Discover how GQG Partners commandeered an astonishing 28% of India’s ₹1.62 trillion FPI investments in just one year! Find out what propelled their strategy as we unveil insights through 27 December.

MUMBAI: Under the astute leadership of Rajiv Jain, GQG Partners has remarkably captured over a quarter of India’s net foreign portfolio investments (FPI) in 2023. Diving deeper, it’s revealed that an overwhelming 80% of this capital infusion favored the Adani Group, with the remainder bolstering five other top-tier listed entities. The investment outcomes have been equally striking in their success.

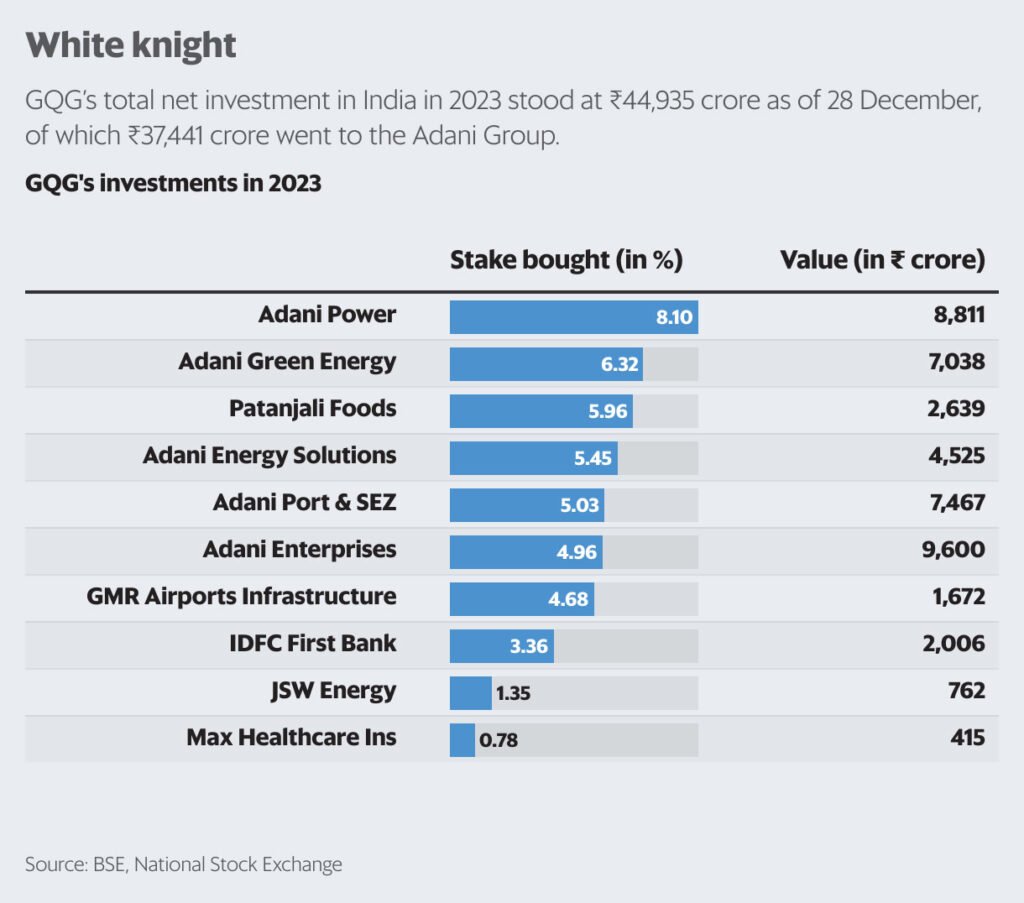

By 28 December this year, GQG Partners’ Indian investment portfolio burgeoned to an impactful ₹44,935 crore. A substantial ₹37,441 crore of this was channeled into the robust Adani Group, spanning five key companies. These included the eminent Adani Enterprises and were further complemented by stakes in Adani Ports and Special Economic Zone, Adani Power, Adani Green Energy, and Adani Total Gas, as per the voluminous bulk and block deal disclosures on the National Stock Exchange and BSE.

GQG Partners has placed significant investment in Indian markets, with a substantial ₹7,494 crore flowing into five leading firms apart from the Adani Group. These include well-known names such as IDFC First Bank, Patanjali Foods, GMR Airports Infrastructure, JSW Energy, and Max Healthcare Institute.

Within the calendar year to December 27, India has seen net Foreign Portfolio Investment (FPI) inflows totalling ₹1.62 trillion. Impressively, GQG Partners has contributed nearly 28% of these inflows, showcasing their strong commitment to the Indian financial landscape.

The Adani Group experienced a revival in stock value, in part due to GQG’s timely investment, starting in March. These actions came following allegations by US-based Hindenburg Research on January 24, which were firmly denied by the conglomerate. The group witnessed a positive shift in market sentiment, largely attributed to subsequent funding rounds by GQG in June and August.

In response to the contentious Hindenburg report, the Adani Group saw a precipitous drop in market capitalization across its 10 publicly traded companies, plummeting by $125 billion to a low of $73.18 billion on February 27. The market valuation has remarkably bounced back to $155.4 billion, a rebound propelled significantly by GQG’s strategic investments.

GQG hasn’t just reaped rewards from the Adani stocks. Their ventures into five other top-tier firms have yielded a commendable 20% profit as per NSE and BSE data. The Adani shares, however, have outperformed with a striking 76% return on the initial investments, thereby augmenting Rajiv Jain’s reputation within investment circles.

Rajiv Jain, GQG’s investment maestro, has gained industry recognition for his investment acumen, echoed by Nilesh Shah, managing director at Kotak Mahindra Asset Management, who reflected on Jain’s impactful investment strategies, particularly on Indian consumer staples. Shah noted that Jain’s substantial FPI contributions, particularly throughout this year, would likely draw the attention of global investors.

Veteran investor Shankar Sharma, founder of GQuant Investech, also spoke of Jain, noting his preference for traditional assets over new-age technology.

Jain has publicly defended his backing of the Adani Group during the Hindenburg scrutiny, stating his bullish stance stems from the group’s indispensable role in developing India’s infrastructure. He expressed the aspiration to be a long-term ally in India’s quest to establish global-standard infrastructure.

At the close of September 2023, GQG Partners maintained a stake in all ten companies previously mentioned, signaling continuous investor confidence.