Institutional and Retail Investors Ignite Indian Stocks: Nifty Soars by 20% while Midcap and Smallcap Indices Skyrocket by 44% and 48%. Discover What’s Behind the Surge!

In 2023, the resilience of domestic investors has been critical in stabilizing the Indian stock market amid volatile foreign portfolio investor (FPI) activity. As global interest rates climbed, FPIs, driven by a fear of missing out, made a significant comeback late in the year, injecting ₹66,135 crore in December—the most substantial monthly inflow to date. By 28 December, their total for the year hit a record of ₹1.71 trillion. However, this figure is eclipsed by the ₹1.85 trillion from domestic institutional investors and a considerable ₹8,700 crore from direct investors on the NSE between April and November.

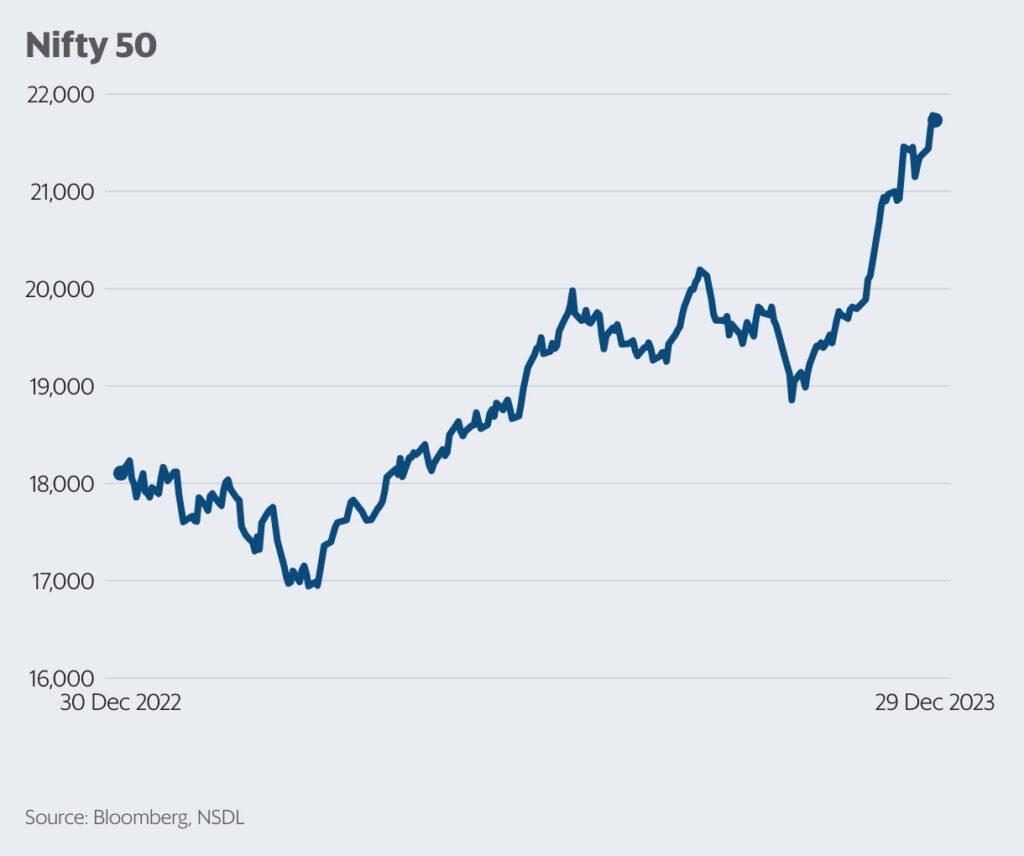

The robust influx of capital from both institutional and retail investors has propelled the benchmark Nifty 50 index up by 20%, with midcap and smallcap indices surging by 44% and 48%, respectively. Consequently, valuations across the indices now surpass their five-year medians, with the Nifty’s forward price-to-earnings (PE) ratio at 20.18—mild compared to the Nifty Midcap 150 and Nifty Smallcap 250 indices, valued at 27.63 and 21.64, against medians of 21.48 and 15.5. These figures indicate that the market is well-positioned to excel, especially among the minor indices.

The recent state assembly election triumph for the National Democratic Alliance (NDA) in three key Hindi-speaking states has further solidified expectations for political stability, with Prime Minister Narendra Modi’s direct involvement seen as a pivotal factor. This has led investors to price in a continuation of policies into the 2024 general election.

This bullish sentiment spills over into public sector shares, reflected in the staggering 75% year-on-year growth of the thematic Nifty CPSE index, now at 4,860. With Demat accounts at NSDL and CDSL surging from 10.81 crore to 13.5 crore in just a year within a nation of 144 crore citizens, the potential for broader market participation is vast. This potential is reinforced by India’s projected 7% real GDP growth, making it a global standout, and the anticipated rate cuts by major central banks, setting a positive tone for the coming year.