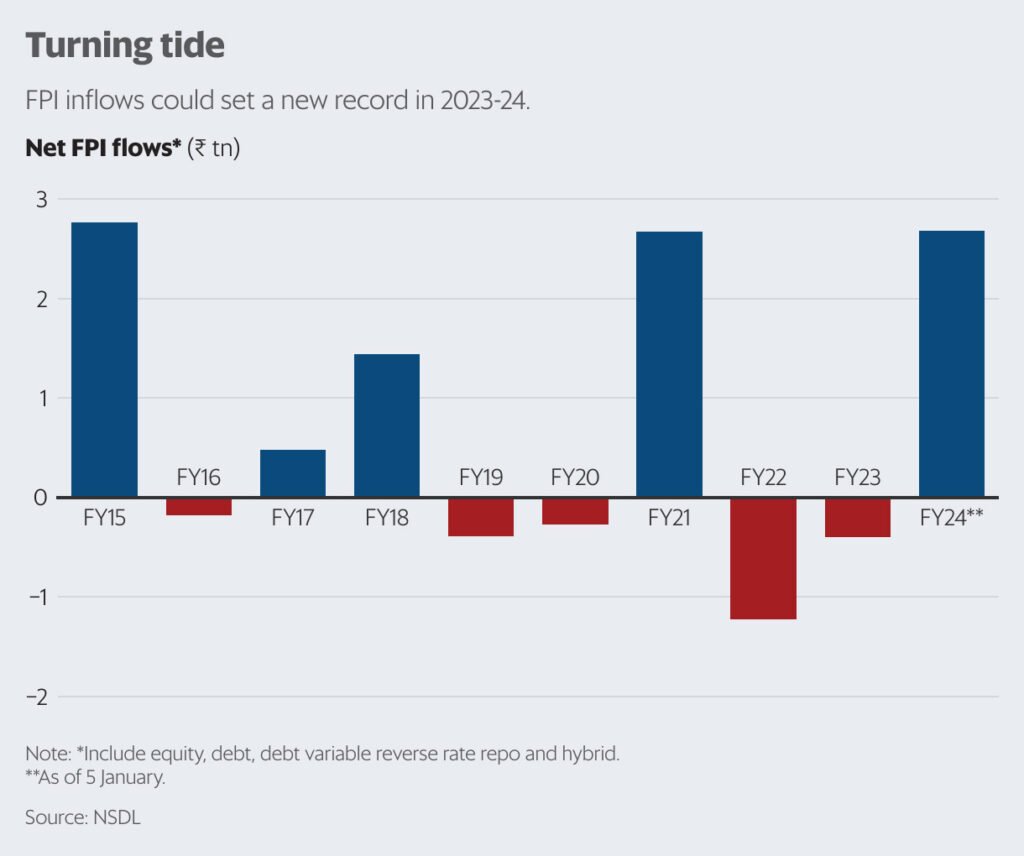

With foreign portfolio investment amounting to ₹2.68 trillion, the net inflows are only ₹9,625 crore short of the record set in 2014-15 at ₹2.77 trillion.

MUMBAI :

Foreign Portfolio Investment (FPI) net inflows into Indian equities and debt in 2023-24 have surged to a nine-year high, reaching ₹2.68 trillion. This marks a significant rise, inching close to the 2014-15 record net inflows of ₹2.77 trillion. The robust performance in monthly average terms shows that foreign portfolio investors have injected a net ₹29,780 crore into Indian equities and debt this fiscal year. With three months remaining in the fiscal year, there is anticipation that the final figure could potentially set a new record for FPI.

Financial Dynamics:

The FPI figures show that equity net flows amount to ₹2.02 trillion, with debt investments standing at ₹66,105 crore. In 2014-15, during the inception of the Narendra Modi government, equity inflows were at ₹1.11 trillion, while net debt inflows reached ₹1.66 trillion. The recent surge in inflows can be attributed to several factors, including the anticipation of robust corporate earnings, global fund purchases in light of India’s forthcoming inclusion in the JP Morgan Government Bond Index-Emerging Markets (GBI-EM), and the wider spread in yields between US and India 10-year bonds. The robust performance of FPI inflows is expected to persist due to the strong corporate earnings performance and the projected growth of Nifty earnings by 10% in the December quarter.

Foreign portfolio investment net inflows into Indian equities and debt for 2023-24 have surged to a nine-year high at ₹2.68 trillion, nearing the 2014-15 record. Robust corporate earnings and global fund purchases are driving this surge. Anticipated Nifty earnings growth of 10% in the December quarter further strengthens FPI inflows.

Impact of Inclusion in JP Morgan’s Bond Index on FPI Inflows

Chief economist Sujan Hajra, of Anand Rathi Shares and Stock Brokers, notes that FPI flows have been bolstered by global funds’ purchase of Indian government paper, ahead of its inclusion in JP Morgan’s bond index on June 28. The widening yield spread between India and the US has also contributed to increased flows into Indian paper, with the spread expanding from 242 basis points in October to 329 basis points by December.

Founder of Alphaniti Fintech, U.R. Bhat, predicts that investors purchasing now could eventually supply when global index funds enter the scene to buy bonds in June. The inclusion in the GBM-EM index is expected to attract $20-25 billion of foreign fund inflows, as about two dozen Indian government bonds, with a notional value of $330 billion, become eligible for indexing. These bonds will gradually be included in the benchmark index over 10 months, with a monthly addition of 1% weight.

This significant development has propelled FPI investments in debt, particularly in November and December, with the latter month seeing a record high monthly investment of ₹66,135 crore. FPI assets under custody in equity and debt, as reported by NSDL, stood at $795.19 billion as of December 31, marking a 34% increase from the end of 2022-23, when the total was $592.4 billion.