The surge in market share for the automaker was propelled by substantial discounts and a wide range of competitively priced e-scooters available at various price levels.

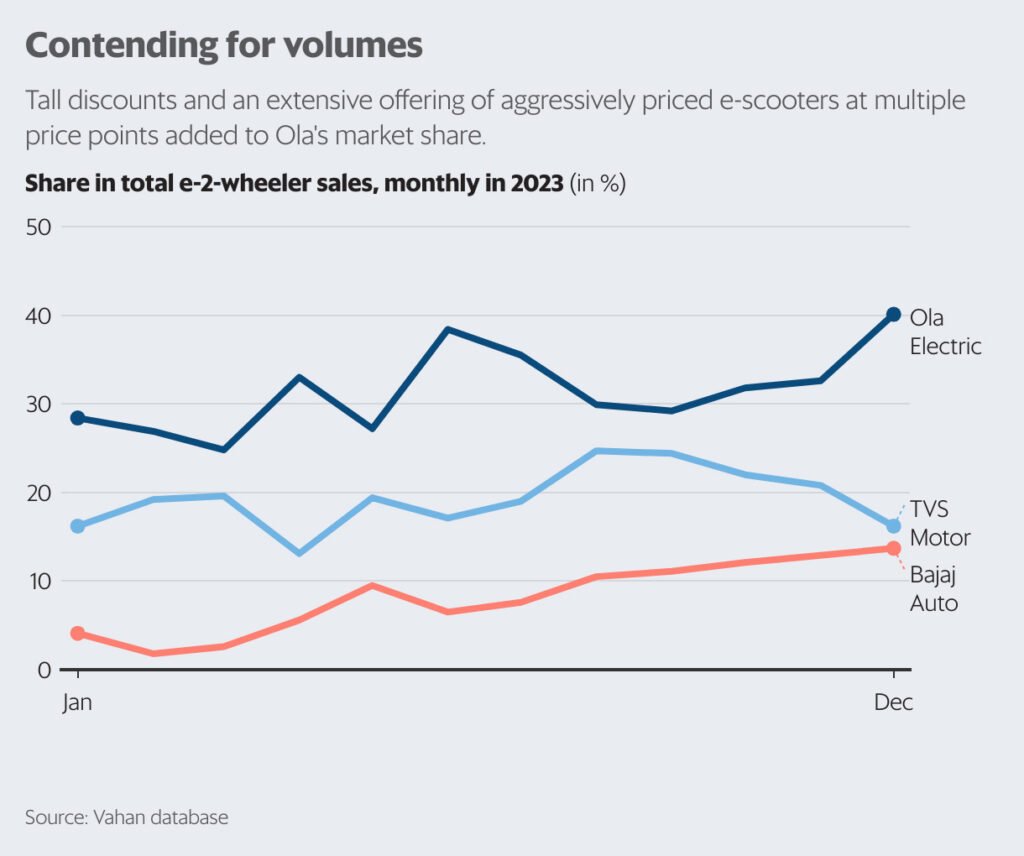

Ola Electric achieved a significant milestone in the electric two-wheeler market, surpassing a 40% market share in December. This remarkable feat was driven by substantial discounts and a diverse range of competitively priced e-scooters catering to various price points. Notably, the company offered discounts of up to 18% or ₹20,000 on its most affordable model, the S1 X+ electric scooter, as part of its strategic move to secure a larger portion of the e-two-wheeler market preceding a potential public listing early this year.

In contrast, after the festive season, there were minimal discounts on the TVS iQube and Bajaj Chetak. Hero’s Vida V1 and Ather’s 450 range of scooters featured cash discounts of only ₹6,500, as reported by Motilal Oswal. Ola’s dominance in market share was followed by TVS Motor (16.2%) and Bajaj Auto (13.7%), with no other company reaching double-digit market share in December.

Sources indicate that Ola plans to sustain the discount on the S1 X+ in January and intends to introduce promotional offers monthly, including exchange bonuses, although these may not be in the form of cash discounts.

This marks the first instance in nearly three years that a company has exceeded the 40% market share threshold within this segment. Ola’s market share surged from 32.6% in November, surpassing its prior highest market share of 38.4% in June, as per analysis of data from the Centre’s Vahan database.

Ola Electric’s entry into the electric two-wheeler market in late 2021 disrupted the highly fragmented segment, where multiple players vied for market share, and the low-speed scooter market thrived. Notably, its entry reshaped the market share landscape, as no company had surpassed the 30% market share mark between then and April 2023.

Ola’s competitors are facing a tough challenge ahead. As Ola Electric’s product range expands and offers competitive pricing, gaining market share will be an uphill battle for its rivals. This is due to the need for more models catering to newer markets and segments.

Bajaj Auto may currently benefit from increased market share and product availability. However, analysts caution that TVS Motor’s single-product offering, the iQube, may lead to reduced interest, and additional sales from new showrooms may be limited given its strong presence in major markets. Moreover, TVS Motor faces constraints in its supply chain, with production volumes capped at around 25,000 units per month at its current facility.

Ather Energy, the fourth largest seller in December with an 8.6% market share, also faces the pressure to broaden its product range and reach more segments.

According to an anonymous analyst cited, Ather Energy is already working on expanding its product range.

Meanwhile, Ola Electric’s chief marketing officer, Anshul Khandelwal, highlighted the company’s strong market leadership and successful “December to Remember” campaign, which has contributed to increased adoption of electric vehicles.

Ola Electric recently expanded its scooter portfolio to include five products, with the flagship S1 Pro priced at ₹1,47,499, S1 Air at ₹1,19,999, and the newly introduced S1X offered in three variants: S1 X+, S1 X (3kWh), and S1 X (2kWh). Despite a 16.6% year-on-year increase in electric two-wheeler sales last month, there was a sequential decline following a festive sales push in November. The record sales for last year were observed in May 2023, with 105,565 electric two-wheelers sold.

Throughout 2023, approximately 860,000 electric two-wheelers were sold, marking a 36% increase from 2022. Ola Electric secured a 31.1% share, followed by TVS Motor at 19.4% and Ather Energy at 12.2%.