane is an appealing crop for farmers due to its lucrative returns, driven by regular revisions of the minimum support price. Moreover, mills are obligated to process the sugarcane brought to them. Diversifying towards ethanol is not only more profitable for mills but also helps in managing surplus production.

Isma’s Rao highlighted the potential for the sugar industry to divert more sugar for ethanol production, given better sugarcane availability in the future. Yet, companies that have made substantial investments to expand their ethanol production capacities are facing challenges. Their working capital and loan repayment capabilities are expected to suffer due to the recent constraints.

Triveni Engineering and Industries Expanding Ethanol Capacity

Triveni Engineering and Industries, a major player in the industry, is increasing its ethanol production capacity. The company is enhancing the distillation capacity at its Sabitgarh unit in Uttar Pradesh from 660 KLPD to 1,100 KLPD. Additionally, in the last quarter of the fiscal year, Triveni is set to launch a distillery in Rani Nangal, Uttar Pradesh, as part of its ₹460 crore capital expenditure for two new plants, each with a capacity of 225 KLPD.

In order to meet the ambitious blending target of 20%, industry experts suggest that the government may need to reassess the prices of ethanol derived from sugarcane and grain-based feedstocks. This adjustment is crucial to bolster the financial viability of ethanol projects and to encourage further expansions in distillation capacity.

Blending targets in jeopardy

The sugar industry had high hopes for achieving a blending rate of 13-15% in the 2023-24 sugar year, but a recent cap on ethanol could throw a wrench into those plans. Analysts predict a 20-25% decrease in ethanol availability, potentially leading to a blending rate of less than 10% for the year. This would be a significant drop compared to the expected rate, highlighting a substantial shortage of 250 crore litres of ethanol. It would mark the first time in seven years that such an event has occurred.

This shortfall not only means that the industry would need to make up for lost ground in the following year to reach the 20% blending target set for 2025, but it also raises doubts about the medium-term goal of achieving 30% blending by 2029-30.

Crisil’s Sharma emphasized how using cane juice for ethanol production plays a significant role, and any restrictions on its usage would hinder the government’s blending targets, as seen in the case of ethanol year 24. Achieving the ambitious 30% target for ethanol blending in India has its challenges, but a 20-25% target seems feasible, given the expected growth rate of key feedstocks. Additionally, attention to demand-side factors, such as ensuring automobiles can operate on 30% ethanol blended petrol, is crucial.

The automotive industry is uncertain about ethanol blending, although it does support the 20% blending goal. However, for higher blending percentages, vehicles equipped with flex fuel technology, capable of using blends ranging from 20% to 85%, would be necessary.

TVS chief executive K.N. Radhakrishnan disclosed plans to introduce flex fuel vehicles at an industry event, with a target to showcase a pilot of flex fuel two-wheelers and work towards mass production by September-October 2024. However, concerns around ethanol availability raise questions about the necessity of flex fuel vehicles at this time.

As we embark on a new year, there is uncertainty about the introduction of TVS’ pilot vehicle. Given the concerns regarding ethanol availability, the immediate need for flex fuel vehicles may be less pressing than initially thought.