JTL INDUSTRIES : STEELING FOR GROWTH

✓ Infrastructure development to boost demand

✓ Inclusion of value-added products

✓ Increasing manufacturing capacity

BSE: 534600

Price: 257

Globally, seamless steel is expected to experience strong growth, driven by increased demand for OCTG pipes in the oil and gas sector and growing usage in the sugar and chemical industries. It is anticipated to expand at a CAGR of 7 per cent and reach USD 122.2 billion by 2032.

Steel production is projected to boom past 300 million tonnes by 2030, driven by investments in highways, bridges and utilities. Steel pipe and tube manufacturers, already scaling up to meet global demand, are poised for significant growth as this infrastructure roars ahead.

Keeping all these factors in mind, our choice scrip for this issue is JTL Industries (JTL). Incorporated in the year 1991, JTL Industries specialises in the production of ERW black pipe and has expanded its offering by including value-added products such as hot dipped galvanised steel tubes and pipes, solar module mounting structures, and large diameter steel tubes and pipes.

The company tries to understand the needs of diverse clients such as B2B, B2G, OEMs and international. JTL Industries has a strong presence in the domestic and international markets and aims to further expand its reach for sustained growth.

About 87 per cent of its revenue comes from the domestic market and 13 per cent from the export market. The company serves client in 20 countries and aims to expand its geographic reach and customer base as part of its business strategy for sustained growth.

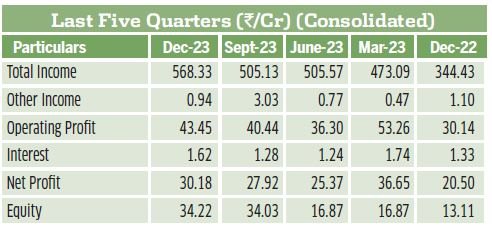

In Q3FY24, on a consolidated basis, the net revenue of the company rose by 65.26 per cent YoY to ₹567.39 crore compared to ₹343.33 crore from the previous year’s same quarter. On a sequential basis, its revenue increased by 13 per cent from ₹502.10 crore. For Q3FY24, the PBIDT excluding other income increased by 46.35 per cent and stands at ₹42.51 crore from ₹29.05 crore in the previous year’s same quarter. The profit after tax (PAT) showed growth of 47.24 per cent and stands at ₹30.18 crore from ₹20.50 crore from the previous year’s same quarter.

On a sequential basis, the company’s net profit increased by 8.12 per cent from ₹27.92 crore. Looking at the growth of the solar industry, JTL Industries is expanding its business in the domain of solar module structures with a focus on providing these products in both the local and international markets.

The company has a network of around 800 dealers and plans to expand into new geographies. Value-added products’ contribution is steady at 40 per cent of the sales. It aims to reach 50 per cent by FY25.

The company’s plan is to reach a total manufacturing capacity of 1 million tonnes by adding capacity in Maharashtra and Chhattisgarh.

The company has recently raised ₹384 crore through the allotment of fully convertible warrants to fund the expansion and aims to double its market share with the upcoming capacity expansion.

The company is currently trading at a PE of 35.5 times as against the industry PE of 22.1 times and is higher than its three-year median PE of 28.4 times.

Nonetheless, higher growth justifies such valuation. In the last three years, the company has delivered average ROE of 33.5 per cent and ROCE of 34.3 per cent, respectively.

Considering the high growth of the company’s business and the demand for pipes, we expect this company’s stock price to zoom to high level.

Disclaimer: This content is purely for informational purposes and does not constitute a recommendation for stock investment. Any decision related to investments should be made in consultation with a qualified financial advisor.